The FTSE 250 hosts a broad spectrum of excellent stocks. Constructing a balanced portfolio of various stocks allows investors to manage risk and secure steady, strong returns in the long run.

Growth shares have the potential to increase sales and profits far faster than the broader stock market, and often operate in innovative sectors and/or emerging markets. Dividend shares are usually financially robust companies that provide an income across the economic cycle.

Finally, value stocks offer the possibility of substantial capital appreciation as the market wises up to their true wealth. Or at least that’s the theory.

Thankfully, the FTSE 250 is jam-packed with companies that straddle one or more of these categories. Here are three I think investors should seriously consider right now.

Growth

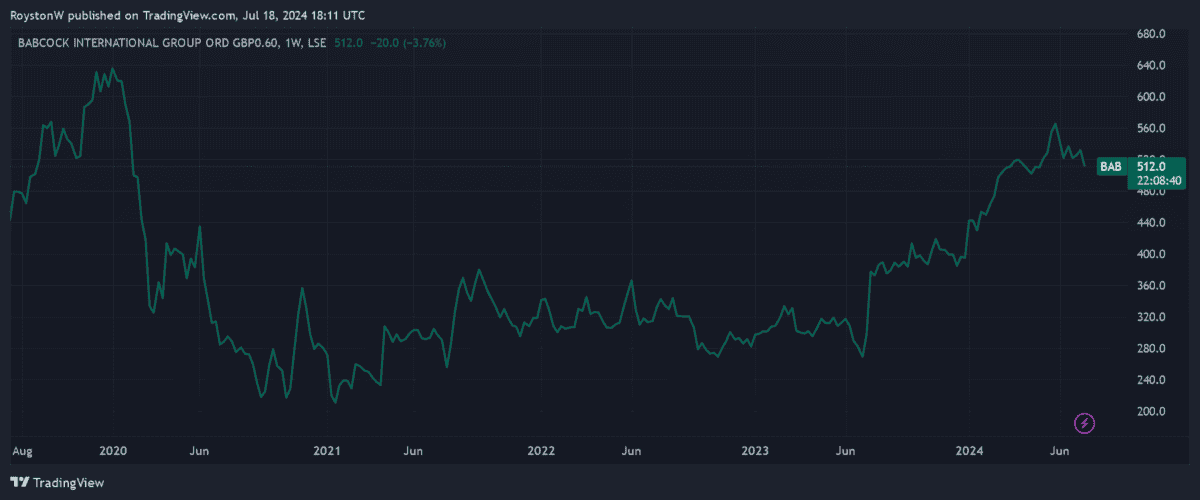

Rising geopolitical tensions mean weapons spending is rising sharply. Babcock International (LSE:BAB) — which provides engineering and training services to countries including the UK, France and Australia — is one business whose sales (and share price) have rocketed of late.

Latest financials showed revenues up 11% in the year to March, at £4.4bn. The firm’s contract backlog meanwhile leapt 9% year on year to £10.9bn.

Strong order levels mean Babcock’s earnings are tipped to rise strongly through the short term at least. Bottom-line rises of 12% and 13% are forecast for financial 2025 and 2026 respectively.

With Western nations steadily committed to defence budget boosts, I think Babcock could be a top profits grower for years to come too. But I realise that the less volatile world we all long for could mean its prospects diminish.

Dividend

At 6.3%, property company Tritax EuroBox (LSE:EBOX) has one of the largest forward dividend yields on the FTSE 250.

It’s able to reliably pay large dividends over time, thanks to its excellent defensive qualities. It rents out its assets to blue-chip companies such as Amazon, Puma and Lidl, meaning it can expect rents to be paid regardless of economic conditions.

Tritax also has its tenants tied down on ultra-long contracts. The weighted average unexpired lease term (WAULT) on its buildings stood at 9.6 years at the end of 2023.

A failure to identify new sites could harm the company’s long-term investment case. But on balance, I think it could be a great way to play Europe’s booming logistics market.

Value

Real estate investment trusts (REITs) like Assura (LSE:AGR) could remain under pressure if interest rates don’t significantly fall. Yet it’s my opinion that this threat is baked into the ultra-low share prices of many such businesses.

This particular REIT — which builds, owns and operates more than 600 primary healthcare properties in the UK — trades on a price-to-book (P/B) ratio of approximately 0.9.

Any value under 1 suggests that a share is trading below the worth of its assets.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

On top of this, Assura carries a mighty 8.1% forward dividend yield. This is more than double the FTSE 250 average of 3.5%.

I think the business could prove a top long-term buy as Britain’s ageing population drives demand for healthcare properties.