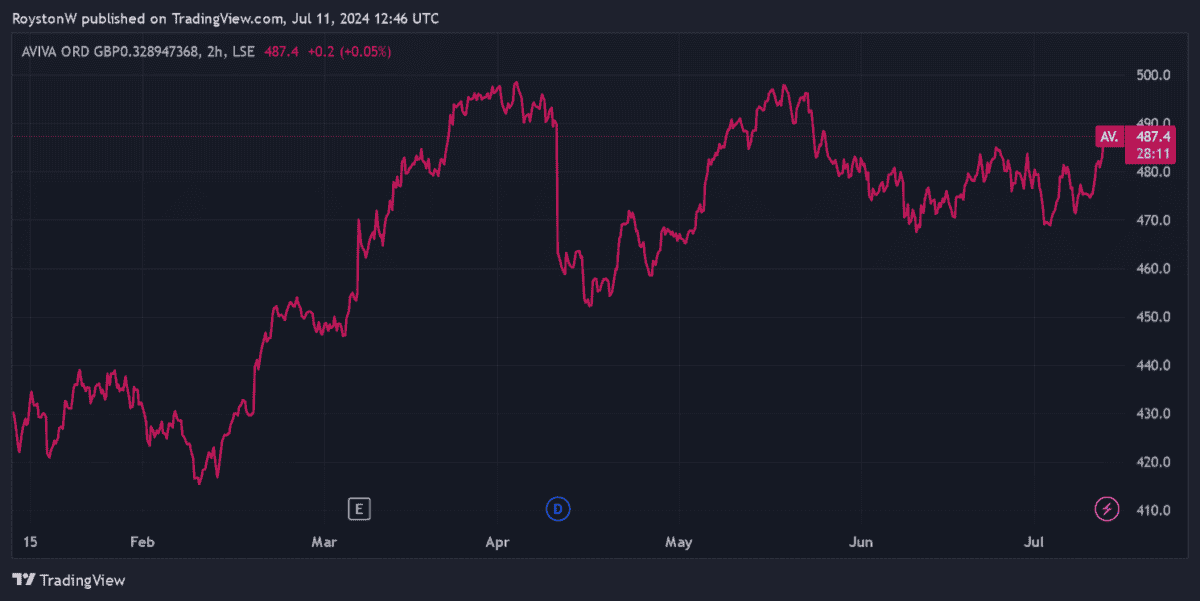

Aviva‘s (LSE:AV.) share price has soared in 2023. Up 12%, the financial services giant has risen on improved hopes for the UK’s economic and political landscape. Predictions of interest rate cuts from the summer that could stimulate consumer spending has also boosted the price.

Yet at 487.4p per share, I believe the FTSE 100 firm still looks dirt cheap. Here are several reasons why.

Earnings metrics

The first thing to do is consider Aviva’s share price relative to predicted profits. Based on this, the company scores pretty well, in my view.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

City analysts think the bottom line will grow 20% year on year in 2024. This leaves Aviva trading on an attractive price-to-earnings (P/E) ratio of 10.7 times.

However, the Footsie firm’s price-to-earnings growth (PEG) ratio is even more impressive. At 0.5, it’s below the watermark of 1 that indicates a stock is undervalued.

The PEG ratio stays low at 0.8 for 2025 too, thanks to predictions of another double-digit rise in annual earnings.

Dividend yields

The next step is to take a look at the dividend yield on Aviva shares. To provide some context, it’s a good idea to compare how the company compares on this front against the broader FTSE 100.

The firm’s dividends have recovered strongly since the pandemic, and City analysts expect this trend to continue. Consequently, the forward dividend yield stands at an enormous 7.1%, almost double the 3.6% Footsie average.

In further good news, brokers think dividends will keep rising sharply over the next two years as well. And so the yield marches to 7.8% and 8.4% for 2025 and 2026 respectively.

Book value

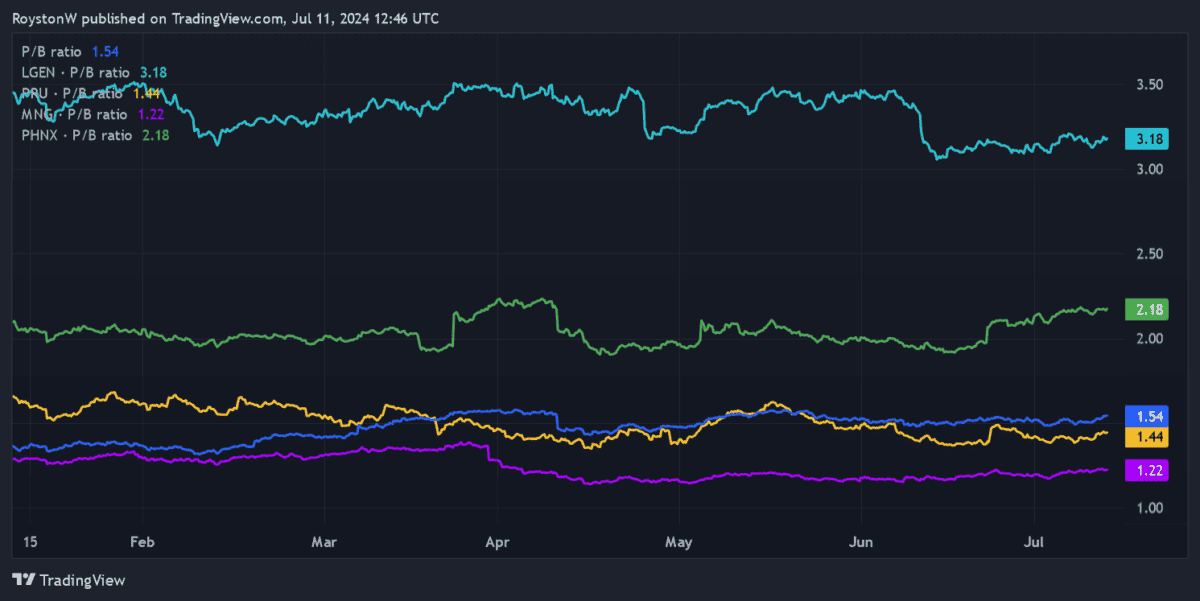

At face value, Aviva’s share price doesn’t look so cheap relative to the value of its assets. Right now, the company trades on a price-to-book (P/B) value of 1.4 times.

A reading above 1 indicates the market values a share more highly than the book value of its assets.

As the graph above shows, this reading is some distance below those of Legal & General Group and Phoenix Group Holdings, but above those of Prudential and M&G.

However, with the industry average coming in at 1.9 times, Aviva’s P/B value actually looks decent today.

A top value stock

In recent years Aviva has undertaken a series of large disposals, the most recent of which saw it sell its Singapore Life division in March. This raises risk as it’s much more dependent on strong economic conditions in a narrow selection of countries (namely the UK, Ireland and Canada). As we know, the UK economy hasn’t been firing on all cylinders and UK consumers haven’t felt hugely confident of late.

Yet the company’s capacity to grow earnings and dividends in the future remains good. Brand strength makes it a market leader in many protection, retirement and insurance product categories. And as the saving needs of a increasing elderly population increase, it could be in the box seat to continue growing sales rapidly.

All things considered, I think it’s one of the FTSE 100’s most attractive value stocks right now.