Real estate investment trusts (REITs) make money by owning and leasing properties. And the FTSE 100 has some great examples, including Land Securities Group, SEGRO, and Unite Group.

Importantly, they distribute their income as dividends. And after an 8% fall over the last five years, shares in LondonMetric Property (LSE:LMP) come with a 5.25% dividend yield.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

What makes a good REIT?

The biggest challenge REITs face is growth. They are required to distribute 90% of the rental income they generate to shareholders in the form of dividends and this limits their reinvestment opportunities.

That means the options for growing earnings are limited. The two main strategies are increasing rents or raising cash to make acquisitions, either by issuing shares or taking on debt.

Neither is straightforward, but the key to both is having a portfolio of properties that are in high demand. This creates pricing power and financial flexibility.

LondonMetric Property has a strong position and the company’s track record demonstrates this. And I think the prospects for the future also look strong.

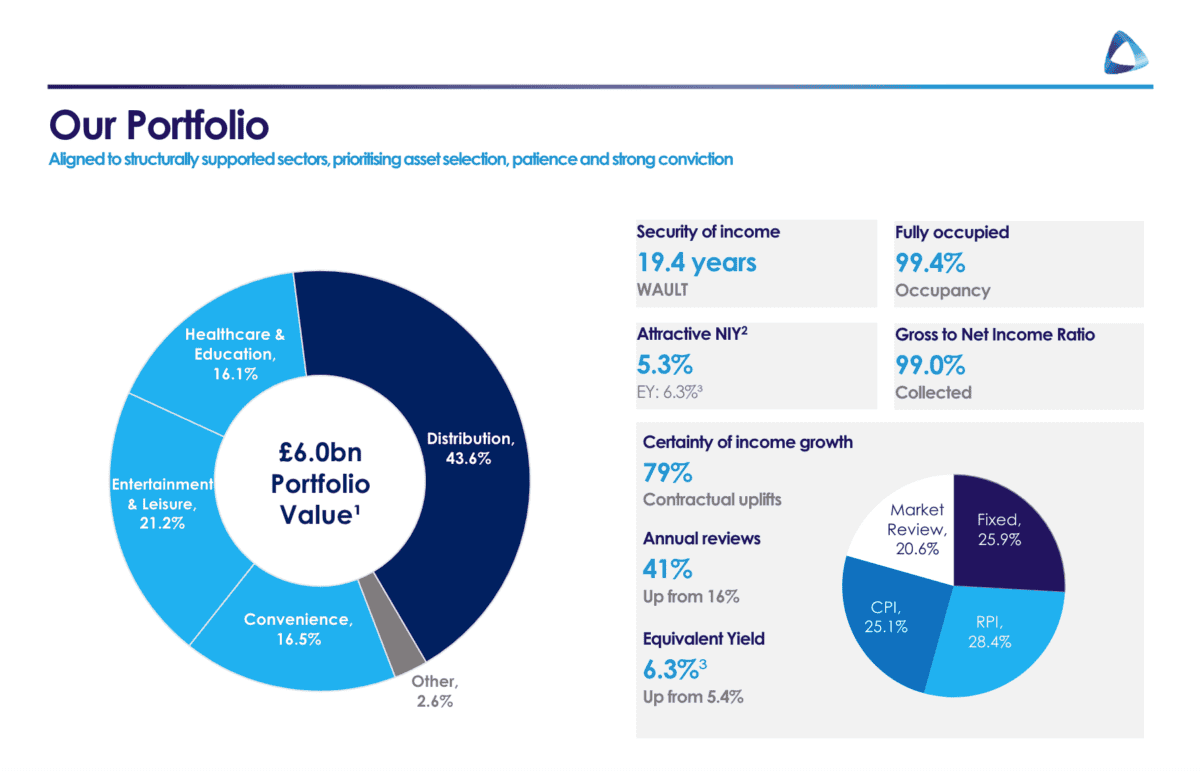

Property Portfolio

LondonMetric Property has a portfolio that consists of warehouses, theme parks, and convenience stores. Importantly, these are areas where demand has been strong.

LondonMetric property portfolio

Source: LondonMetric Property investor presentation

As a result, the company’s portfolio is fully occupied. And it has generated impressive growth over the last decade – earnings have increased by an average of 10% per year since 2014.

Part of this has come from increasing rents. And this looks set to continue – the average lease has just under 20 years to run and the vast majority have contractual uplifts built in.

A series of mergers and acquisitions have also grown LondonMetric’s property portfolio. The most recent of these – a deal with LXi this year – has taken the company’s portfolio from £3.1bn to £6bn.

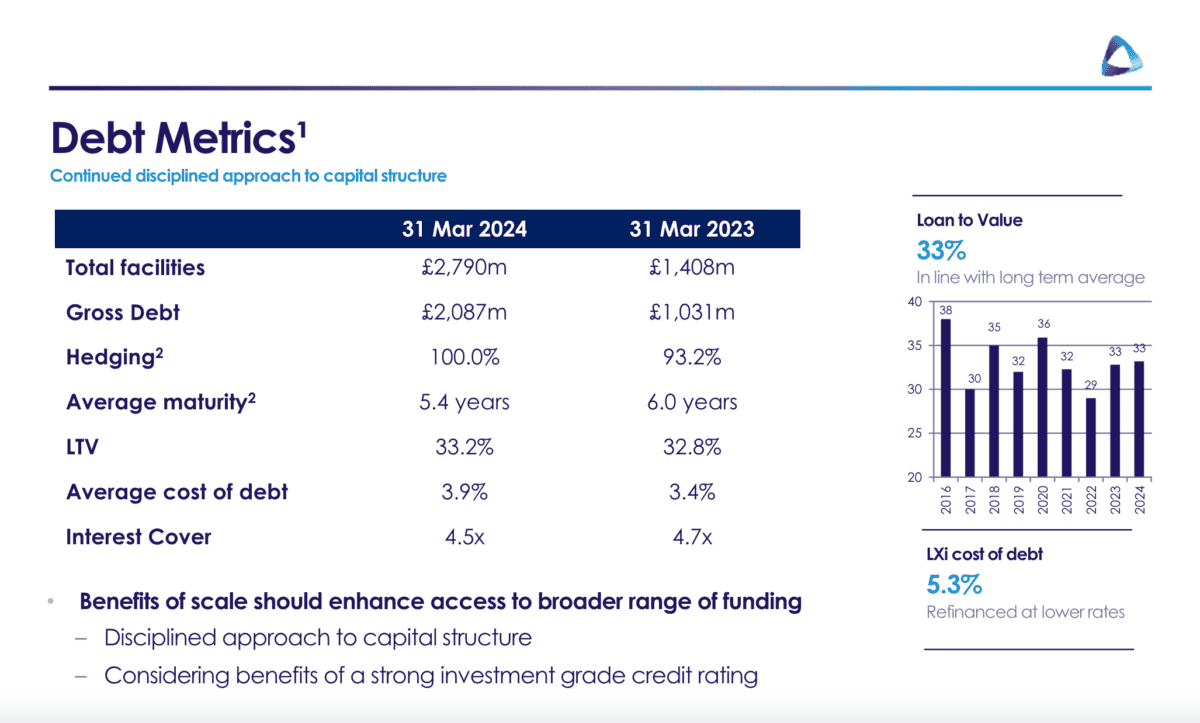

Balance sheet

The biggest risk with LondonMetric Property is probably its debt. The LXi deal has seen the company’s average cost of debt increase and the average time to maturity on its loans shorten.

LondonMetric property debt

High interest rates make both of those real issues. And it’s worth noting that the company has a higher average cost of debt than Unite and a shorter average time to maturity than SEGRO.

That puts LondonMetric Property in a slightly more vulnerable position than other FTSE 100 REITs. But it’s also worth noting that management has been making moves to improve the situation.

The firm has been divesting non-core assets to reduce its total debt. And selling these at yields lower than its average cost of debt means it has been boosting its earning power as well as its balance sheet.

Should I buy the stock?

At today’s prices, LondonMetric Property shares have a 5.25% dividend yield. That’s higher than the 3.59% average for the FTSE 100.

The company’s property portfolio is one that should remain in high demand for some time. And the built-in rent increases should help the dividend grow.

Ultimately, I think this is an better-than-average company with a higher-than-average dividend yield. That puts it at the top of my list of FTSE 100 stocks to buy for long-term passive income.