In times gone by, the prospect of a Labour general election victory would be viewed with trepidation by many in the markets. Traditonally, the red party has championed higher taxation and tighter business regulations than the Conservatives. And this has sometimes had an adverse impact on FTSE 100 shares.

But markets are much calmer this time around, with those in the City encouraged by current party leader Keir Starmer’s vow to work closely with business to boost growth. Pledges to improve relations with the European Union have also gone down well with investors and economists.

Sea of calm

In one such example, Susannah Streeter, head of money and markets at Hargreaves Lansdown, has predicted that asset prices will remain robust should Starmer enter Downing Street.

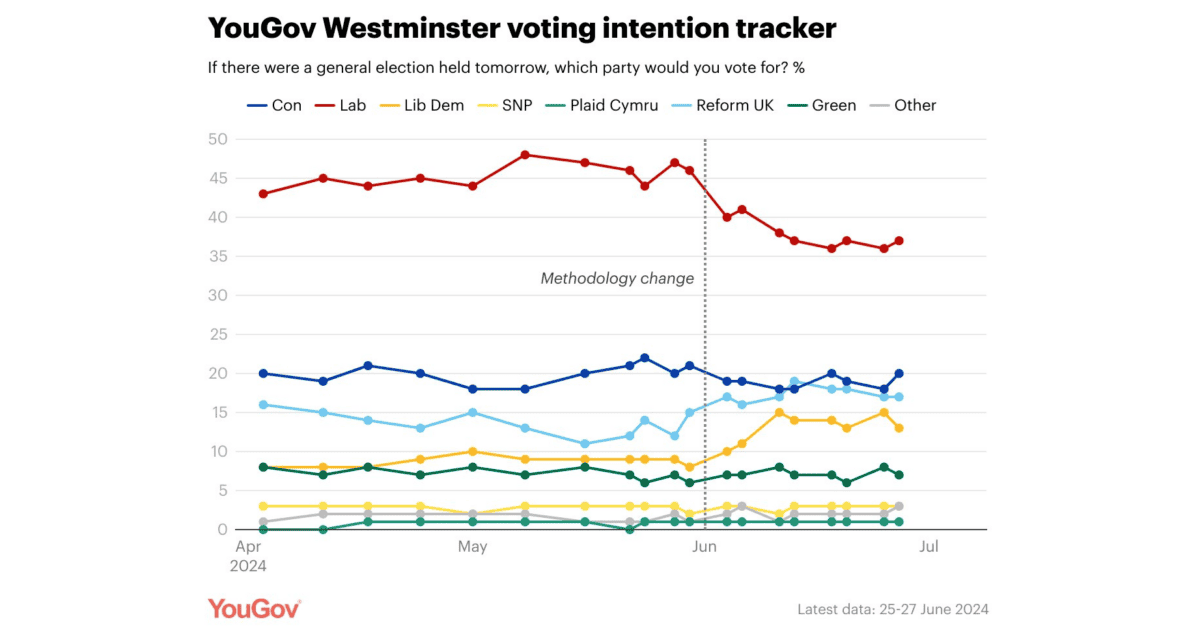

She says that “in all likelihood, the impact of a Labour victory on financial markets would be minimal, especially if the current poll predictions materialise.”

Looking at election outcomes, Streeter says that “a minority administration or coalition would be more unsettling as it would mean more uncertainty, and could hold back investment.“

Streeter adds that a large majority “would enable the new government to get on with their agenda which has largely been digested by markets.”

A potential FTSE winner

That said, there are some important things for investors to remember. Parties can fail to deliver their manifesto promises, both intentionally and unintentionally. What’s more, other major events can happen that derail a government’s plans and cause stock markets to sink.

The Covid-19 pandemic erupted merely months after the Conservatives won the 2019 general election. And in the aftermath, the FTSE 100 collapsed to multi-year lows.

But there could be some major winners on London’s stock market if Labour carries out its post-election plans. One of these could be residential construction companies like Persimmon (LSE:PSN) which, in my opinion, already looks in good shape to grow sales as the UK’s population increases.

Analyst Streeter also notes that “Labour’s pledge to build 1.5m new homes by shaking up the planning system would benefit housebuilders facing slow approvals of new sites.” However, she does caution that “it remains to be seen how quickly this can be done.”

Persimmon has previously claimed that “the planning environment and limited land supply pose significant barriers to development and home delivery“. But reducing regulations is a contentious issue, and housebuilder shares could fall sharply should Labour’s plans run into trouble.

Renewables boost

Renewable energy stocks like SSE (LSE:SSE) could also rise in value if polling projections prove correct. Labour announced in its manifesto that it plans to “work with the private sector to double onshore wind, triple solar power, and quadruple offshore wind by 2030“.

As with the housing market, Labour has vowed to ease planning restrictions for new wind farms within weeks, should they win the election. This would be a big boost to SSE, which is focusing on wind power to drive future earnings.

More favourable planning regulations don’t make the FTSE 100 a slam dunk buy however. Building renewable energy assets is famously expensive and a significant drag on profits.

That said, I still believe SSE should thrive as the climate crisis drives green energy expansion. It could be a strong performer, regardless of who wins the election.