I plan on dividends playing an important role in my retirement. That’s why I invest regularly to generate a sizeable future passive income from my Stocks and Shares ISA.

Here, I’ll explore how £9,000 invested today could lay the foundations for a sizeable second income.

Fine progress

Before getting to the maths, one stock I own but would still buy today is Games Workshop (LSE: GAW). This is the maker of the Warhammer tabletop wargame franchise.

Should you invest £1,000 in Prudential right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Prudential made the list?

On 19 June, the FTSE 250 firm released a cracking set of full-year figures covering the 53 weeks to 2 June. It said revenue would be no less than £490m, representing at least 10% growth on the year before.

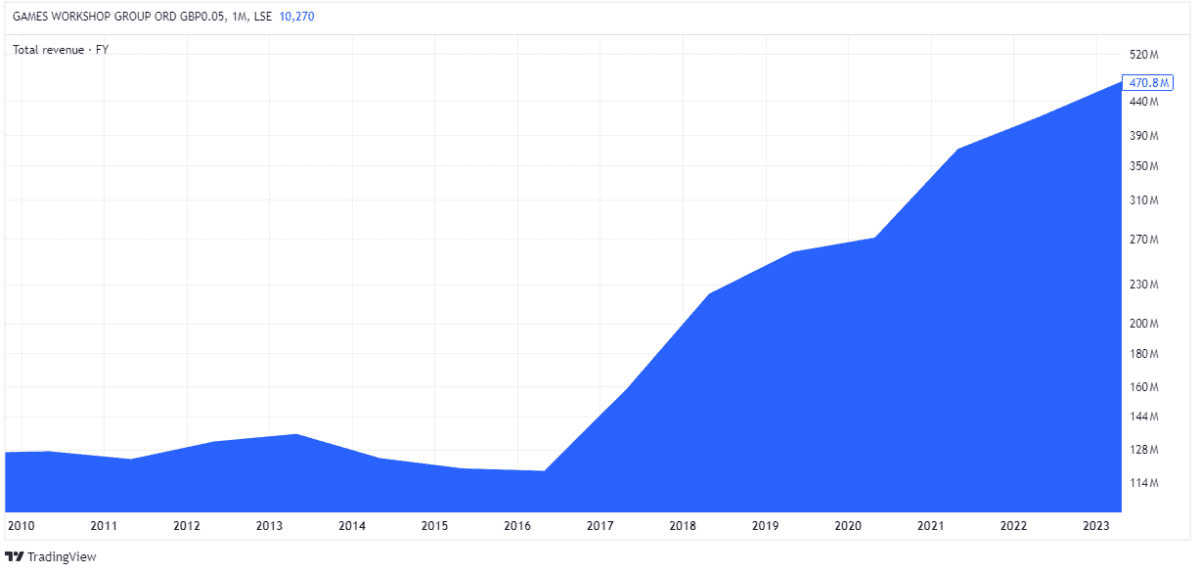

Given the tough consumer backdrop, this is very pleasing to see. It means its top line has more than doubled since 2018!

Meanwhile, annual pre-tax profit’s expected to be at least £200m, up from £171m, and more than market forecasts.

Also encouraging was that licensing income, which comes from allowing other companies to use its intellectual property (IP), rose 20% to £30m. This income’s beneficial because it leverages the company’s existing IP and expands its brand without the need for significant additional investment.

There was no further commentary on its deal with Amazon to make Warhammer 40,000 content. Perhaps we’ll hear more about this when the full annual report’s released on 30 July.

Nevertheless, the market seemed happy enough. The stock rose 13% in the days following this update.

‘Wokehammer’ backlash

One potential concern I’d highlight here is recent online squabbles about the firm adding a female character to a previously all-male army squadron. Some long-time customers weren’t happy about this.

While this may seem like a storm in a teacup, it could affect sales if groups of fans boycott new products in protest.

Disney’s the most high-profile company to get caught up in such stuff. I’m sure Games Workshop will get this balance right, but it’s something worth noting.

Plenty of cash

A key thing I like about the stock from a wealth-building perspective is that it regularly pays dividends. It currently yields 4%, which is high given that the share price has more than doubled in five years.

Of course, this might not always be the case as payouts aren’t guaranteed. But the company does have a tremendous record of rewarding shareholders (and employees) with rising income. I like to see that.

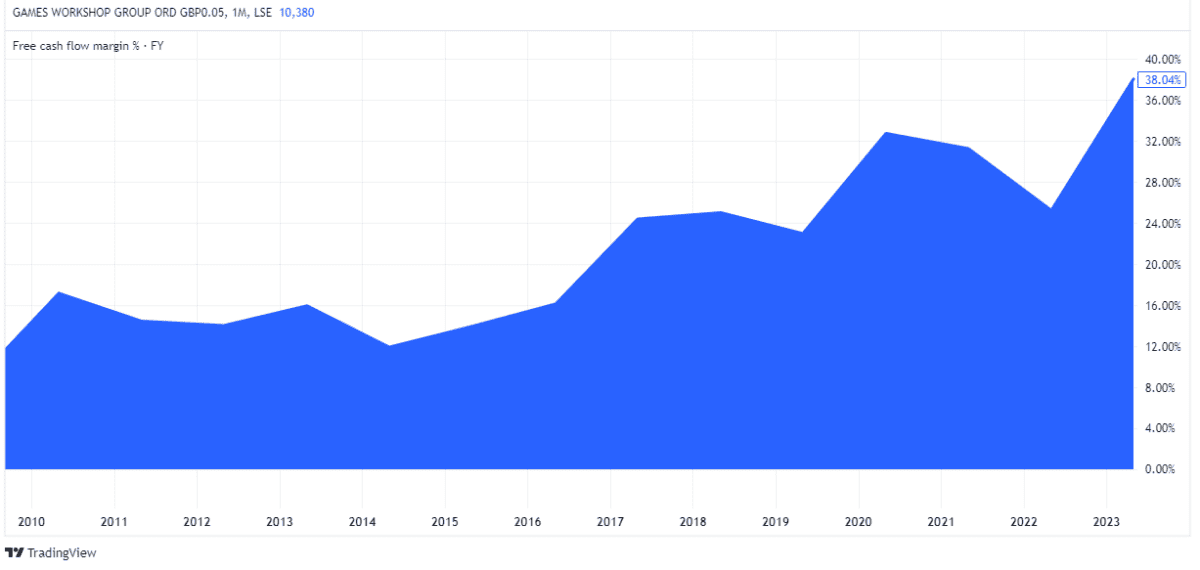

More importantly, these dividends should remain generous given how much cash the asset-light firm generates. Its free cash flow margin has been trending higher for years and is now above 30%.

Income generation

Let’s assume I invest my £9,000 in the stock and the 4% yield is sustained, along with 4% average share price growth (far less than in the past). In this conservative scenario, I’d have £41,948 after 20 years.

However, if I invested a further £600 a month in other stocks returning 8%, my final figure would be £383,515, assuming I reinvested dividends.

By this point, I’d be receiving £19,175 in income every year if my portfolio were yielding just 5%.

This shows how investing in high-quality stocks with affordable sums of money can result in attractive passive income down the road.