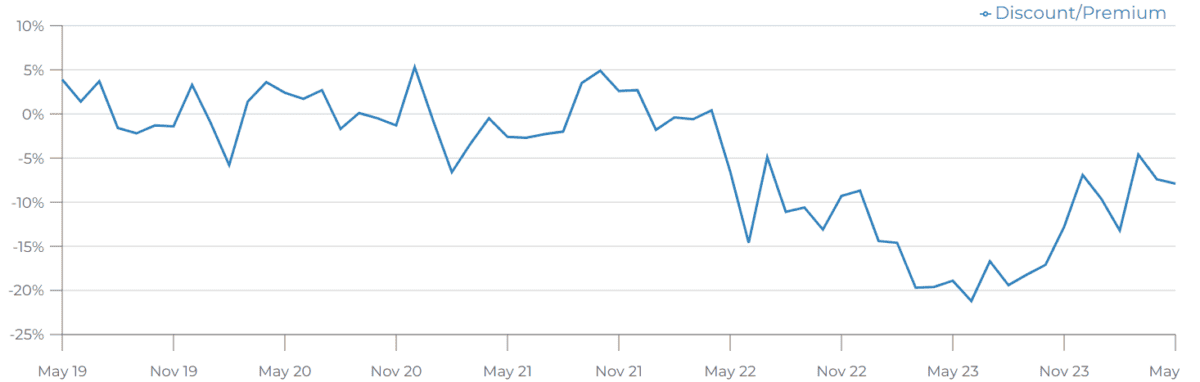

The Scottish Mortgage Investment Trust (LSE:SMT) share price currently trade at an 8% discount to the net asset value of the fund.

Although the discount has narrowed over the past year or so, it wasn’t that long ago (see chart below) that the shares changed hands at a premium.

During the pandemic, the share price performed well. But the trust’s emphasis on owning only “the world’s most exceptional public and private growth companies” led to its stock market valuation falling in 2022. And then stagnating for most of the following year.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

However, the trust’s performed better in 2024. Its share price has risen by nearly 14%, significantly outperforming the FTSE 100, which has increased by around 5%.

Largest investments

The table below shows the most recent valuation of the trust’s top 10 holdings — at 31 May — compared to 31 March 2023. I’ve used this as the basis for comparison as it gives 14 months of data to look at, rather than only two months if I used its March accounts.

These holdings account for nearly 52% of the total asset value of £14.01bn.

| Stock | Valuation at 31.3.23 (£m) | Valuation at 31.5.24 (£m) | Change (£m) |

|---|---|---|---|

| Nvidia | 404 | 1,233 | + 829 |

| Moderna | 1,143 | 1,037 | – 106 |

| ASML | 1,061 | 995 | – 66 |

| MercadoLibre | 601 | 771 | + 170 |

| Amazon | 338 | 743 | + 405 |

| Space Exploration Technologies | 465 | 616 | + 151 |

| PDD Holdings | – | 574 | + 574 |

| Ferrari | 298 | 434 | + 136 |

| Tesla | 686 | 434 | – 252 |

| Northvolt | 441 | 378 | – 63 |

Encouragingly, most of them have done well with a net increase of £1.2bn. I’ve excluded PDD Holdings from this figure as this was a new investment during the period.

But the performance of these big names appears to have overshadowed other investments in the portfolio. Since the end of its 2023 financial year, the value of all the trust’s holdings has increased by £686m.

Remove Nvidia — whose stock has risen nearly fivefold during this period — and the trust’s value has fallen by £143m.

Unquoted holdings

Another issue I see is that Scottish Mortgage has 52 stakes in private companies. At 31 May, these accounted for 26.4% of total assets.

It can be difficult to value companies whose shares are not quoted on stock markets. And it’s hard to turn these shareholdings into cash.

The most notable unlisted company in the portfolio is Elon Musk’s Space Exploration Technologies. SpaceX is rumoured to be worth around $200bn and could float as early as 2025.

But many other companies owned by the trust are in their infancy and have yet to prove they can become the ‘next big thing’.

My verdict

A significant proportion of the trust’s holdings are in companies that are at the forefront of the artificial intelligence (AI) boom. And I think how an individual investor perceives the impact of this technology largely determines their view of the stock.

Personally, I believe AI will change our lives and the way in which we work. But I have to admit I don’t yet know who will gain most from AI. Nvidia’s certainly leading the pack when it comes to semi-conductors. But it’s not yet clear to me which other technology companies will succeed.

And it’s this uncertainty that makes an investment trust in general — and the Scottish Mortgage Investment Trust in particular — ideal for me. It’s a way of investing in the technology sector without having to identify individual winners. It’s also a means of spreading risk across several companies through having just one shareholding.

That’s why it’s on my watchlist for when I’m next in a position to invest.