Although it’s sometimes difficult preparing a dividend forecast, Legal & General (LSE:LGEN) has made the task relatively straightforward with a detailed announcement explaining how it plans to reward shareholders up until 2027.

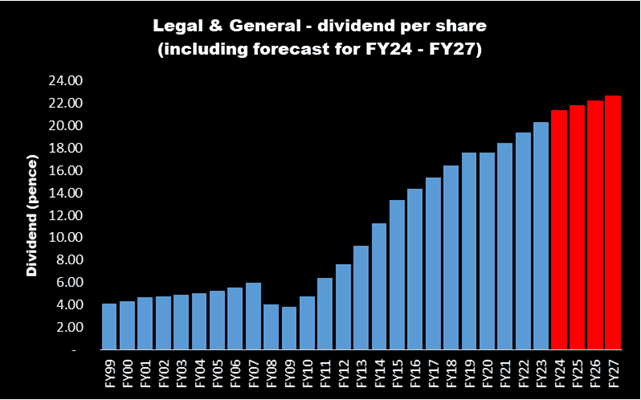

For the year ended 31 December 2023 (FY23), the FTSE 100 insurance and asset management group paid a dividend of 20.34p a share.

On 12 June, the company said it plans to increase this by 5% in FY24, with further annual increases of 2% for FY25-FY27. If this is delivered, it means the payout will be 22.66p in FY27, an increase of 11.4% on its current level.

Should you invest £1,000 in Glencore Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Glencore Plc made the list?

| Financial year | Forecast dividend (pence per share) | Increase (%) |

|---|---|---|

| 2024 | 21.36 | 5 |

| 2025 | 21.78 | 2 |

| 2026 | 22.22 | 2 |

| 2027 | 22.66 | 2 |

Disappointed shareholders

But investors didn’t appear to like the news very much. Legal & General’s shares closed the day 5.5% lower, at just under 230p.

This came as a surprise to me. The company’s shares are currently yielding 9.3%, comfortably above the FTSE 100 average of 3.8%.

And although dividends are never guaranteed, the company has a good track record of increasing its return to shareholders. It’s raised its payout during 13 of the past 14 years. Over this period, the pandemic is the only ‘blip’ during which it remained unchanged. This provides me with some comfort that it will be able to deliver its plan.

However, as the chart below shows, the forecast dividend is growing more slowly than previously. Since FY09 — when it was last cut — the average annual hike has been over 11%. The anticipated increases over the next four years are much lower than this.

The company tried to sweeten the pill by announcing £200m of share buybacks but this didn’t appear to help very much. The shares fell steadily throughout the day of the announcement. Perhaps investors prefer cash in their hand.

Other plans

On the same day that it unveiled its strategy for returning cash to shareholders, the company revealed plans to restructure its business and focus on its pensions division.

There is a growing trend of trustees wanting to offload their pension schemes. Legal & General claims that only 10% of the estimated £6.6trn of pension assets in the UK, US, and Canada have been transferred to date.

The company seeks to benefit by charging an initial fee. It then hopes to make more from investing the assets than it’s required to pay out in retirement benefits.

My view

In my opinion, I think the company is well positioned to grow over the next few years. It has a strong balance sheet – it holds more than twice the capital it’s legally obliged to have. This underpins its target of increasing earnings per share by 6%-9% annually, from FY24 to FY27.

However, there are risks. The company is sensitive to economic conditions in the UK and US. And if there’s any sign that either economy isn’t growing as forecast then the share price could wobble.

Also, it operates in a fiercely competitive industry which could threaten its market share.

But with a dividend yield of more than twice the average of the FTSE 100 and a huge pipeline of potential new business to target, I think Legal & General’s shares are offering good value at the moment.

That’s why the company’s on my watchlist for when I next have some spare cash.