Securing a steady stream of passive income isn’t a once-off job. It takes time to identify the stocks that will keep delivering returns far into the future. Dividend stocks aim to fulfil this dream with a regular flow of income that requires little attention. But it’s not guaranteed.

To feel comfortable dumping cash into a stock, investors need some assurance of future performance. The companies are ideally well-established with a long history of making reliable payments. Plus a decent yield, of course!

So are there any stocks like that on the FTSE 100? I think I’ve found two possible candidates.

Should you invest £1,000 in Dcc Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Dcc Plc made the list?

Phoenix Group

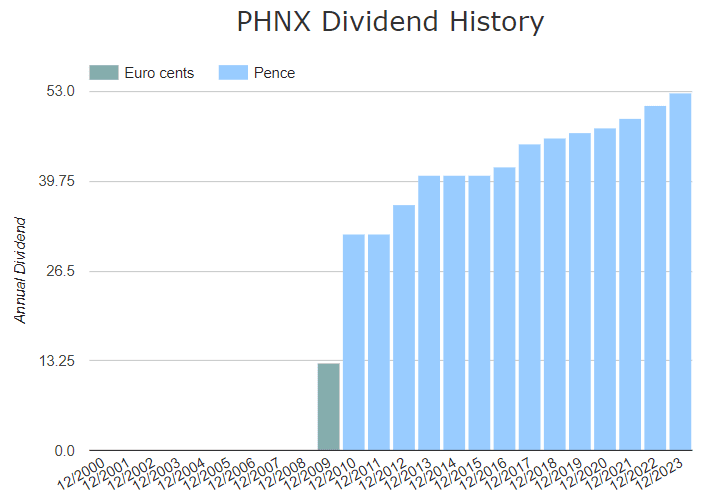

My knee-jerk reaction when I see a high dividend yield like 10.8% is scepticism. Why is it so high and, more importantly, will it stay that way? With Phoenix Group (LSE: PHNX) I was pleasantly surprised to find a 13-year track record of stable or increasing dividends.

Although the brand isn’t well-known, it’s the parent company of major insurance providers Sunlife and Standard Life. It’s also been in business for almost 170 years and sports a weighty £4.86bn market-cap. Even the share price is doing okay for a value stock. It’s down a bit in five years but has held pretty steady around 600p for most of the past decade.

However, there are some downsides. The recent spike in UK unemployment coupled with economic uncertainty heading into a tumultuous election presents risks for the firm. Insurance is a reliable industry but cash-strapped consumers still tend to prioritise immediate needs over it. Moreso, in its latest earnings, revenue missed expectations by 27%, which was a big surprise.

Fortunately, earnings-per-share (EPS) did better than expected but still came in a loss of 14p per share. If the group’s EPS continues to decline, it could threaten dividend payments.

Looking at the firm’s track record, I don’t think that’ll happen but it’s worth keeping an eye on. Long-term, I think the consistent payment history combined with large-cap stability gives it a lot of promise.

DCC

DCC (LSE:DCC) flew largely under my radar the past few years. It provides third-party support services and resources for businesses in the energy, healthcare, and technology sectors. The brand name isn’t seen plastered around town, which may be why it eluded my attention until now.

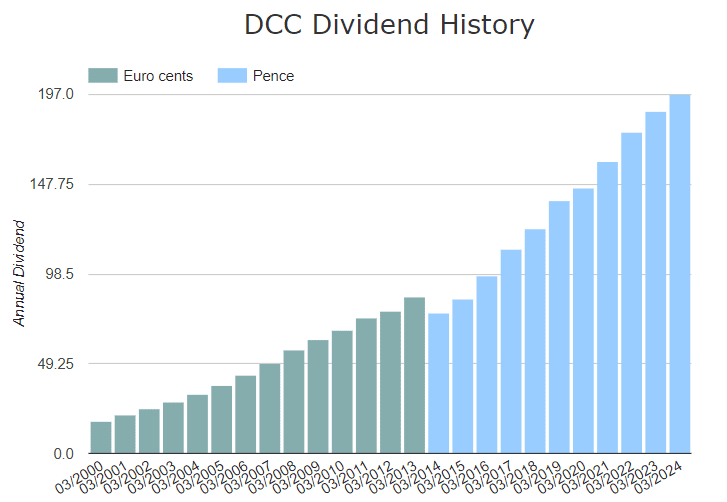

But it has two very impressive statistics: 25 years of consecutive dividend growth with a 10-year compound annual growth rate (CAGR) of 9.85%. So while the 3.5% yield may seem small for now, it suggests a promising future. With that kind of growth, DCC could be a future dividend hero!

What’s more, the share price looks like it’s in recovery mode. It suffered in the years following the 2020 market collapse but has regained 20% in the past 12 months. And between 2012 and 2018 it shot up 400%, suggesting it performs well in a strong economy.

Still, it has some room for improvement. In the latest earnings report, revenue and EPS missed analyst expectations by 3.7% and 6.7% respectively. Net income was down 2.3% while profit margins increased slightly.

With a share price lagging behind earnings, it’s estimated to be undervalued by 37% based on future cash flows. That gives the price decent room to grow. Along with the increasing yield, it could equate to impressive returns.