All passive income investors love a juicy dividend yield. But there’s more to picking winning FTSE 100 dividend shares than simply focusing on the near-term yield.

When searching for income stocks, I’m targeting companies that can provide a decent and growing dividend over time. I’m not interested in selecting shares that will provide a blowout payout this year before falling by the wayside.

I’m also looking for businesses that appear in good shape to meet dividend forecasts. Any failure on this front could prompt a sharp share price correction, so I predominantly aim for companies with strong balance sheets, stable earnings and market-leading positions.

Should you invest £1,000 in Ithaca Energy right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ithaca Energy made the list?

So which companies would I add to my Stocks and Shares ISA right now? Here’s one dividend growth share on my watchlist.

Dividends lift off

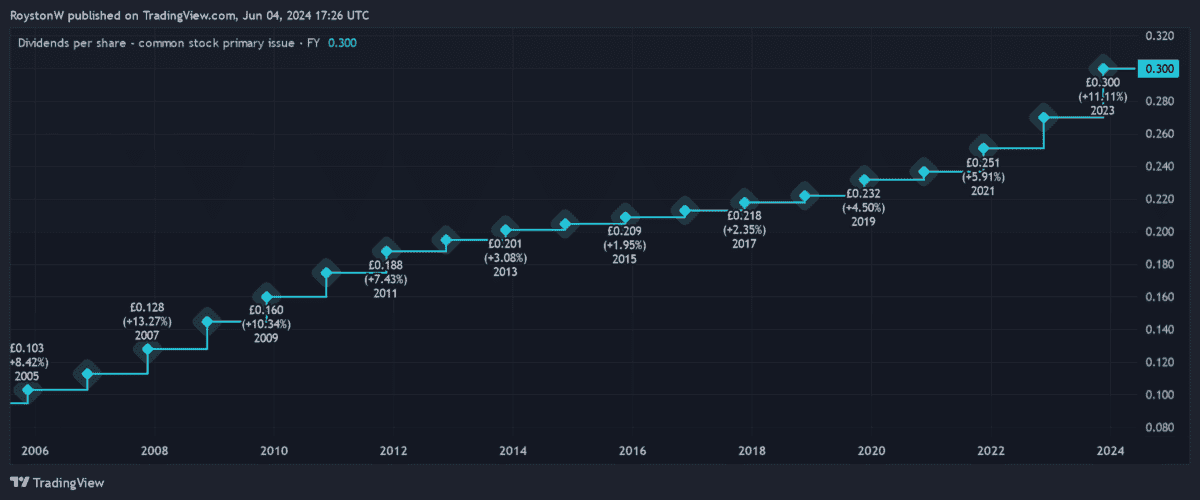

BAE Systems (LSE:BA.) is one of the Footsie’s true Dividend Aristocrats. As the chart below shows, the defence giant has a stunning record of increasing shareholder payouts.

BAE has several qualities that make it such a dividend winner. Armed forces spending remains broadly stable over time, giving the business the earnings stability and the confidence to steady grow rewards over time.

It is also a critical supplier to the US and UK, two of the largest weapons buyers on the planet. This is thanks to its enormous scale and huge R&D budgets that give it the scale to develop and build cutting-edge weaponry across land, sea and air.

A bright outlook for the defence industry means the company looks in good shape to continue growing profits and dividends. Sector peer Chemring said this week that the increase in geopolitical tensions around the world is driving a fundamental rearmament upcycle, which is expected to last for at least the next decade.

Record orders

BAE Systems is already reaping the rewards of this favourable landscape. Orders rose £600m in 2023, to £37.7bn, which pushed its order backlog to record levels of £69.8bn.

It has predicted more fireworks this year, with sales growth of 10%-12% expected. It’s a target the firm affirmed last month, along with underlying EBIT growth of 11%-13%.

Encouragingly for future dividends, the business expects to remain highly cash generative in the near term too. It expects to deliver cumulative free cash flow above £5bn for the three years to 2026.

Furthermore, this year’s predicted payout (which currently yields 2.3%) is well covered by expected earnings, providing near-term forecasts with extra strength. Dividend cover stands at 2.1 times, just above the safety watermark of 2 times.

In great shape

While things are looking good for the company, BAE Systems — like any share — still exposes investors to risk.

Inflation remains an issue across the aerospace industry, putting pressure on company earnings. Furthermore, while BAE has a strong track record of project delivery, problems at the development stages or in the field are a constant danger.

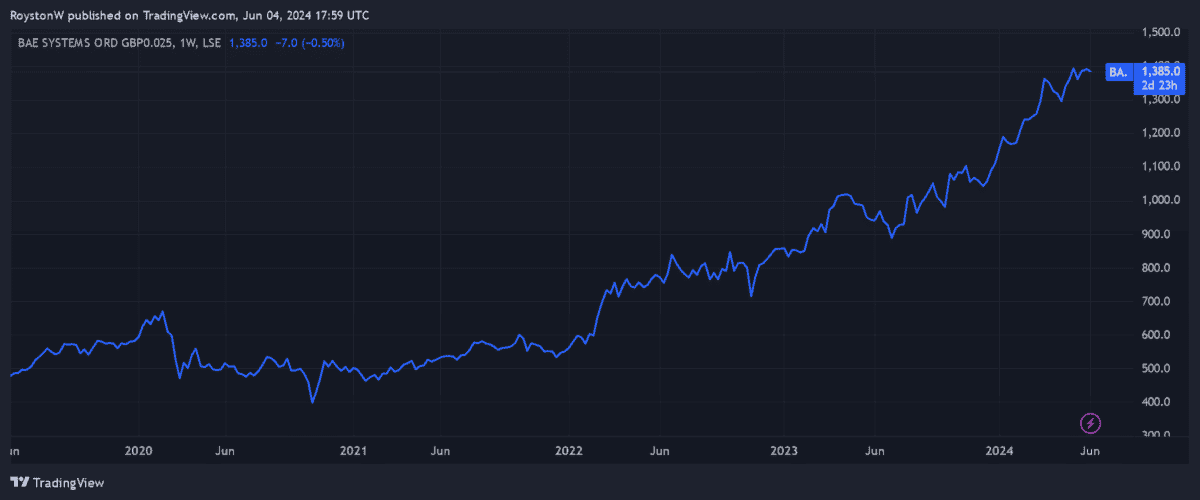

But on balance, I still think the defence giant is worth serious consideration today. As well as delivering a growing dividend, I think it might keep delivering large capital gains as its share price takes off.