On 28 May, when the stock market opened after the bank holiday weekend, the Persimmon (LSE:PSN) share price dropped sharply. Investors didn’t appear to like reports that the FTSE 100 housebuilder was considering buying Cala Group, a smaller, Scottish builder owned by Legal & General.

At one point, the shares fell 3.5%, before recovering a little by close of business.

Mixed feelings

As a general rule, I welcome takeovers.

They enable companies to expand more quickly than if they tried to grow organically. And if all goes smoothly, they should help improve earnings, enabling more generous dividends to be paid.

But as a shareholder in Persimmon I was concerned when I first heard the speculation about the purchase of Cala Group.

Legal & General took full control of the business in March 2018. At the time, the group was valued at £605m. If the rumoured price tag of £1bn is correct, Cala Group is now worth 65% more. I think that seems expensive.

Over the same period, due to well documented problems in the UK housing market, Persimmon’s stock market valuation has fallen by approximately 45%.

At first, the deal didn’t make sense to me.

Delving deeper

But a closer look at the target’s financial statements provided me with some reassurance.

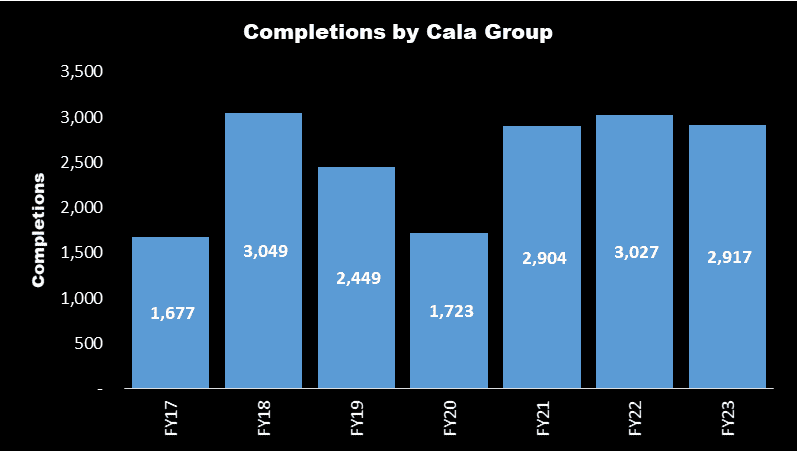

In 2018, the company extended its accounting period to 18 months. This slightly distorts the figures but, as the chart below shows, it’s consistently completed around 3,000 homes during each of the past three financial years.

By contrast, Persimmon has done much worse.

During the year ended 31 December 2021 (FY21) it completed 14,551 homes, followed by 14,868 (FY22) and 9,922 (FY23). The company is expecting to build 10,500 units in FY24.

And after looking more closely at Cala’s accounts, the reported price tag of £1bn doesn’t feel quite as expensive as it first did.

Excluding exceptional items, it made a profit after tax of £76.5m in FY23. A £1bn deal would imply an earnings multiple of 13.

For FY23, Persimmon reported earnings per share of 81.9p. This means it’s currently trading on 17.5 times historic earnings.

Also, as a builder of “high-quality family housing” Cala is able to achieve a higher average selling price of over £400k, compared to Persimmon’s £255k. If a deal is concluded, this means the FTSE 100 company would have exposure to a different segment of the market.

And post-takeover synergies could help Cala match Persimmon’s better operating margin. In FY23, this would have generated an additional £38m of pre-tax profit.

Risks

But there are risks associated with a possible deal. Integration can go wrong.

It’s also unclear how a transaction might be funded. A rights issue is unlikely to be well received by shareholders. More likely the company will have to borrow. This will ‘spoil’ its balance sheet that currently doesn’t carry any debt.

And if the housing market remains in the doldrums, Persimmon may regret expanding its cost base when revenues are stagnant or — worse — declining.

Bring it on

However, after initially being a little sceptical about the deal, I’m now more comfortable with it. I therefore plan to hold on to my stock.

And during the three days after the market digested the rumours, Persimmon’s share price went up. Perhaps other investors have also satisfied themselves that a possible deal would be good for the company.