For investors wanting to add a bit of oomph to their ISA portfolios, some of Baillie Gifford’s growth funds and trusts are well worth considering.

The Edinburgh-based investment management firm has a reputation for delivering strong returns. Lately though, it has been in the news after the Hay Festival dropped its sponsorship.

This was due to celebrity figures pulling out of the literary event and accusing the asset manager of investing billions in fossil fuels and firms with alleged links to the Israeli defence sector.

In response, the company said: “The suggestion that Baillie Gifford is a large investor in the Occupied Palestinian Territories is seriously misleading.”

Just as bizarre to my mind is the notion that Baillie Gifford is a major oil investor. It’s more famous for backing Tesla, many years before it was popular to do so.

The solar and electric vehicle pioneer has arguably done more than almost any other firm to move the world towards more sustainable forms of energy.

Anyway, here’s one Baillie Gifford investment trust that I’d buy today and hold long term.

Growth and income

The Scottish American Investment Company (LSE: SAIN) is a FTSE 250 member with a truly amazing track record of growing its dividend. It has now raised its payout for 50 straight years!

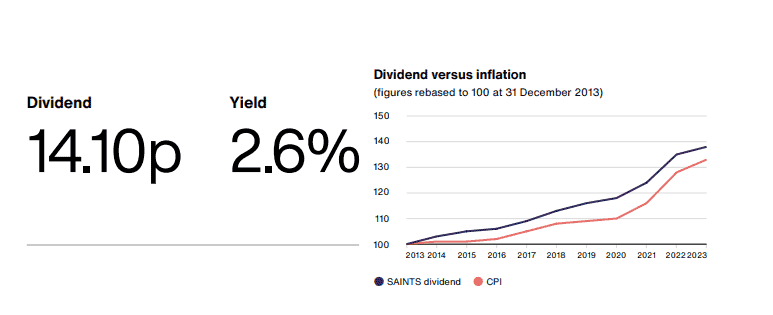

Founded in 1873, its objective is to deliver real dividend growth by increasing capital and income. Real dividend growth means above the rate of inflation, which it has achieved long term.

Now, as we can see above, the dividend yield isn’t that eye-catching. Based on the current share price, it’s just 2.75%. When I can bag 7%-10% yields in the FTSE 100, that doesn’t seem very appealing.

However, it targets firms with the potential to grow both their share prices and dividends for many years. And it only invests in those whose earnings and cash flows are likely to grow ahead of inflation.

Risk to consider

The downside to this approach is that there can be periods of underperformance when a small number of non-dividend-paying stocks drive the market forward.

This has happened recently with Nvidia, whose dividend is negligible and therefore not part of the portfolio. Partly because of this, the trust underperformed its benchmark (the FTSE All-World Index) last year.

If this happens again, investors might question the strategy and sell the shares.

Two massive global trends

Despite this risk, I’m bullish due to the quality and durability of the trust’s portfolio, which also contains a smattering of bonds, property and infrastructure assets that pay income.

I like that Novo Nordisk and Microsoft are among its top holdings. This pair are at the forefront of two of the largest trends I see unfolding over the next decade: weight-loss drugs and artificial intelligence (AI).

The number of adults living with obesity is expected to rise from 800m in 2020 to 1.53bn by 2035. So this is a truly gigantic addressable market opportunity for weight-loss treatments like Novo Nordisk’s Wegovy.

Meanwhile, we can’t go 24 hours nowadays without hearing about AI. Nvidia’s CEO Jensen Huang has just pronounced that a new AI “industrial revolution” has begun.

As a leader in cloud computing and major investor in ChatGPT parent OpenAI, Microsoft looks incredibly well-placed to benefit from this.