Nordic American Tankers (NYSE:NAT) is a dividend stock I’ve spoken about before. It’s something of a hidden gem for UK investors. The Bermuda-headquartered company runs a fleet of Suezmax tankers and currently offers a mega 10.7% dividend yield.

What’s with my optimism?

Putting the huge dividend to one side, Nordic American Tankers is operating in a booming sector. Analysts had been warning for years that the sector wasn’t building enough new vessels, and they were right.

Currently, the global tanker fleet is the oldest it’s been in living memory, and there are just two new supertankers entering service in 2024 — that’s 90% lower than the average this millennium.

Remember, old vessels can’t operate on prime contracts. Big energy companies like Exxon and Vitol don’t use clapped-out Soviet tankers to transport their valuable products. This means well-prepared companies, especially those with plenty of vessels under 15-years-old, are perfectly positioned to benefit.

Red Sea turmoil

What’s more, there’s trouble in the Red Sea, one of the world’s most important shipping lanes. Due to Houthi attacks, approximately 90% of Red Sea shipping is being diverted around South Africa.

According to legendary investor J Mintzmyer, this rerouting “adds 40% to that key Asia to Europe route, it adds 60% to 70% to Asia-Mediterranean trades“. This is eating up any spare tanker capacity and has been pushing leasing rates sky-high on affected routes.

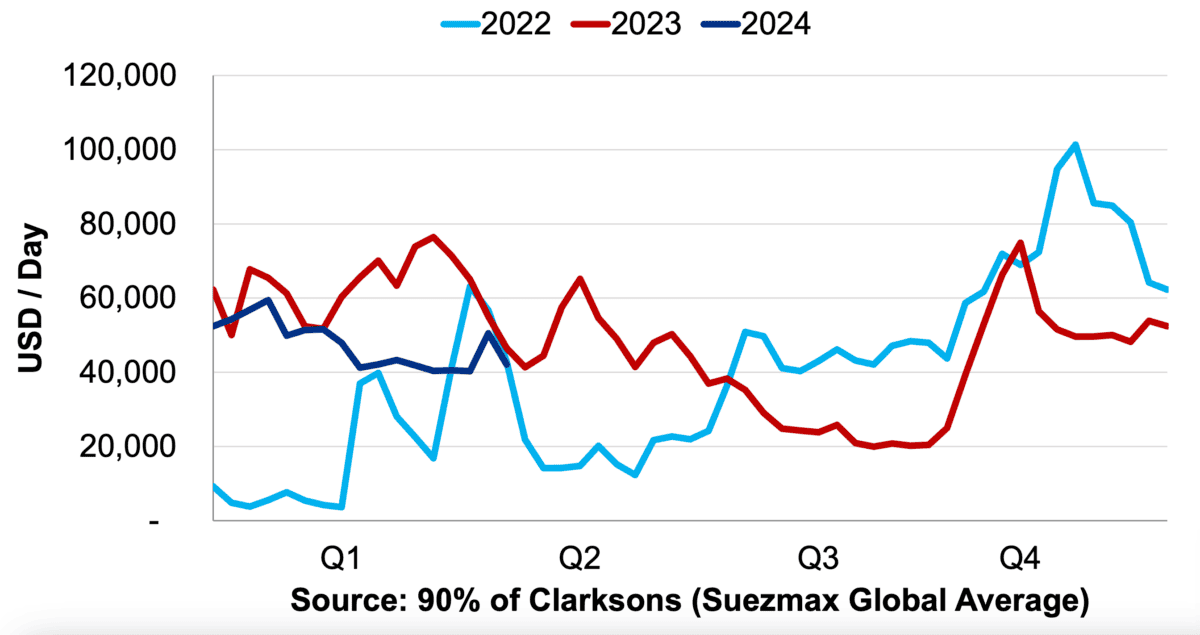

As the name suggests, Nordic American’s tankers are the largest vessels that can fit through the Suez Canal — Suezmax. And that means they’re in demand. The spot rate for leasing a Suezmax tanker has tripled over two years.

What’s happening next week?

Nordic American is due to report its Q1 2024 earnings next week — 29 May pre-market (US time). This means we’ll be able to see how well the company is performing.

Analysts are expecting the company to announce earnings per share of 11¢ and revenues of $66.19m. In the last quarter, the tanker stock reported earnings per share of 8¢ per share and revenues of $59.25m. So, we’re looking at a 10% increase in revenue.

Am I being too optimistic?

It’s not a perfect science, but leasing rates for Suezmax tankers remained strong throughout Q1. I don’t have the exact data, but long-run contracts appeared to running at a premium in Q1 compared with Q4, and spot rates remained elevated. The total average time charter equivalent (TCE) achieved by Nordic in Q4 was $39,170 per day per ship.

It’s also worth noting that peers like Scorpio Tankers, which I have been bullish on, also outperformed expectations in Q1. The larger tanker company highlighted higher TCE revenue in Q1 of 2024 versus Q4 of 2023.

However, it’s also worth recognising that the company’s own guidance is extremely important. Nordic’s management was cautious about how long these elevated prices would last. Should the Red Sea attacks stop, I’d also expect to see rates decrease in the short term. Long-term supply and demand imbalances remain.