The most recent addition to my ISA is BBGI Global Infrastructure (LSE: BBGI). The FTSE 250 stock had been on my buy list for ages and was starting to rise (up 10% in three months). So I delayed no longer.

Here’s why I think this is an excellent dividend share for investors to consider.

A lower-risk portfolio

BBGI’s an infrastructure investment company with ownership stakes in 56 projects across the UK, continental Europe, North America, and Australia.

Its partners include national and regional governments with credit ratings between AA and AAA. The assets consist of toll bridges, motorways, schools, hospital facilities and other social infrastructure.

These projects are entirely availability-based, which means that as long as they’re up to scratch and operational, BBGI gets paid. It doesn’t matter if anyone’s using them or not.

The income is government-backed and inflation-linked. Needless to say, this makes it consistent and reliable. And while no dividend is ever truly guaranteed, I’d be very surprised if this one was cancelled.

Some risks to consider

Of course, this doesn’t mean there aren’t risks. An economic downturn is one because infrastructure projects might be delayed or even cancelled, impacting BBGI’s income stream from these projects.

Also, the success of BBGI depends on the skills and decisions made by the management team. The running of the fund has been excellent so far, but poor future investments could lead to losses.

Finally, high interest rates make it more expensive for governments and companies to finance infrastructure projects, limiting the growth of the fund’s portfolio.

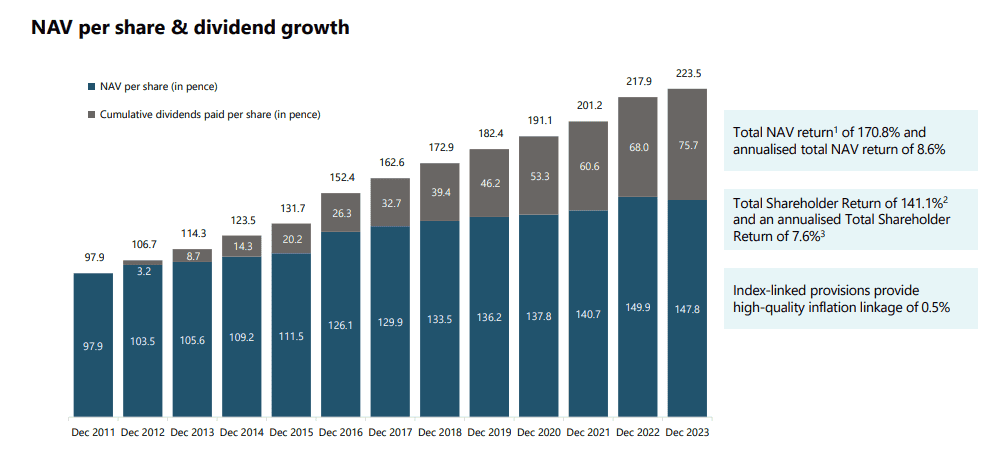

Indeed, it suffered a decline of 1.4% in net asset value (NAV) last year, due to higher rates. This was its first ever annual fall since going public in late 2011.

Solid track record

However, the decline in NAV doesn’t really bother me. It was down to macro factors rather than anything wrong with the strategy.

The cash flows remain solid. Last year’s dividend was raised 6% to 7.93p and was fully covered 1.4 times. This translates into a dividend yield of 5.9%.

From IPO to the end of 2023, the annualised total return on a NAV basis is 8.6%. In reality though, shareholders have received 1% less than that figure due to the recent share price weakness, with the fund currently trading at an 8% discount to NAV.

15 years of growth left in the tank

For 2024, the firm’s committed to increasing the payout to 8.4p. That puts the forward yield at 6.2%, meaning a £5k investment would return £311 a year in dividends, without any further increases.

However, BBGI reckons the projected cash flows from its existing portfolio are enough to keep growing the annual dividend for the next 15 years. That’s music to an investor’s ears!

Plus, after fully repaying a revolving credit facility in 2023, there is now no debt on the trust level.

All things considered, I reckon this is an excellent dividend share, with an attractive forward yield and rock-solid fundamentals. I’m going to reinvest the dividends it pays me and let them compound.