The Tesla (NASDAQ:TSLA) stock price has had an eventful April. A drop in deliveries and a poor set of results for the first quarter (Q1 24) led to some sharp falls. News of Elon Musk’s decision to sack the company’s entire ‘Supercharger’ team caused further losses. But his trip to China, which appears to have paved the way for the company’s self-driving technology to be used in the country, lifted its stock price higher.

Experienced investors will know that short-term fluctuations in the value of a company are largely irrelevant. What really matters are its long-term prospects. And one issue I think needs to be resolved is the company’s declining automotive gross profit margin.

Travelling in the wrong direction

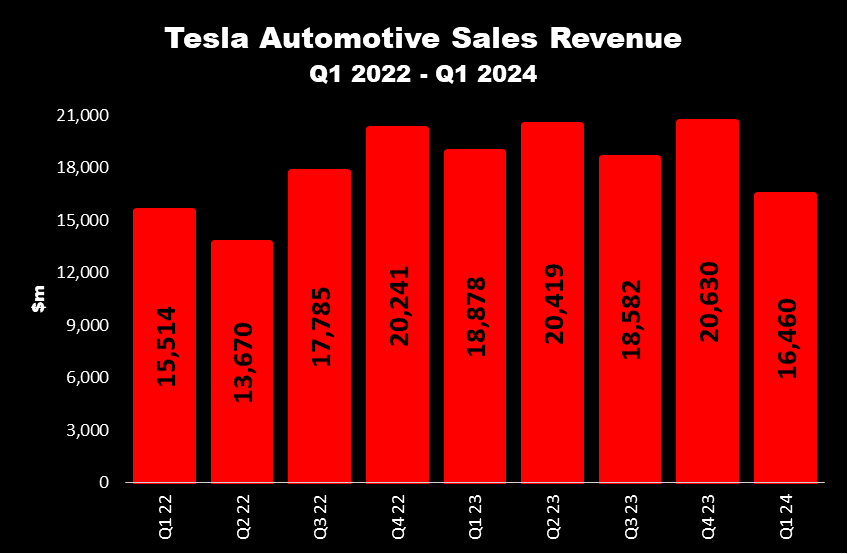

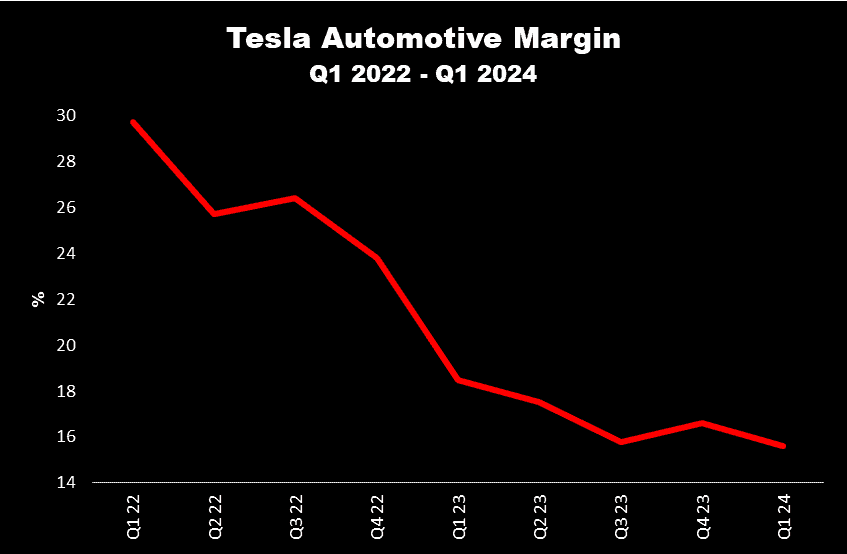

As the chart below illustrates, this has dropped from 29.7% in Q1 22, to 15.6% for Q1 24. It’s falling due to a series of aggressive price cuts and post-pandemic inflation.

However, unlike most of its competitors, Tesla reports its research and development (R&D) expenditure within overheads. This means it falls outside its gross profit calculation. Of course, it doesn’t affect the company’s bottom line but it does mean its margin is overstated when compared to some other manufacturers, including Ford and Volkswagen Group.

Not all of Tesla’s R&D spend relates to its car business. But if we assume 50% is automotive specific, a further 3.3 percentage points would have been shaved off its margin in Q1 24, if it changed its reporting of costs.

Car manufacturer or tech company?

In 2022, Musk said on Twitter: “Tesla is as much a software company as it is a hardware company, both in car and in factory. This is not widely understood.”

The visionary leader sees autonomous vehicles as the future and believes that licensing its self-driving technology — paid for by monthly subscription — will massively improve its margin.

Indeed, it’s not uncommon for software companies to have margins in excess of 80%. And Musk’s vision of a high-margin future is one of the reasons behind his recent visit to China. If he can persuade the Chinese that autonomous vehicles are the future then others may follow.

In May 2023, Musk was asked how artificial intelligence (AI) will impact the company. He said: “It’d be like selling cars for software margins because, in fact, it is software. And so, instead of effectively having, say, 25% margins, it might be 70%, or more.“

Not as easy as it sounds

In a competitive market, it’s difficult to increase margins. The most obvious short-term solution is to raise prices but Tesla has recently cut these to combat falling sales. And the company has already relocated some its production to China where manufacturing costs are cheaper.

Looking further ahead, transitioning to a software business isn’t going to be quick. There are all sorts of technological, legal and regulatory hurdles that need to be overcome before truly automated cars are on our roads.

But one thing I’ve learned about Tesla, and Musk in particular, is that they have repeatedly proven the doubters wrong. Many invest in the company because they have faith in its inspirational chief executive. And I’m sure they’ll be hoping the company’s declining margin is a temporary blip on the long road to becoming a software company.