The FTSE 100 is home to a wide variety of different stocks. However, it is especially famous for certain industries like financial services, energy, mining, and fast-moving consumer goods.

Mega caps like Shell, Lloyds, Glencore, and Unilever are some of its most notable sons. It’s incredible to think that a niche hobby stock could be adding its name to this hallowed list, but that’s what we are looking at today.

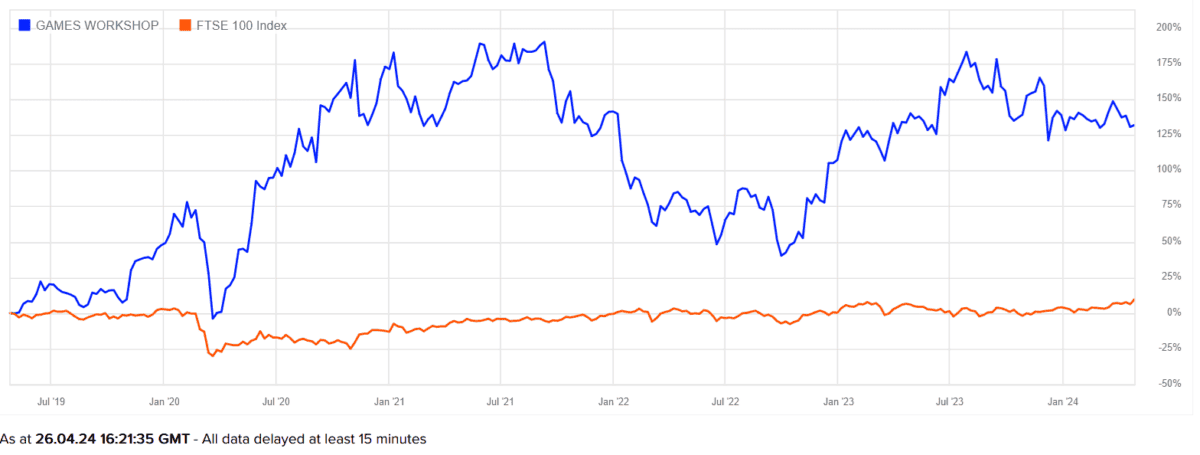

Games Workshop Group’s (LSE:GAW) share price has risen a stunning 133% in value over the past five years. If it continues its current path, the fantasy wargaming giant might soon be banging on the door of the Footsie.

The chances of this happening are super high, in my opinion. Here is why.

A brilliant enigma

Games Workshop’s share price performance since 2019

It’s been 46 years since Games Workshop opened its first shop in Hammersmith, London. But to many, the products it churns out — and what makes them so popular with hobbyists — remain a mystery.

It’s easy to understand what British American Tobacco, Diageo and Barclays all do and what makes them investable companies. And that’s what makes them so popular.

Tabletop wargaming, by comparison, is a more opaque sector and trickier to understand. So let me give you a potted history of what Games Workshop does, and what makes it an industry powerhouse.

Booming industry

The FTSE 250 company designs, manufactures, and then sells — through its own shops and websites, and via third-party vendors — a huge range of plastic miniatures and gaming systems. Its miniatures represent various armies, factions, and characters from their fictional universes.

Hobbyists buy these models in boxed kit form, then build and decorate them (often using Games Workshop’s vast collections of paints, brushes and crafting tools). Once finished, players then do battle with their miniatures on a tabletop with others using a turn-based playing system incorporating dice.

It’s a unique hobby, sure, and certainly not to everyone’s tastes. But it’s a gigantic one that has a passionate following. And it’s still growing steadily in popularity.

According to researchers at USD Analystics, this industry is set to expand 6.3% between 2024 and 2030.

A top stock to consider

Hobbyists have a variety of tabletop games systems to choose from. And the number of game manufacturers entering the market is growing, representing a threat to Games Workshop.

But the Nottingham company has built a formidable fanbase in its own right. This is thanks to the high quality of its product and storyline development around its miniature armies and characters.

Its flagship Warhammer 40,000 games universe, for instance, has evolved over decades and spawned vast communities of players in that time.

The business is busy bringing its products to new generations of devoted followers, too. It is steadily expanding its global store network. And it is in talks with Amazon to bring its Warhammer universes to the big and small screens to boost model sales and generate huge revenues in its own right.

Today Games Workshop shares trade on a forward price-to-earnings (P/E) ratio of 21.3 times. Given its position as a top growth stock I think this valuation is pretty reasonable.

I believe it’s a top stock to buy today and hold onto for the long term.