There’s not much to dislike about a company growing revenues at 27% and earnings per share at 117%. But Meta Platforms (NASDAQ:META) saw its share price fall after its Q1 earnings report.

The company’s results for the first three months of 2024 came in ahead of expectations. But having increased by 137% over the last 12 months, a more tepid outlook for Q2 caused the stock to pull back.

Strong earnings

If Meta’s report had a weak point – and I think it did – it was the metaverse segment. Reality Labs reported lower revenues and managed to burn through another $3.8bn between January and March.

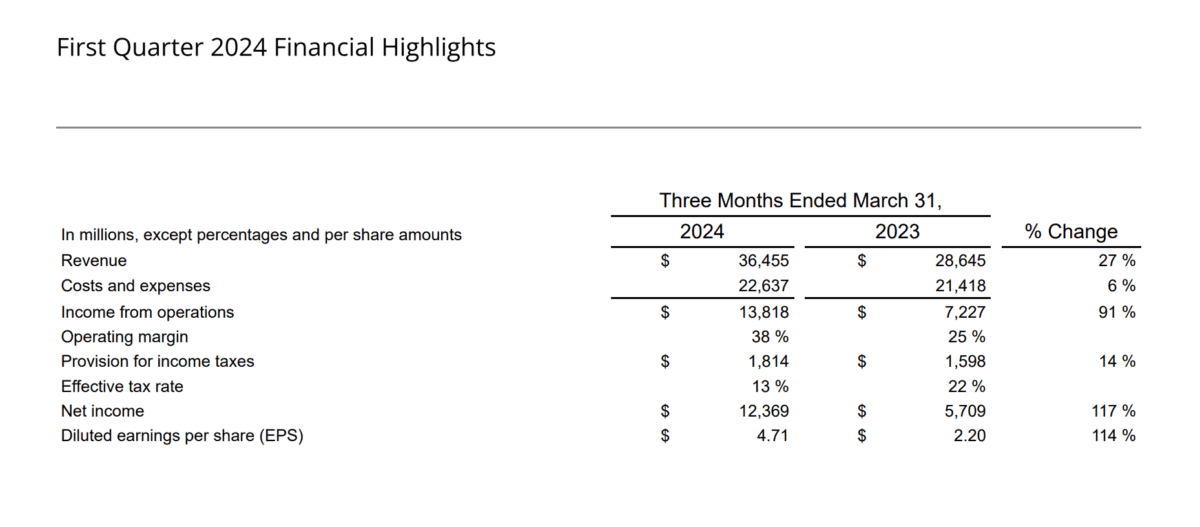

Meta Platforms Q1 earnings report:

Source: Meta Platforms Earnings Presentation Q1 2024

This was more than offset by the company’s social media results though. Revenues from the Family of Apps increased by $7.7bn and income grew by $6445 – more than offsetting the metaverse loss.

Furthermore, the number of people using Meta’s social media platforms increased again. I’d have thought they’d start running out of humans soon, but not yet – the number of users increased by 7%.

Realistically, investors can overlook the metaverse incinerating capital when higher revenues and lower costs are causing earnings to more than double. But things don’t look as good going forward.

Weak guidance

For the next three months, Meta’s forecasting revenues of between $36.5bn and $39bn. That implies growth ranging 14-22% – slightly lower on average than the 20% analysts were anticipating.

On top of this, the company raised its forecast for expenses through the rest of the year. The forecast for capital expenditures increased from $30bn-$37bn to $35bn-$40bn.

Meta expects its expenditure to keep increasing beyond this year as the firm looks to build out its artificial intelligence (AI) capabilities. Oh, and Reality Labs is set to lose yet more money.

A 42% increase in the Meta share price since January reflects the company’s strong growth this year. But the stock’s pulling back in anticipation of slower growth and weaker margins going forward.

Time to buy?

Accounting for its latest results, a 10% drop puts Meta shares at a price-to-earnings (P/E) ratio of around 24. That’s high but, arguably, not outrageous.

The company’s shown it has some legitimate AI credentials. And these are backed by some serious capital and a management team that’s unafraid of making bold investments.

This could make Meta a serious force in AI. But the question investors need to consider is whether this is the next Family of Apps or the next Reality Labs?

At today’s prices, the stock looks like a bargain only if the AI investments add at least incremental value to the business. They might do this, but I find it hard to weigh Meta against its rivals here.

Reality check

A 10% pullback doesn’t change the fact that investors who bought Meta shares a year ago have done very well. And this isn’t just hype – the underlying business has produced exceptional results.

Equally though, the stock falling slightly after strong Q1 earnings doesn’t quite put it into obvious buying territory for me. If Reality Labs could chip a bit more off the price, I’d happily take another look.