I’m a big fan of dividend income. Not because I want to spend it on one-off treats but, instead, I like to use it to buy more shares.

Take Kingfisher (LSE:KGF) as an example. It’s the parent company of B&Q and Screwfix. The group sells everything from sheds to kitchens. On Monday (15 April), a £20,000 investment (ignoring stamp duty and broker’s fees) would have bought me 8,025 shares.

The declared dividend for its financial year ended 31 January (FY24) is 12.40p. Assuming this is repeated for the next 10 years, and I used the cash to buy more shares at their current price, I’d be able to purchase another 5,010 of them. After a decade, assuming no stock price change, my initial stake would have grown to £32,485. That’s enough to buy 73 of B&Q‘s cheapest wooden sheds!

Unfortunately, dividends aren’t guaranteed. And looking at the recent history of Kingfisher’s earnings, it’s easy to see why. They’ve fluctuated significantly from one period to the next. And if profits are volatile, it’s likely that dividend payments will remain erratic.

| Financial year (31 January) | Profit after tax (£m) | Dividend per share (pence) |

| 2020 | 8 | 3.3 |

| 2021 | 592 | 5.5 |

| 2022 | 843 | 12.4 |

| 2023 | 471 | 8.6 |

| 2024 | 345 | 12.4 |

Difficult times

In 2020, the pandemic clearly played a part in the drop in earnings. But the company’s performance since Covid has been mixed.

It’s doing well in the UK and Ireland but is finding trading conditions more challenging in France and Poland. These two markets accounted for 47% of group revenue in FY24. However, Kingfisher has put into place a plan to restructure operations and cut costs. It also wants to encourage more trade professionals to buy from its 2,000 worldwide stores.

This means directors are forecasting a better year ahead. They’re expecting to achieve a profit before tax of £490m-£550m in FY24 (FY23: £475m).

Although an improvement, it’s not much of one, which probably explains mixed broker opinions. Of the 16 surveyed on the company’s website, four recommend the stock a ‘buy’, eight say ‘hold’ and four suggest their clients should ‘sell’.

Market influences

On the face of it, the DIY industry should do well, irrespective of the wider economy. House repairs need to be undertaken as and when they occur, to prevent further damage.

And if people aren’t moving due to a slump in the housing market, they’re more likely to improve their properties. However, research shows that DIY retailers do better when house prices are rising. That’s because property owners are more likely to spend money improving their homes when they see a greater return on that investment.

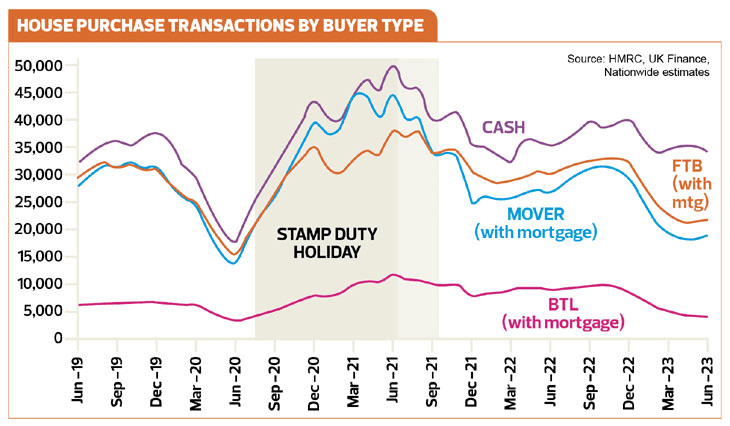

Also, when people move home, they take the opportunity to redecorate or upgrade. That’s why the shape of the Kingfisher five-year share price chart looks similar to a graph of UK housing transactions.

Final thought

But I already have exposure to the housing market through my shareholding in Persimmon. Therefore, I don’t want another share that’s reliant on the sector.

Otherwise I’d be happy to take a stake in Kingfisher. The shares are yielding a healthy 5% — the average for the FTSE 100 is 3.9%. And there’s a chance they’ll benefit from a recovery in the housing market.