UK defence stocks have been performing strongly recently. The largest of them all, BAE Systems (LSE: BA.), has been a big FTSE outperformer, rising 140% since late 2021.

Its meteoric rise reflects how unstable geopolitics has become. On 13 April, Iran launched its first-ever direct attack on Israel, sparking fears of a much wider conflict. Meanwhile, the war in Ukraine continues while tensions remain high between China and Taiwan.

Given all this, it’s very likely that global military budgets will rise even higher.

It’s often said that the stock market is forward-looking. So is all this already priced into FTSE defence shares? Let’s take a look.

Turning to the charts

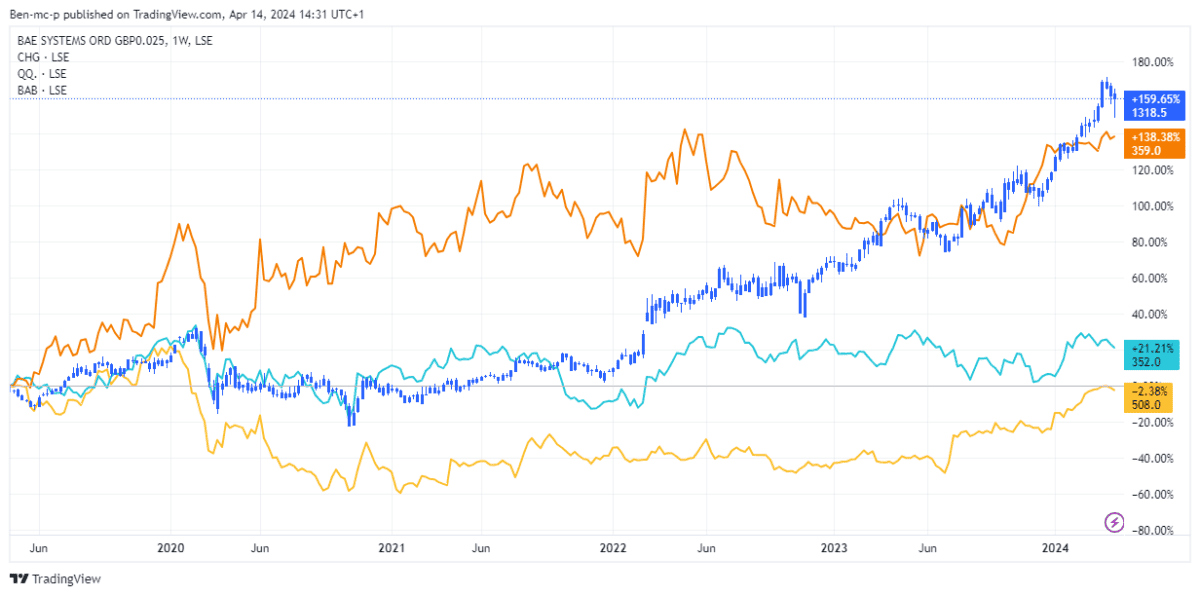

Below, we can see the five-year share price performances of four UK defence stocks. Namely, BAE Systems (159%), Chemring (138%), Babcock International (-2%) and QinetiQ (LSE: QQ), which is up 21%.

Over this time frame, two stocks have more than doubled (BAE and Chemring), while the other two haven’t performed anywhere near as well.

However, while QinetiQ’s 21% gain looks relatively modest, it is actually a far better return over tbis period than the FTSE 250 (to which it belongs). The mid-cap index is flat.

And Babcock’s disappointing five-year performance hides the fact that the stock has rocketed 72% in the past year alone.

How have these movements affected valuations?

The P/E ratio

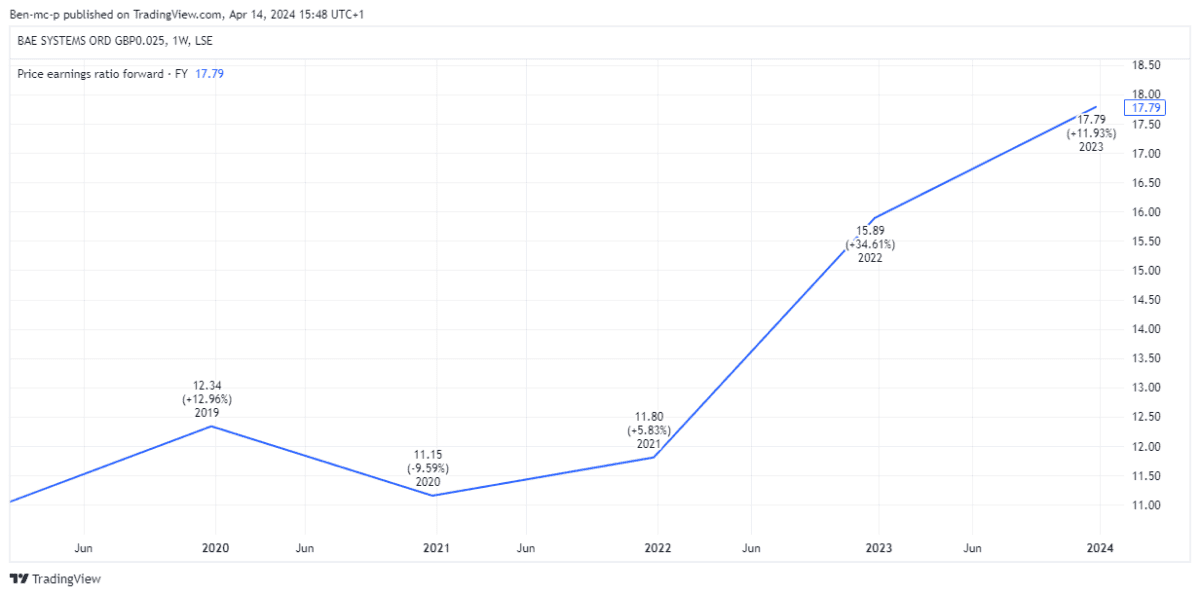

Looking at the forward price-to-earnings (P/E) metric, none of the stocks strike me as grossly overvalued.

| Forward P/E | |

| BAE | 17.8 |

| Chemring | 17.8 |

| Babcock | 13.6 |

| QinetiQ | 12.5 |

BAE’s forward P/E of 17.8 is noticeably higher than its historical average, though.

Yet it could be argued that the stock had been undervalued versus US peers for many years. So perhaps its strong performance has just closed that gap, affording it fair value.

Dividends

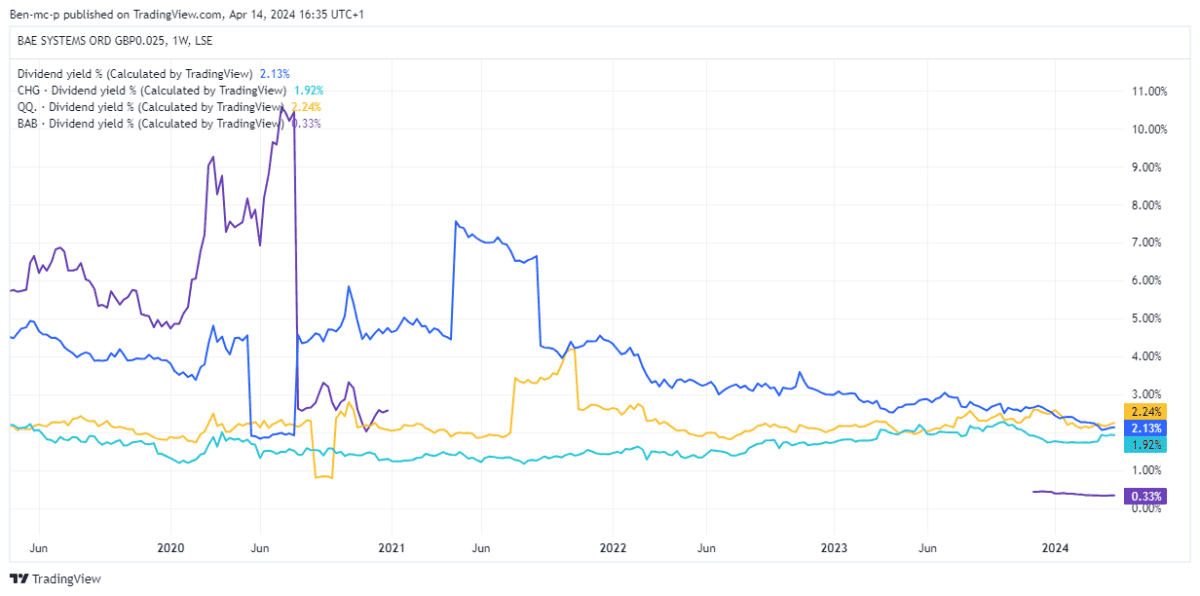

On the dividend front, all yield 1.9% to 2.2% except Babcock. It didn’t pay out at all in 2021 and 2022. The dividend is back now (yielding 0.33%), but is nowhere near its prior 2019 level. The forward yield is just 1%.

While not the highest yields due to rising share prices, all four dividends are extremely well-covered by earnings.

Which looks the better buy?

Based on this, I’d say QinetiQ stock looks good value. The shares haven’t surged like the others over the past year. Consequently, the forward P/E ratio is just 12.8 and there is a 2.2% dividend yield.

The firm’s revenues and profits are forecast to trend higher over the next couple of years while the dividend is heading in the right direction, too. It has also commenced a £100m share buyback programme to run over the next 12 months.

One issue I’d highlight here though is that about 66% of QinetiQ’s revenue comes from the UK. If elected, Labour has committed to raise the UK’s defence spending to 2.5% of GDP “as soon as resources allow”.

But what if resources don’t allow and the Ministry of Defence (MOD) budget is slashed? That could be bad news for the stock.

Taking everything into account, I’d consider investing in BAE if I hadn’t done so already. The stock is pricier, which adds risk, but the firm is more diversified both in terms of geography and products.