Millions of us invest for passive income, but I’d imagine most of us haven’t come across this stock. It’s not small, but US-listed tanker stock, Nordic American Tankers (NYSE:NAT) probably isn’t the first company we think of for dividends. So, here’s why I’ve bought Nordic American Tanker shares.

Huge dividends

Nordic American Tankers has one of the strongest dividend yields I’ve come across. The current $0.48 annual dividend payment per share equates to a dividend yield of 12.06%. That’s really huge.

From a passive income perspective, investors may be interested to know that it pays its dividends quarterly — more regularly than most companies. If I had £10,000 in the stock, that’d be around £300 every quarter.

Moving forward, analysts expect the dividend yield to hit $0.50 in 2025. This would be covered by $0.63 of earnings. So, the dividend coverage ratio isn’t the strongest, but clearly the company is confident it can cover it.

The dividend coverage ratio is perhaps the weakest part of the investment thesis. Normally, the benchmark for a healthy dividend coverage ratio is around two times. That means that the stated dividend could be covered two times by net earnings.

Booming industry

Thankfully, however, the tanker sector is booming, and it could well be at the start of a super-cycle that will keep pushing revenue and earnings higher. This makes me confident that the dividend remains fundable throughout the medium term.

The tanker industry is currently facing significant shortages and the global fleet is older than it’s been in living memory. As with many things, the reason is the pandemic. During the pandemic, tanker companies were hesitant to put in new orders as business lagged.

Fast-forward to today, the global economy is bubbling away, demand for hydrocarbon products has recovered, and there just aren’t enough tankers.

What makes this shortage worse is that it can take up to five years for a tanker to be delivered from the moment of ordering. Moreover, there are fewer than half the number of shipyards today as there were back in 2007 (700 vs 300).

Additional factors

Long-term supply and demand dynamics are the main reasons pushing leasing prices up — leasing costs are the prices of renting Nordic American’s services. However, there are other factors exacerbating shortages in the industry.

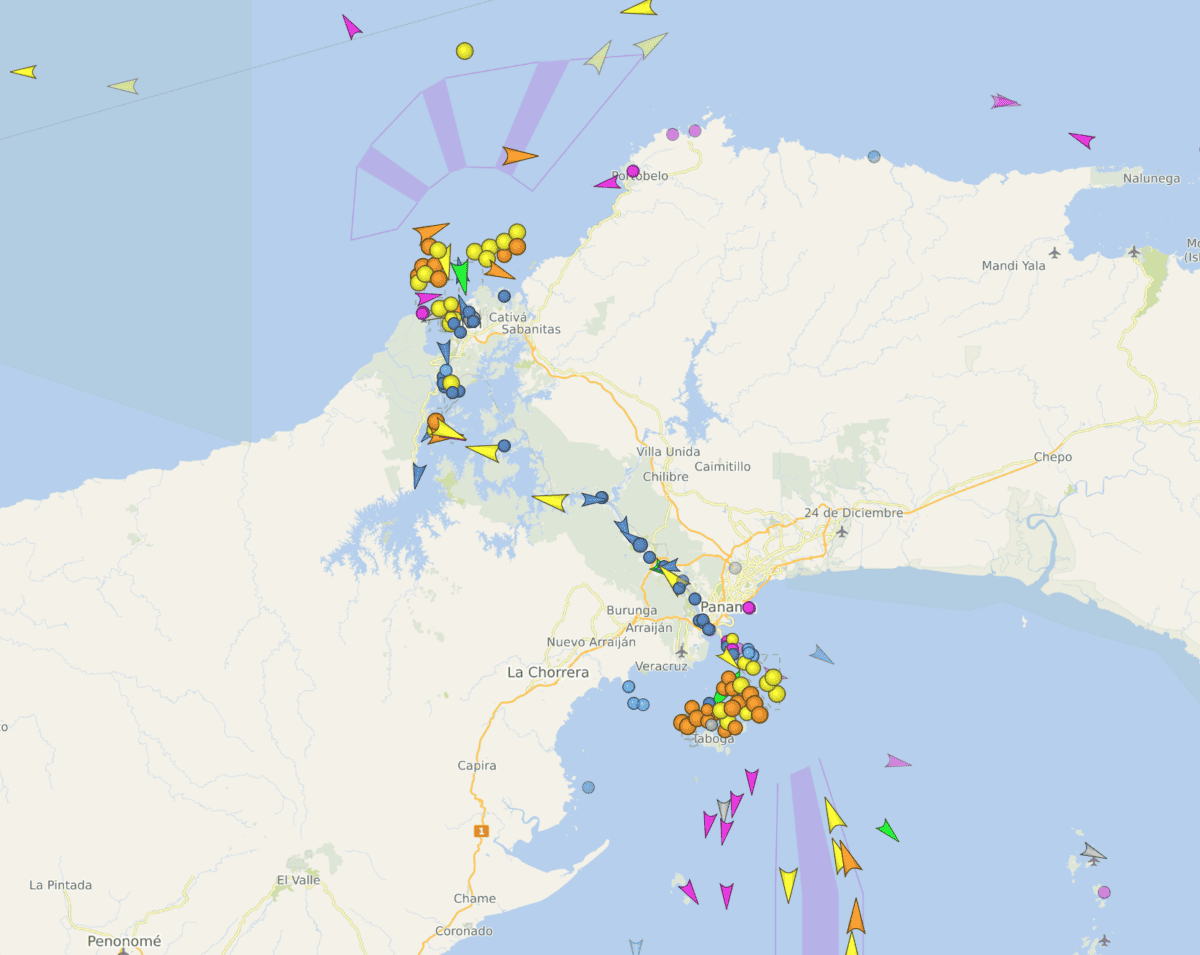

Chief among these are Houthi attacks on vessels transiting the Bab el-Mandeb Strait, and a drought in Panama.

So, why are these important? Well, many vessels that would have been transiting through the Red Sea are now rerouting around the Cape of Good Hope — southern Africa. It’s a huge addition to the length of their journeys and means fewer vessels are available.

Likewise, vessels wanting to transit between the Atlantic and the Pacific are either sitting in queues near Panama or finding alternative routes. The number of ships transiting the canal has reportedly risen to 27, from 18 in January. But this is still down on normal numbers, and queues, as we can see below, are building up.

The bottom line

The dividend coverage ratio could be stronger, but given the positive factors at work in the sector, I’m confident that Nordic American’s dividend payment remains safe. If I could increase my holding to £10,000, I would. I think it’s an excellent passive income opportunity.