The new Stocks and Shares ISA tax year started on 6 April. This means investors can put away another twenty grand in their accounts and enjoy tax-free passive income and growth from their investments.

If I was lucky enough to have this amount in cash, here’s how I’d go about investing it to target a large second income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Get the ball rolling

For starters, I’d open a Stocks and Shares ISA if I hadn’t already done so.

Doing so would immediately open up a whole world of investing possibilities. I’d be able to invest in individual shares, exchange-traded funds (ETFs), and investment funds and trusts.

As I write (12 April), the FTSE 100 is flirting with an all-time high. Yet that doesn’t mean there aren’t opportunities.

Quite the opposite, in fact.

A symbiotic relationship

One FTSE 100 stock I’d invest in is Coca-Cola HBC (LSE: CCH).

This Switzerland-based bottler enjoys exclusive rights to manufacture and sell Coca-Cola products in 29 countries across Europe, Asia, and Africa. The HBC bit stands for Hellenic Bottling Company, its original name when it was founded in Greece in 1963.

How it works is that the firm buys core concentrates, syrups, and bases from The Coca-Cola Company. These are the formulas that give Coca-Cola its unique taste.

Meanwhile, The Coca-Cola Company owns the brand and focuses on product development and marketing. Overall then, this setup creates a symbiotic relationship.

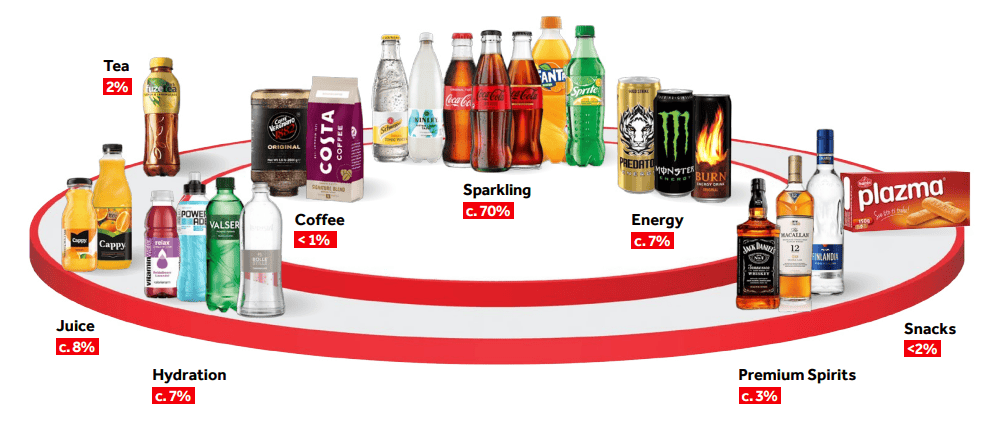

The company also sells other soft drinks and products, many owned outright by the US beverages giant, including Fanta and Sprite.

All-round value

Ongoing growth has been impressive. In 2023, net sales revenue increased 10.7% year on year to €10.2bn. This was the third consecutive year of double-digit growth. Revenue is forecast to reach €11.6bn in 2026.

Plus, the dividend was raised by 19%, with the payout growing at a five-year compound annual growth rate (CAGR) of 10.3%. The starting dividend yield is 3.33%.

In November, the company also launched a €400m share buyback program. Buybacks tend to boost metrics like earnings per share (EPS) as there are fewer shares for the profits to be divided among.

Looking ahead, one risk could be a major economic downturn. That could lead to less demand for soft drinks in restaurants and tourist hotspots.

That said, Coke sales don’t tend to drop off a cliff even during recessions. And as more brands are eventually brought under the company’s umbrella, this should benefit Coca-Cola HBC.

The stock is cheap trading at just 13 times forward earnings for 2024. I think it offers fantastic all-round value.

Passive income target

From a well-rounded portfolio of such stocks, I could realistically aim for an average annual long-term return of 8%. This isn’t guaranteed and there will naturally be ups and downs along the way.

Assuming I do though, my £20k compounded over 25 years would hypothetically become £136,969 (excluding any brokerage fees). Nice.

However, if I invested a further £10,000 a year along the way — the equivalent of £833 a month — while still generating that 8% return, I could get to £894,531 over the same time frame.

At this point, I could invest in dividend stocks yielding an average 6%, leaving me with a potential annual passive income stream of £53,671.