We’d all love a second income, but many of us just don’t know how to earn one. And it’s certainly not easy to see the wood for the trees these days with thousands of get-rich-quick schemes and free trading programmes claiming “Scott from Manchester made £25,000 in a month“.

For the record, I don’t doubt that trading programmes can be viable, and I do trade myself. But these are inherently risky activities, and I’d only put a fraction of my money behind them. Instead, I make educated investments into stocks and shares, taking long-term positions based on solid fundamental analysis.

So, how could I turn £10,000 of savings into a second income worth £45,500?

Getting started

There are some simple first steps. First of all, I’m going to want to make sure I’m using a Stocks and Shares ISA as this has a number of tax advantages — namely I pay no tax on capital gains or dividends received within an ISA account.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Secondly, I’m going to want to make further commitments to help my portfolio grow. Of course, I don’t want to stretch myself financially, but if I can afford, say £200 a month, it will make a huge difference over the long run.

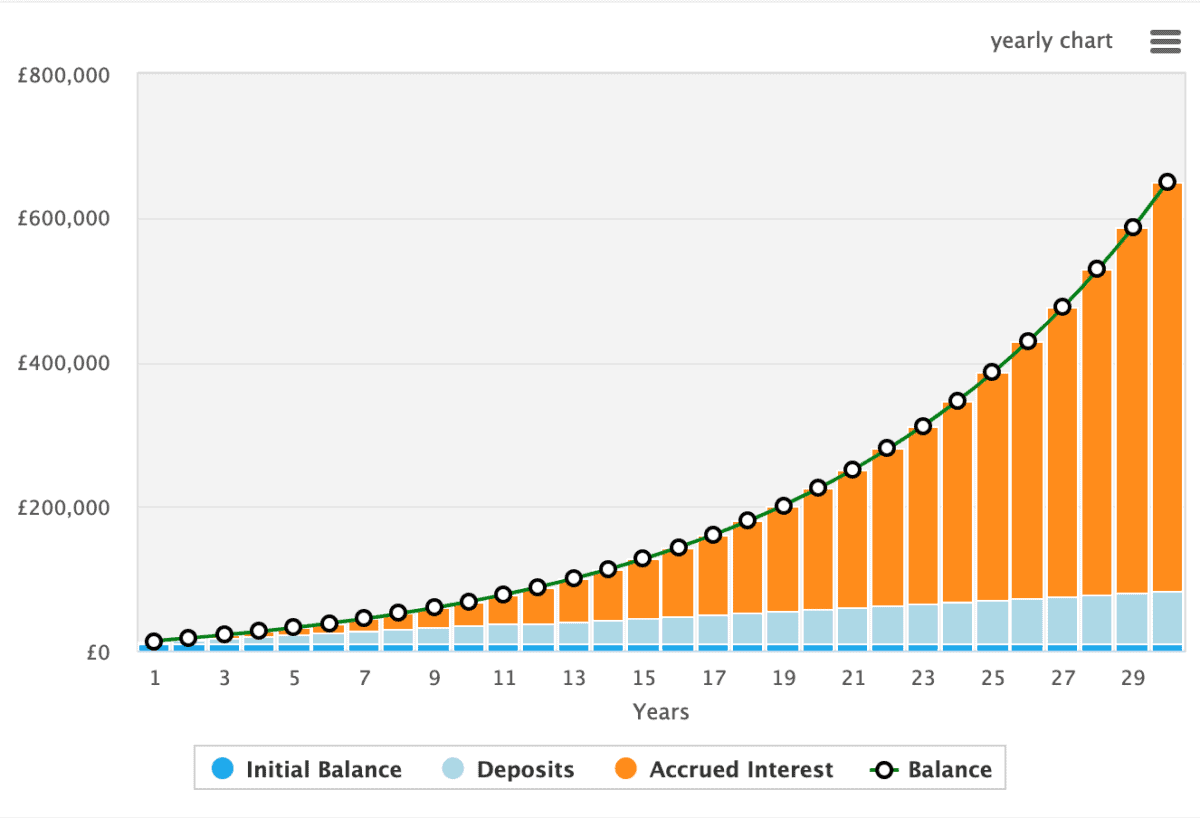

Next, I need to recognise the value of compounding returns. A friend of mine really needs to hear this, because compounding is the real magic of investing. Just look at how £10,000 grows at 10% annually with £200 of monthly contributions.

In this example, I’d have £650,000 after 30 years. That’s all from my initial £10,000 investment and just £200 a month. Assuming I could actualise something like a 7% dividend yield across my portfolio, that would be a £45,500 second income.

Finally, we have to recognise that by investing poorly, I could lose money. And losses compound too. Instead, I have to make wise investment decisions.

Where am I putting my money?

So, how do I get my money to grow at 10% a year? Well, one company I’m banking on going forward is Celestica (NYSE:CLS).

Celestica helps other companies build and assemble electronic products, and AI appears to be a game-changer here. The stock has gone from strength to strength over the past year, and it still looks great value.

The Canadian multi-national is a manufacturer of enterprise-level data communications and information processing infrastructure products. This includes routers, switches, and data centre interconnects, which are provided to OEMs and cloud-based service providers.

Of course, it’s a fast-paced industry and companies can be left behind if they don’t keep up. But Celestica is killing it at the moment. The stock trades at 15.4 times forward earnings, but earnings are growing handsomely. The price-to-earnings ratio, based on earnings forecasts, drops to 14.2 times in 2025 and 10.4 times in 2026.

I think this stock is great value. I’m up 68% on this stock already, but I’m adding to my position as I’m confident it can go a lot further.