Nordic American Tankers (NYSE:NAT) is my favourite dividend stock at this time. The tanker operator currently offers a 12% dividend yield, and the sector is truly booming. It’s the biggest paying dividend stock in my portfolio and, along with Dorian LPG, makes up my exposure to the sector.

The dividend yield

Nordic American is set to pay investors $0.48 per share in 2023. This is paid quarterly as $0.12. While this is a very strong dividend yield, it’s worth recognising that the dividend coverage ratio isn’t the strongest.

Moving forward to 2024, analysts expect the dividend payments to increase to $0.50 per share. Meanwhile, the company is forecasted to earn $0.63 in 2024 and $0.60 in 2025. This means that the forward dividend coverage ratio is 1.26. Normally, investors would consider a dividend coverage ratio of two to be a benchmark for health.

However, clearly the company’s strategy is the remunerate investors handsomely, and the yield looks manageable considering the supportive economic factors.

Economic tailwinds

The tanker sector is entering a multi-year super-cycle. This is because demand is resurgent and supply is stretched, primarily as a result of delayed tanker orders during the pandemic. And these huge vessels can’t be built overnight. It can take up to four years from the moment of order to delivery. Compounding this is the closure of shipyards over recent decades. The number of shipyards globally has dropped steeply from about 700 in 2007 to about 300 in 2022.

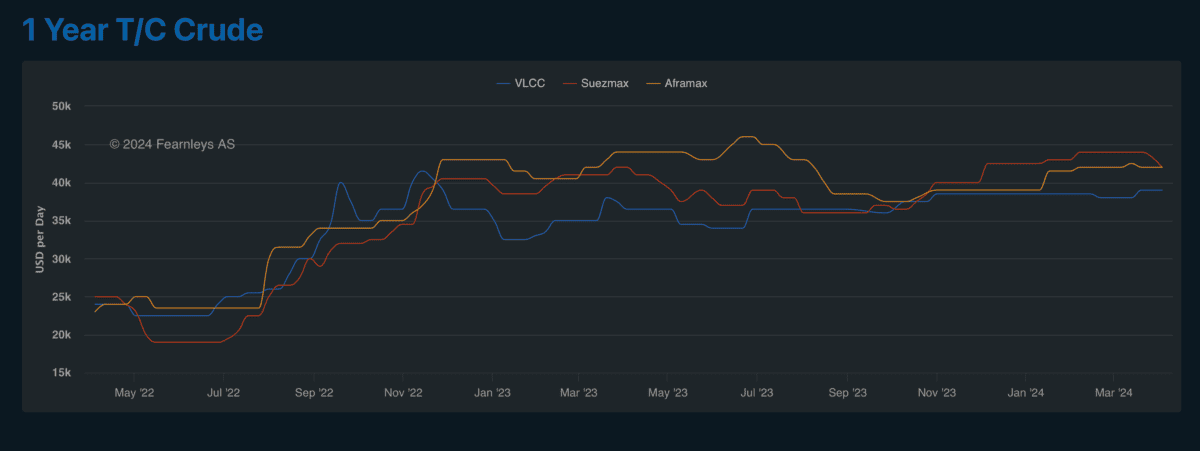

All of this means that the price for leasing Nordic American’s vessels is soaring. In the last quarter of 2023, Nordic American said that the average time charter equivalent (TCE) for spot vessels reached $41,580 per day per ship. At the time of writing, the average spot price to leasing a Suezmax vessel — Nordic only operates Suezmax vessels — is $42,000. For context, this is more than double the day rate in mid-2022.

Further compounding the above are three further factors. Firstly, sanctions on Russian means that hydrocarbon products once destined for Europe are now being shipped to Asia. Secondly, there’s a drought in Panama — just 24 vessels transited the canal per day in January, down from around 50. Tankers are being forced to queue to reroute.

And finally there’s the Houthi attacks in the Bab el-Mandeb strait. As such, vessels are being redirected round the Cape of Good Hope which is adding up to 70% to journey time. In short, these events mean ships are taking longer to undertake their normal journeys, and taking supply off the market.

The bottom line

I think the only downside to Nordic American is the strength of the dividend coverage ratio, but I like everything else about it. The dividend looks to be affordable in the current market, and some analysts are suggesting that the tanker market could become even tighter than I’ve noted above. It’s a sector to keep an eye on and this is an excellent stock to consider investing in. Moreover, at 6.6 times forward earnings, it’s not expensive.