Valuations in the stock market have been starting to look stretched. And this has been especially true of shares in companies associated with the rise of artificial intelligence (AI).

This raises the possibility of share prices falling this year. But I think investors who stick to some basic principles don’t have too much to worry about.

Valuations

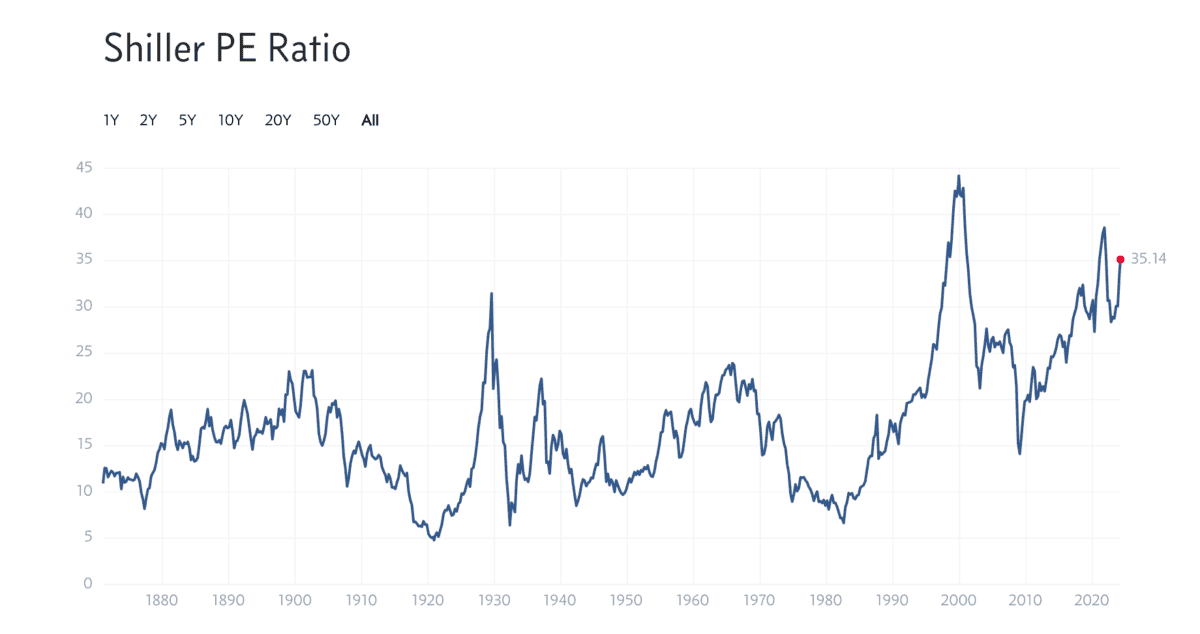

There’s no question share prices are reflecting some optimistic assumptions – especially in the US. This can be seen by looking at the Shiller P/E ratio (which adjusts for cyclicality) of the S&P 500.

Source: Multipl.com

There are two big reasons for this. One is optimism about corporate profitability – largely fuelled by AI – and the other is the expectation of lower interest rates justifying higher price multiples.

That puts the share prices in a precarious position. If things don’t play out the way investors are expecting – if AI doesn’t boost earnings, or interest rates don’t come down – stocks could fall sharply.

The trouble is, there are no guarantees and that creates a dilemma. Investors can either stay out of the stock market and risk missing out as prices go up, or they can invest and face the possibility of a crash.

Kobayashi Maru

Some readers might get the Star Trek reference — the Kobayashi Maru is a test for Starfleet Academy cadets via a no-win scenario. Well, it looks like investors are in a no-win scenario too. But there are some things they can do to avoid the dilemma entirely. One is by focusing on buying shares in quality companies.

A strong business is a valuable asset. And while share prices may not indicate this in a downturn, the stock market tends to reflect this over time.

This point reveals another thing investors can do to navigate a stock market crash. Having a long-term view helps negate the significance of a sudden drop in share prices.

If investors don’t need to sell their shares, what the market is offering to pay doesn’t matter. What’s important is where they will be in 10 or 20 years – and that depends on the underlying businesses.

An example

Dr Martens (LSE:DOCS) a good example. I own the stock in my portfolio, but my investment thesis has nothing to do with what the share price might do in 2024.

The company has been struggling recently due to a combination of operational mistakes and a difficult macroeconomic environment. The former’s under its control, the latter isn’t.

There’s a risk consumer spending might remain weak for a while – especially in China. But things are starting to look up elsewhere and I think the business might have made it through the worst already.

Ultimately, I don’t think the company’s long-term prospects are being accurately reflected by a price-to-earnings (P/E) ratio of 8.5. And that’s why I’ve been buying the stock.

What will share prices do?

The stock market’s pricing in some optimistic assumptions about AI and interest rates at the moment. But while that creates scope for a potential downturn, it doesn’t mean share prices will definitely crash.

With my own portfolio, I’m sticking to the principle of investing for the long term – get that right and the rest will follow. And with no intention of selling this year, I don’t need to worry about a potential crash.