If I were lucky enough to have £8,000 burning a hole in my pocket today, I’d start investing in the stock market. That’s because history has long shown its wealth-creating powers.

For instance, an average 10% return per year would transform my £8,000 investment into approximately £33,417 after 15 years.

However, if I invested another £500 a month, assuming the same 10% return, that £8,000 would grow into a huge £232,790 after 15 years. That’s due to the power of compound returns (interest upon interest).

Here are two areas of the stock market that I’d consider investing in right now to get the compound snowball rolling.

Discounts galore

First up are investment trusts. These are closed-end funds that are listed like stocks. Interestingly, this means they can trade at what are known as discounts or premiums.

This refers to the difference between the market price of the investment trust’s shares and its net asset value (NAV) per share. If the share price is lower than the NAV, it’s trading at a discount, and vice versa.

Right now, the whole sector has been marked down and is trading at a discount. But I don’t think it will always be this way. Indeed, these discounts have already started to narrow.

One I still like the look of though is Schiehallion Fund (30% discount), which has a large holding in Elon Musk’s rocket firm, SpaceX.

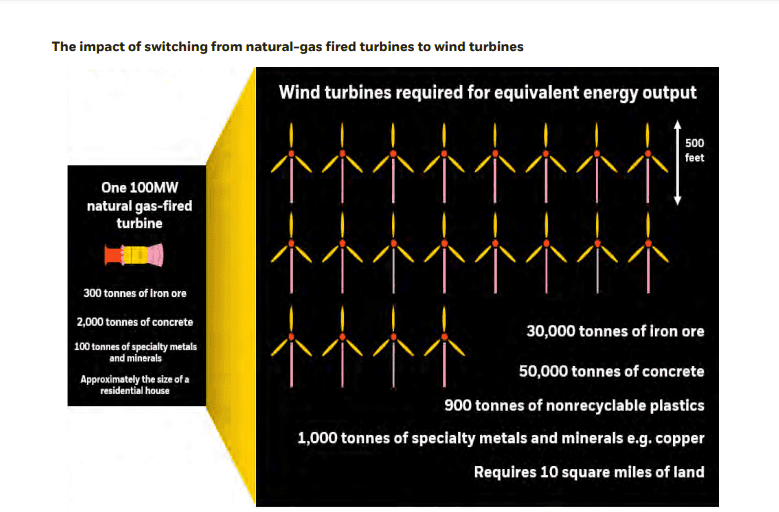

Alternatively, there is BlackRock World Mining Trust (7% discount). As the name implies, this invests in global mining stocks and has a portfolio bias towards precious metals and copper.

Long term, I think the shares will do well due to the energy transition’s need for incredible amounts of raw materials. The stock carries a 6.5% dividend yield.

Both of these trusts have their individual risks. Schiehallion has a large holding in ByteDance, the owner of social media sensation TikTok, which the US could soon ban. That might knock its share price temporarily.

Meanwhile, rising ‘resource nationalism’ may threaten the long-term valuations of mining stocks.

High-yield FTSE 100 shares

Next, I’d target cheap FTSE 100 stocks carrying chunky dividend yields. I’m talking about those with 7%-9% yields.

Again, I don’t think these yields will always be this high, especially once interest rates come down and more money moves back into stocks.

That’s why I’d buy shares of insurer Legal & General (LSE: LGEN) to lock in a near-8% yield.

The company has an incredible track record of raising its annual dividend over many decades. It even carried on paying shareholders during the pandemic, as we can see below.

| Financial year | Dividend per share |

| 2025 (forecast) | 22.5p |

| 2024 (forecast) | 21.4p |

| 2023 | 20.3p |

| 2022 | 19.4p |

| 2021 | 18.5p |

| 2020 | 17.6p |

| 2019 | 17.6p |

| 2018 | 16.4p |

Assuming that forecast dividend for 2025 proves accurate, which isn’t guaranteed, that translates into a forward yield of 8.8%. That soars above anything I’d get from holding cash and most other stocks.

Now, one thing I’d highlight here is that the firm has a new CEO. We don’t know exactly what his plans are yet, but international expansion seems likely. That could open up execution risks.

Nevertheless, I like the firm’s trusted brand, strong balance sheet, and vast experience in pensions and asset management, Plus, the shares are cheap and there are those very generous dividends.

I’d happily buy more shares at £2.54 a pop.