Endeavour Mining (LSE:EDV) is a stock that has been catching my eye lately. And I think shares in the UK gold miner might be a good investment in April.

The company might have fallen out of the FTSE 100 and into the FTSE 250 recently, but it’s a stock I’m looking at buying for my portfolio right now.

Why Endeavour Mining?

Endeavour Mining owns a portfolio of gold assets located in Senegal, Burkina Faso, and the Ivory Coast. Its biggest advantage is its low cost of production.

Endeavour expects to mine gold at between $750-$1,300 per ounce in 2024, which is lower than Newmont ($1,400) and Barrick ($1,320-$1,420). Right now, the spot price is around $2,150.

Gold is denominated in US dollars, so weakness in the dollar is positive for the price of the metal. As such, I’m expecting prices to stay reasonably high as the Federal Reserve aims for 2% inflation.

Each of Endeavour’s mines has an anticipated 10 years or more of useful life left. So I think the outlook for the company’s profitability over the long term looks promising.

Lower share price

All this sounds good. The big question then, is why the share price hasn’t been doing better, having fallen to the point where the stock dropped out of the FTSE 100?

One reason is the departure of CEO Sebastien de Montessus. Over the last year, the company has had to deal with issues around an improper payment from its former leader and allegations about his personal conduct.

That’s not a good thing, but I don’t see it as a long-term issue. The bigger issues are the firm’s operational challenges – a strike at one of its mines and the death of a contractor at another.

Both of these have stalled production over the last few months. And they are indicative of the kind of risks associated with the company going forward.

Why now?

I think Endeavour Mining’s assets are risky, but with the potential for strong long-term profitability. And I think the market is underestimating this at the moment.

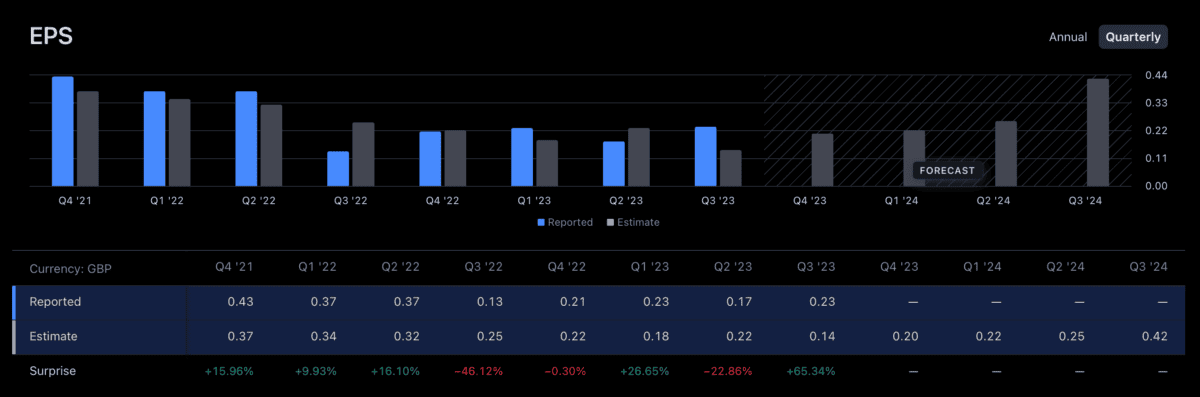

Analysts aren’t particularly optimistic with their earnings forecasts for 2024. I think the company can do significantly better than this though.

Endeavour Mining earnings per share

Source:TradingView

The price of gold is at its highest point for the last 24 months. And I think there’s a good chance of this being reflected in Endeavour’s profitability.

Gold price 2022-24

Created at TradingView

If I’m right, the company could surprise some with its earnings this year. And if the stock rallies on higher-than-expected profits, it will become less attractive from a buying perspective.

My top stock for April

Endeavour Mining looks like an interesting opportunity to me at the moment. I think it has a nice combination of attractive assets with long-term potential and short-term undervaluation.

The price of gold’s generally been rising over the last couple of years, but I don’t see that earnings estimates have caught up with this yet. So I’m looking to take advantage while I can.