Ocado (LSE: OCDO) stock has fallen 66% over the past five years. Fortunately, I haven’t been a shareholder that long, but I’m still down 29% after investing in this FTSE 100 free-faller last year.

Now I’m wondering what to do with my holding.

The retail joint venture

Firstly, I should say that I’m not overly excited by its retail partnership with Marks & Spencer. The UK grocery scene is very mature and packed with competition.

In theory, the online grocery market should be more high-growth. But Ocado isn’t the only game in town, as I can log onto the apps of many supermarkets and easily get groceries dropped off.

Moreover, the products on Ocado’s app don’t seem eye-catchingly cheap to me. So, for all those robots zipping about in its state-of-the-art warehouses, I’m not seeing efficiency translate into lower prices that would surely attract many more customers.

Ocado Retail’s share of the online market in Q1 rose 0.7% to 13.5% in Q1 (for the 13 weeks to 3 March). That’s not exactly dominant, and there are reports of rifts with Marks & Spencer.

Ocado’s own brand range currently has 10,000 products price-matched to Tesco. Meanwhile, Tesco itself has many products price-matched to Aldi. So it all seems like a bit of a race to the bottom on price, which puts me off investing in supermarkets.

Of course, Ocado delivers from its warehouses so is less limited by shelf space than store retailers. This and its robot order pickers should give it a competitive advantage over time, I hope.

Encouragingly, industry data from Kantar shows Ocado was the UK’s fastest growing supermarket in the 12 weeks to 17 March. Overall though, I’d say it’s been slow progress in this business for some time.

The global bit

So, why on earth did I become a shareholder?

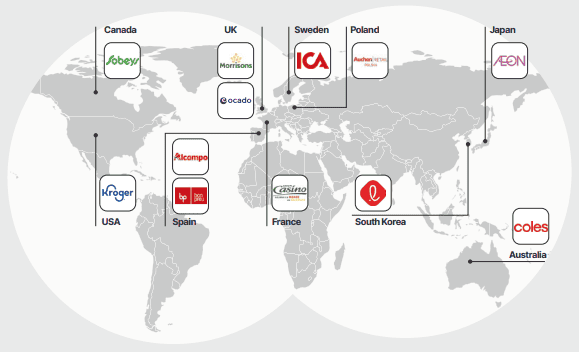

Well, I’m keen on the long-term potential of its Solutions division, which licences out Ocado’s robotics technology around the world.

Its list of partners, including Kroger in the US and Coles in Australia, speaks for itself.

Clearly, its technology is best in class. The reason for this, of course, is due to Ocado’s own retail operation. It has over 20 years of hard-won experience perfecting its tech through experimentation.

And this division, which has returned to profitability (just), is still by far its largest business. It generated revenue of £2.8bn last year.

So this arguably justifies the £3.8bn market cap, which I note is now getting low enough to relegate Ocado to the FTSE 250.

The Solutions unit is growing rapidly though, with revenue up 44% to £420m last year. Importantly, it inked its first non-grocery deal with McKesson Canada (the largest pharmaceutical distributor in North America).

This means Ocado’s potential stretches far beyond just groceries.

My move

You couldn’t have it if you did want it…The rule is, jam tomorrow and jam yesterday – but never jam today.

Lewis Carroll, Through the Looking Glass and What Alice Found There

Ocado reported a loss before tax of £394m last year. In 2022, the pre-tax loss was £500m.

Therefore, despite its massive potential (the third time I’ve used this word), it still hasn’t proven its overall business model.

I’ll only buy more shares once I see more progression towards profitability.