Most of us, maybe all of us, would love a second income. Whether that’s to help us pay for bills, cover the cost of leasing a car, or something that makes those summer holidays a little more achievable. A second income is certainly a boost.

And, of course, if I’m a UK resident, it can all be tax free if I invest through a Stocks and Shares ISA. This incredibly useful vehicle protects my wealth generation from capital gains and my second income from tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Getting started

Let’s imagine I’ve got £5,000 to kick off my investment journey. Well, the first thing I’m going to have to do is open an investment account. I use Hargreaves Lansdown, but it’s expensive. There are a range of alternatives including AJ Bell and Robinhood UK. And of course, I’m going to want to use the ISA if I can.

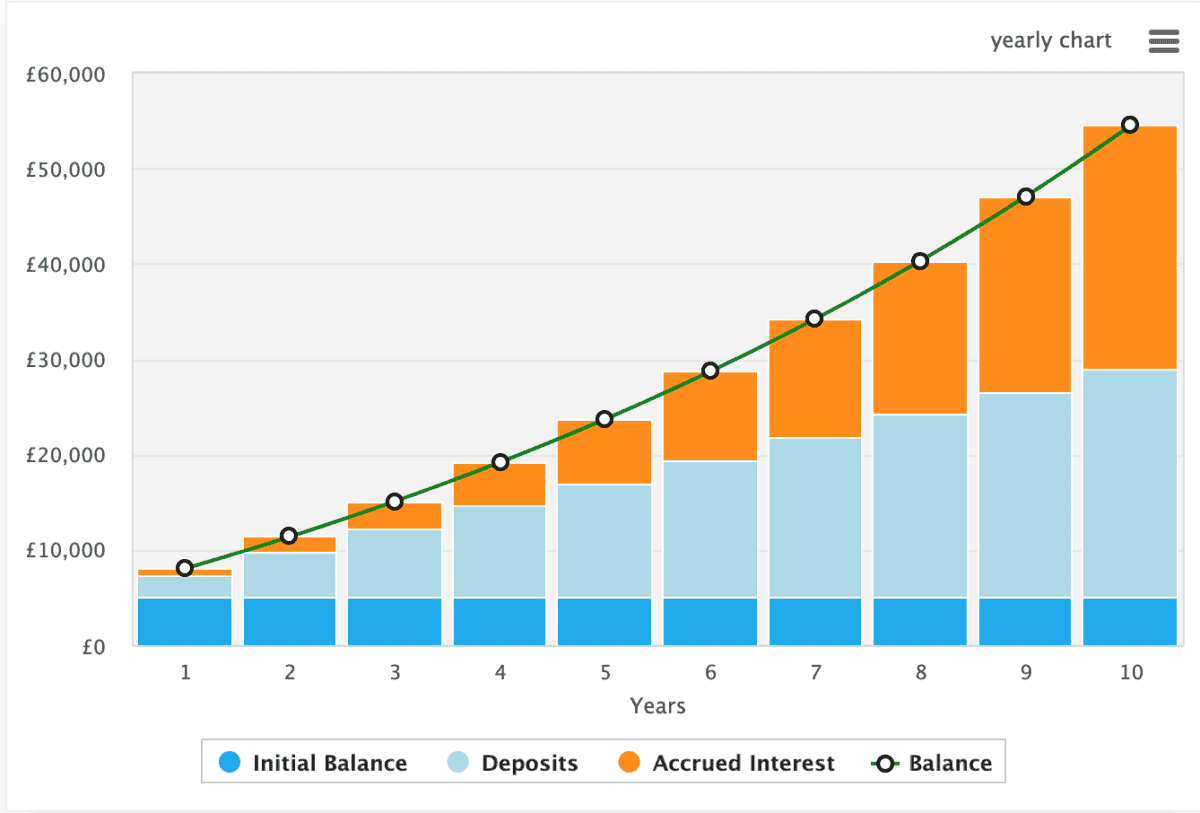

Next, I need a strategy. I need to recognise that £5,000 isn’t going to get me a substantial second income right away. In fact, £5,000 could probably only bring in around £350 a year, assuming I invested in stocks with an average 7% dividend yield — it’d be hard to achieve much better.

So how will I build my £5,000 into something much bigger? Well, I need to consider contributing more money, perhaps a small percentage of my salary, or maybe £200 a month. And I also need to reinvest my portfolio’s earnings each year so that my gains compound.

After just 10 years, and hoping for a strong return of 10% annually (which is by no means guaranteed), I could grow my £5,000 into £54,503. This would be enough for me to generate £3,815 a year — a considerable improvement from just £350.

Investing for growth

Of course, the first phase isn’t about investing for dividends. It’s about investing to grow my portfolio so I can draw a larger passive income in the future. So where should I invest?

GigaCloud Technology (NASDAQ:GCT) is a little volatile, but I think it’s simply underappreciated. I invest in GigaCloud as part of a diverse group of holdings because it I’m hoping it will realise fair value and in turn help my portfolio grow into something that can generate a substantial passive income.

The company, despite its tech-focused name, connects furniture manufacturers, predominantly in China, with resellers and customers in North America and Europe.

Disruption to global shipping does pose a risk to this full-solution company, but management recently said that the Houthi activity in Bab el-Mandeb strait was having limited impact as GigaCloud’s largest market is North America.

Nonetheless, its rise has been phenomenal over the past 12 months, with revenues increasing 94.8%. Moreover, it’s very cheap. The company is trading at 11.15 times earnings for 2024, 9.4 times earnings for 2025, and 6.9 times earnings for 2026.

I appreciate the company raises some alarm bells. It’s clearly not the American firm it claims to be — it’s Chinese. But its earnings trajectory is hugely exciting. It fact, earnings are expecting to grow by another 71.9% over the next 12 months. It’s an impressive story.

Finally, it’s got momentum on its side. The stock is up a considerable 478% over the past 12 months. It could go higher based on the metrics above.