I think it is quite rare to find exceptional UK companies that compete performance-wise with top American shares. However, this FTSE 250 business seems to do just that.

Additionally, I consider the investment to be significantly undervalued. I also believe it could be a big beneficiary of high long-term technology market growth, but there are risks with this, too.

Business overview and updates

Kainos Group (LSE:KNOS) is a UK-based technology company with three core areas of operation that I’ve broken down as follows:

- Digital Services: the company focuses on user-friendly solutions that use cloud computing and data analytics

- Workday Services: Kainos efficiently manages Workday‘s finance, HR, and planning products for organisations in Europe and North America

- Workday Products: the firm provides its own automated testing, compliance monitoring, and data protection products used for enhancing and securing Workday systems

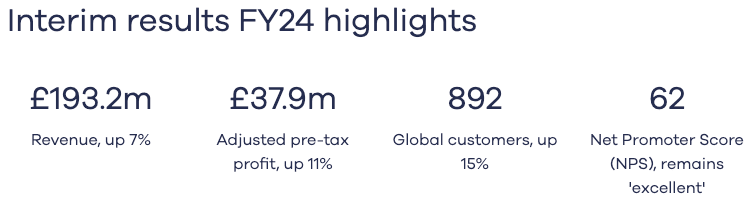

While Kainos is announcing its full financial year 2024 results on 20 May, it has already released interim results. These outline the following excellent statistics:

The significant value opportunity

Considering the financial results expected for the full year, we know growth is set to continue. In fact, analyst estimates anticipate a 13% average growth rate for earnings per share over the next two years.

It’s worth bearing in mind that this is quite a bit lower than the 36.8% per year we’ve seen over the past three years. However, I don’t believe the slowdown in growth means the company should be trading 50% below its all-time high. To me, that’s an obvious value opportunity.

I can look at it another way. Over the past 10 years, Kainos has had a median price-to-earnings ratio of 40. At the moment, its price-to-earnings ratio is 32. That alone indicates that the company is potentially selling at a 20% discount.

The associated risks

With an investment in Kainos comes both significant company-specific and wider industry risks.

For starters, there is a high likelihood of increased speculation in the technology markets at the moment. This is primarily due to the growing popularity of artificial intelligence, and increased investor sentiment as a result. I’m choosing my technology investments carefully so I don’t lose money if a bubble bursts in the market.

That being said, a lot of quality companies involved in advanced technology will last through a period of overvaluation and a correction or crash that happens as a result. The difficulty is finding the ones that are strong enough to do so.

I believe Kainos’ operations unfortunately don’t have what we call in investing a strong ‘moat’. In other words, there’s nothing remarkably unique about what Kainos is doing that other firms can’t copy. While its strong balance sheet positions it for the potential to develop, I don’t see enough evidence of incredibly high long-term operational value right now.

I’m not smitten

Warren Buffett, who made famous the idea of the business moat, also said this: “I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

While I consider it an excellent investment choice, Kainos won’t be one of my 20 punches.