When it comes to playing the AI revolution, many investors have piled in to a narrow group of mega-cap tech stocks. As valuations in the likes of Nvidia become totally detached from underlying fundamentals, I’m looking further afield. And I believe this under-the-radar FTSE 100 blue-chip stock is set for explosive growth.

Data to insight

Relx (LSE: REL) helps businesses and governments across the globe turn data into actionable insights. It achieves this through taking information from a variety of sources, both structured and unstructured.

Its vast databases houses over 40 petabytes of information. This includes tens of billions of public records, 90m scientific publication records, and 138bn legal and news documents and records.

This vast quantity is profiled, cleaned, and standardised using various big data platforms to decrease content volume and increase content quality.

One such technique is through the application of machine-learning algorithms to cluster, link, and learn from the data.

Legal, medical, risk, and academic professionals rely on Relx’s tools to increase efficiency and decision-making. That could be a doctor deciding the best way to treat a patient or a litigator determining whether to take a case to court.

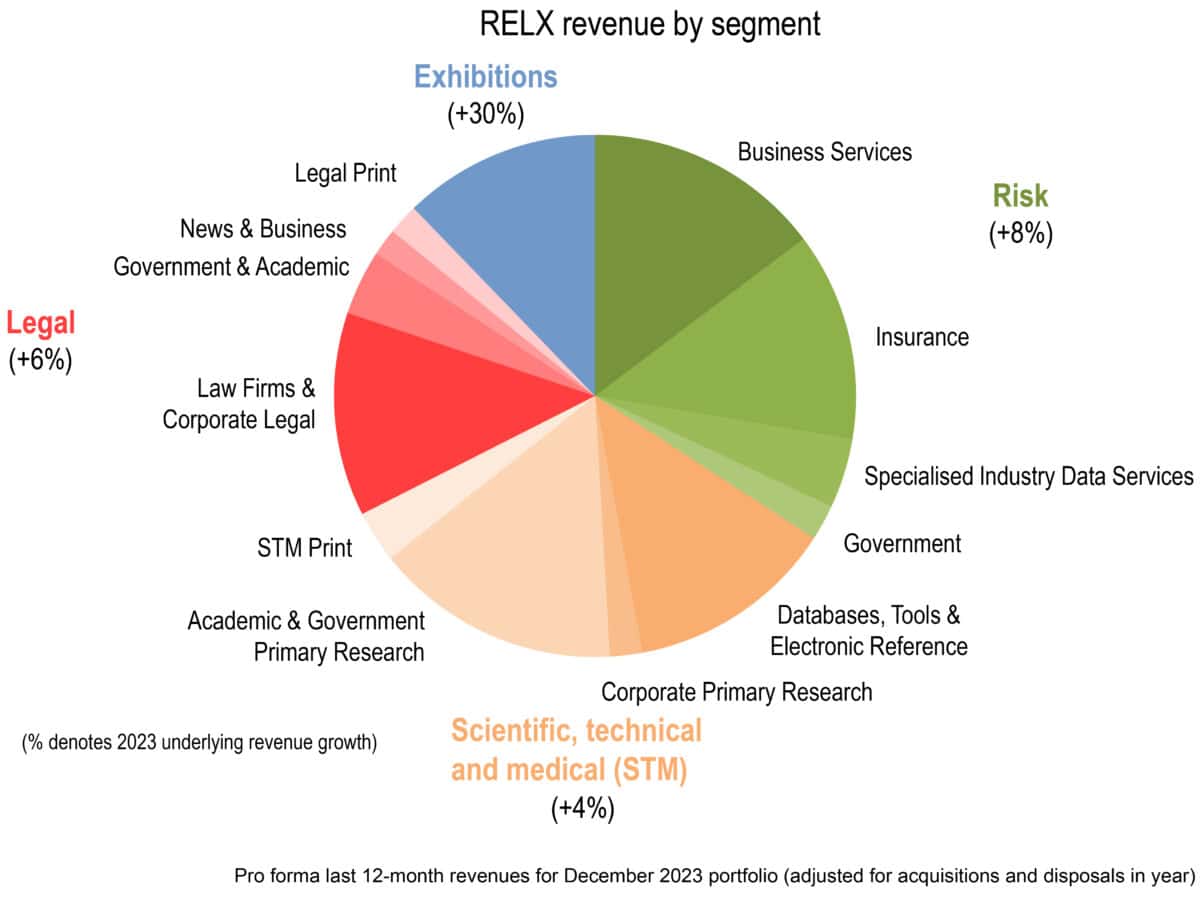

The following infographic highlights the breadth of its business model.

Source: Relx presentation

Changing legal profession

As an individual who studied law for many years, I appreciate the challenges both academic and practising lawyers face. Keeping abreast of legal developments laid down in judicial precedents (case law) and in various statutory forms is a key one.

Lexis is an offering that Relx has long provided lawyers. However, AI-enhanced tools is transforming the profession. This includes conversational search, intelligent legal drafting, insightful summarisation, and document upload and analysis capabilities.

Traditional large language models often struggle to correctly interpret legal use cases. One thorny issue is AI hallucination, where machine-learning algorithms invent content. Clearly, that is not what any lawyer needs.

With its rich proprietary legal dataset built over decades, the company has a clear competitive advantage in tackling this issue. It has successfully partnered with global law firms and US courts. As the tool gains momentum, I expect revenues to continue to rise.

Risks

Off the back of rising revenues and general AI euphoria, its share price is up 35% in a year. It certainly isn’t a cheap stock, with a trailing price-to-earnings (P/E) multiple of 36. This is well above the FTSE 100 average.

One clear risk is that if investor sentiment toward AI were to change, it would undoubtedly get caught up in any sell off.

But more broadly it faces risks of potentially declining revenues from its primary research publishing businesses.

Its subscription-based model is highly cash generative. However, there is a growing trend in academia of moving away from paying to read articles to paying to publish articles. The latter model is commonly referred to as open access. At the moment, it’s difficult to assess the impact of such a change on its revenue mix.

Despite these risks, Relx is a business with a bright future. Last year, it bought back £800m of its own shares and this year it intends to purchase another £1bn. On top of that, its dividend has increased every year for well over a decade. When I have free funds, I will be buying.