The list of cheap shares on my watchlist has far outgrown my budget, leaving me in a tough position to decide what to buy each month.

Two I’ve overlooked for too long are now up by almost 5% this past month. Did I miss the boat or is this just a temporary rise?

Let’s ask the charts.

Aviva

Aviva (LSE:AV.) is one of the UK’s largest multinational insurance companies, dealing in health, savings, investments and pensions. In fact, my very own pension is entrusted to it.

Regarding performance, I haven’t been blown away by Aviva over the past year. The share price spent much of 2023 declining, only to make a weak and staggered recovery towards year-end.

But since February the share price has rocketed 12% and I wasn’t paying enough attention to grab it!

Most of the recent gains came from news earlier this week that Aviva is rejoining the Lloyd’s insurance market. The return results from a £242m acquisition of Probitas and its fully integrated Lloyd’s platform.

The firm also released its full-year 2023 report last week with better-than-expected results. The combined news lit a firecracker under the share price while I was fast asleep!

But what do analysts forecast for the future?

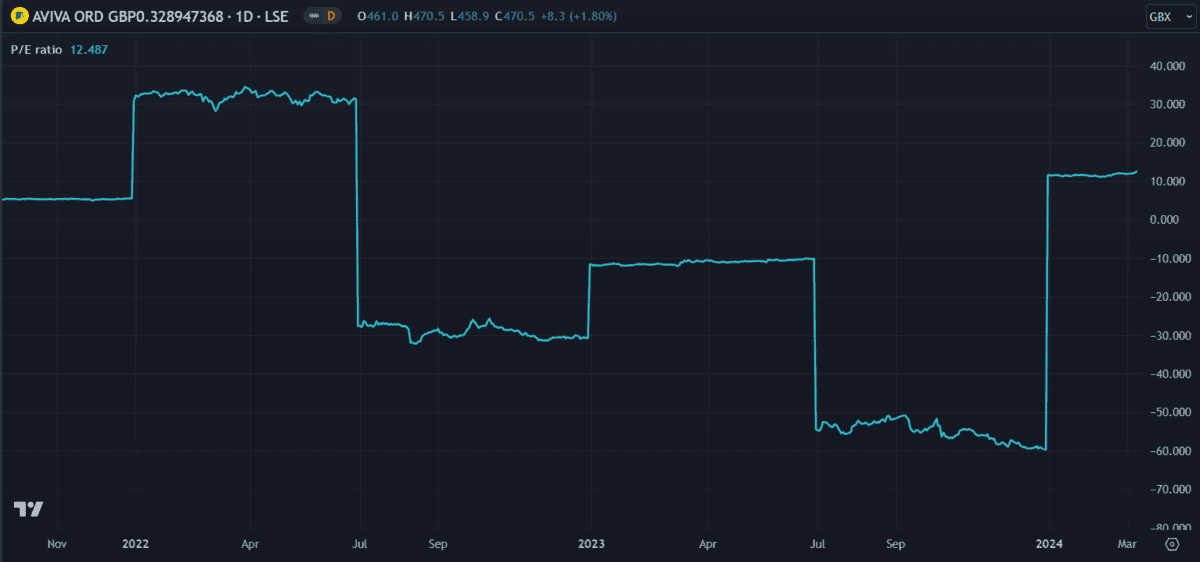

Aviva’s price-to-earnings (P/E) ratio is now at 12.48, up from last year (although lower than in 2022). This suggests the share price is trading at fair value to the industry average, so I probably missed getting in cheap.

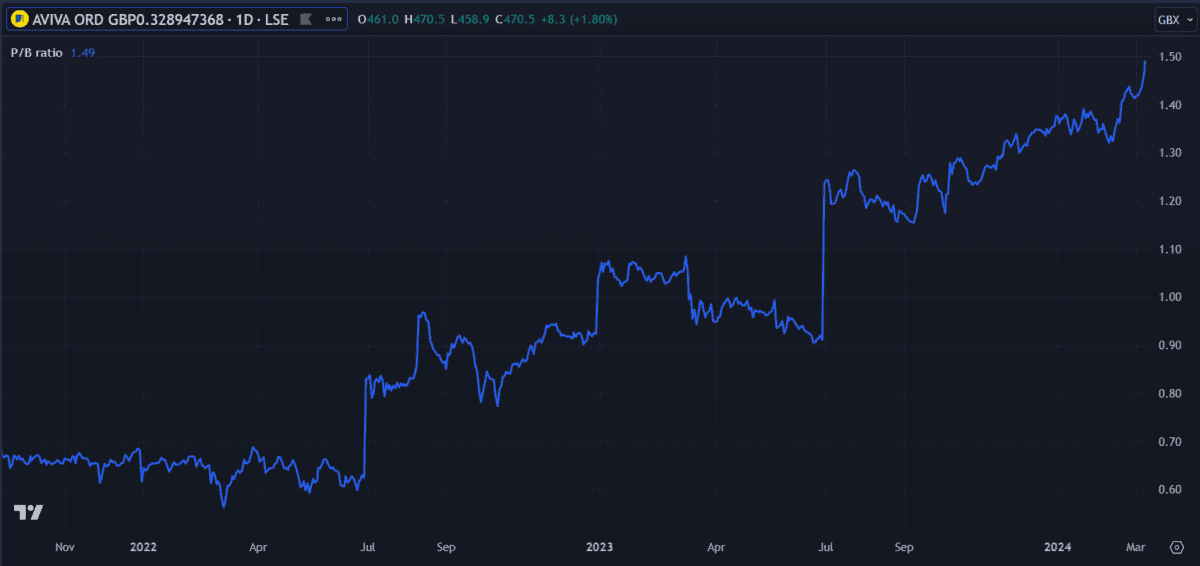

Price-to-book (P/B) ratio is another good indicator of value. With Aviva’s P/B ratio now above one, it looks like I missed out on the cheapest entry point. There might be some growth from here but for now, I won’t be buying Aviva shares.

BT Group

I’ve spoken positively about BT Group (LSE:BT.) several times in the past few months but the share price has made me hesitant to buy. It’s been dipping since early December last year. A mild recovery in mid-February renewed my interest until the sale of the iconic BT Tower was announced, leading to further losses.

I should have jumped in then.

Inexperienced investors may think the sale means BT is desperate for capital. If anything, I think it represents its confidence in the transition to a fully digital network. It’s finally shedding the last remnants of a past era.

Truth is, most of the tower’s infrastructure has been offline for over a decade now.

With the share price now in recovery and BT on track to deliver a nationwide network upgrade, I envision positive growth from here.

Yet with a P/E ratio of 5.84, there’s a good chance the BT share price is still selling below fair value.

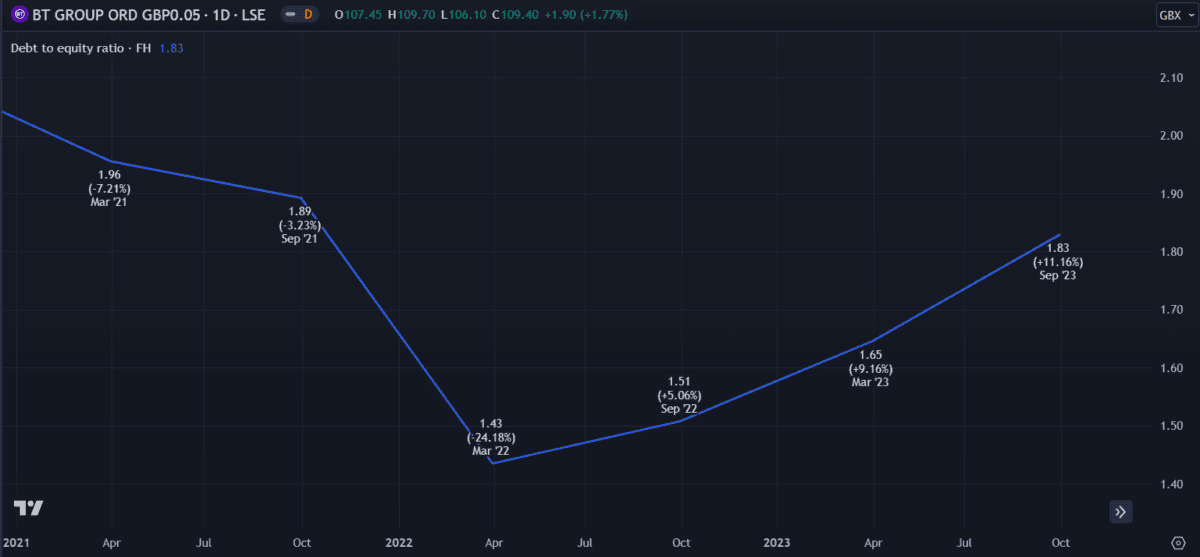

However, BT has been spending a lot in preparation for the upgrade, so its debt is now at a concerning level. Most recent results put its debt-to-equity (D/E) ratio at 1.83. This figure ideally shouldn’t rise above one.

I will need to keep an eye on BT’s debt going forward, particularly considering the current economic uncertainty. However, with a high dividend yield of 7% and an attractive price, it’s firmly on my list of cheap shares for my next buying round.