Many of us invest in stocks and shares for a passive income. We’re looking to turn what we have, regardless of how little we may be starting with, into something that can allow us to live more comfortably.

As interest rates start to fall over the next two years, savers will likely start looking for better returns on their capital. And the best place to do that, in my opinion, is stocks and shares.

Investing in stocks

If I were to invest £10,000 in stocks today, at the very best, I could probably achieve around £800 in annual income from dividend-paying stocks. This would include investing in UK companies like Legal & General, Phoenix Group, Lloyds, British American Tobacco, and Rio Tinto. I could also look at US-listed companies like Nordic American Tankers.

However, if £800 isn’t enough, I may wish to look at reinvesting my returns every year to let my portfolio grow. And remember, growth compounds. Every year I’ll have a bigger portfolio, which will generate greater returns. And the longer I do this, the faster my portfolio will grow.

I don’t have to do this by investing in dividend stock. Many companies, notably those that don’t pay a dividend, reinvest their earnings back into the business. In turn, this can lead to share price appreciation. Just take a look a Nvidia and Super Micro Computer, which have continually reinvested and are now reaping the benefits.

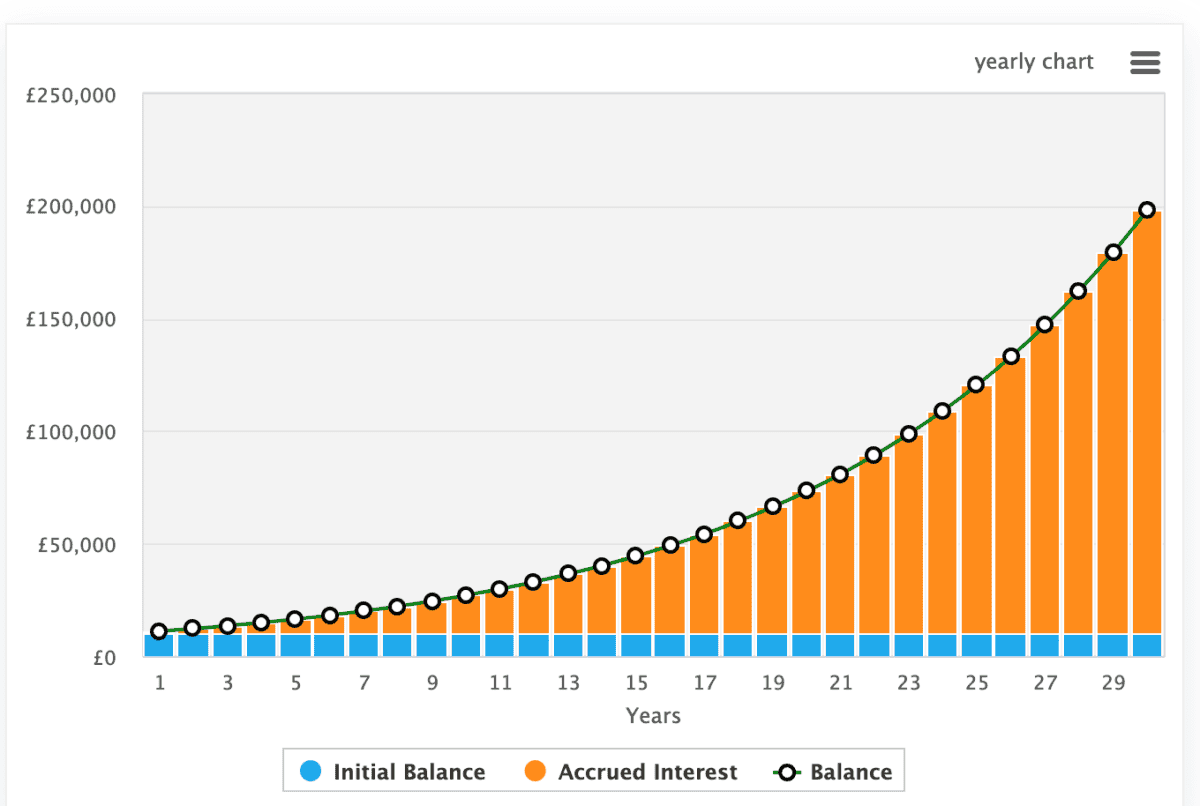

Now, let’s take the below as an example. Just look at how £10,000 can grow over 30 years, assuming the investor can realise a 10% annualised growth rate. With this much invested, and assuming an 8% dividend yield is still achievable, I could earn around £15,040 each year.

Building a bigger pot

There are several ways to identify companies that can help my portfolio grow. We can use ratios like the price-to-earnings metric to identify undervalued companies or the price-to-earnings growth ratio to find businesses with under-appreciated growth trajectories.

But it’s best to make investment decisions using a host of metrics and indicators. One stock I’ve been investing in is Abercrombie and Fitch (NYSE:ANF). While it may appear expensive, the company just keeps on surprising analysts — in a good way — and recently surpassed earnings estimates by around 4%.

The company’s sales have continued to rise compared to peers, reflecting an impressive strategic shift and rebrand as an ‘all-American’ business. In Q4, the firm said that comparative sales had increased 16% versus the same quarter last year.

In turn, this has contributed to a very strong balance sheet and net cash position. In Q4, Abercrombie said cash and equivalents amounted to $901m compared to $518m last year.

While we may see some negative pressure due to the resumption of student loans in October and high interest rates, this company has grown sales and improved margins during challenging economic conditions. It’s the type of winning stock I want in my portfolio to build wealth and eventually give me a bigger pot to drawdown from.