DS Smith‘s (LSE:SMDS) share price has the wind in its sails right now. The FTSE 100 packaging giant has soared in recent weeks on news it’s “considering a possible offer” from rival Mondi.

And it has edged even higher on Wednesday (6 March) following an encouraging trading update. Yet at 322p per share the company still looks terrifically cheap, as I’ll delve into shortly.

Are DS Smith shares now too cheap to miss?

Improving Volumes

Positive news from the packaging sector in early 2024 has fuelled hopes that the market is back in recovery. And today DS Smith added to the sense of optimism by announcing that demand “continues to improve“.

It said that “North America and Eastern Europe saw good growth” in the quarter between November and February, although this was offset by “a weaker performance in Northern Europe“. As a consequence, like-for-like corrugated box volumes were flat year on year during the quarter.

This marks a healthy improvement from the first half of the year, and suggests that the impact of high inflation on consumers’ wallets may be beginning to ease. Like-for-like box volumes had dropped 4.7% during the first half of the year.

Corner turned?

As I mentioned, these comments add to speculation that the packaging sector may be turning a corner. Mondi announced last month that “we are seeing improvements in our order books and are implementing price increases across our range of paper grades.”

And Smurfit Kappa said it had witnessed “a progressive improvement in demand” over the course of 2024. Encouragingly for DS Smith, its FTSE 100 rival also announced a “strong acceleration [in] demand for sustainable packaging solutions“. This is an area in which DS Smith is heavily invested.

Excellent value

Today’s update suggests now could be a time for me to buy more of the shares for my portfolio. I’m certainly attracted to the brilliant value that it offers despite those recent price rises.

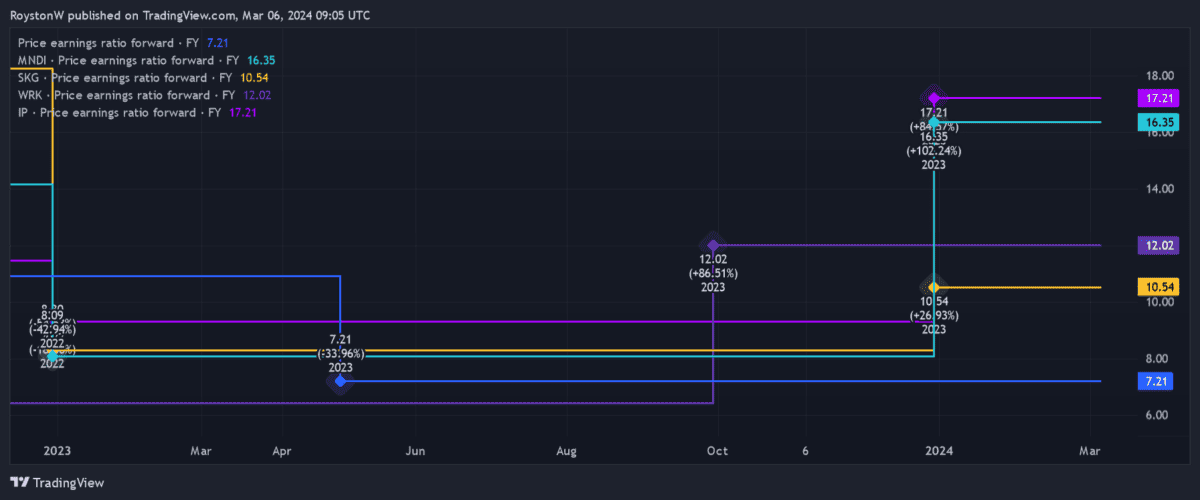

Right now the packager trades on a forward price-to-earnings (P/E) ratio of 7.2 times. This is well below the FTSE 100 average of 10.5 times.

But the company doesn’t just look ultra cheap compared with other UK blue-chips. It also looks like a bargain compared with major operators in its sector.

As the chart below shows, its multiple is far below that of US rival International Paper‘s 17.2 times. We can also see its P/E ratio is more modest than those of (in descending order) Mondi, WestRock, and Smurfit Kappa.

A top stock

It’s too early to say that these companies are out of the woods just yet. Consumer confidence remains fragile, while raw material costs are also higher than historical levels.

Yet at current prices I think DS Smith could be a top stock to buy. Its earnings could rise strongly from here as the e-commerce and food retail segments bounce back. It also stands to gain from soaring demand for sustainable goods. And its share price could rocket again if takeover talk ignites again.

I’ll look closely at adding to my existing holdings when I next have cash to invest.