The Stocks and Shares ISA is an invaluable tool for UK-based investors, allowing us to shield our earnings and dividends from tax. With non-ISA earnings taxed at standard rates, it really makes sense to use this investing vehicle.

And every year we can put up to £20,000 in an ISA investment account. Of course, there’s no obligation to max out our ISA contributions, and the vast majority of us won’t get near. But that doesn’t mean we can’t use this tax-free wrapper to create some serious wealth.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Starting with nothing

Millions of us in the UK don’t have a Stocks and Shares ISA, but getting started is simple. I can simply go to any major brokerage, like Hargreaves Lansdown, AJ Bell, or Interactive Investor, and open an account.

These days, we can start an investment account with almost nothing, and in some cases just a commitment, or direct debit, to contribute monthly. But, naturally, the more money I contribute, the quicker I’d be able to build wealth.

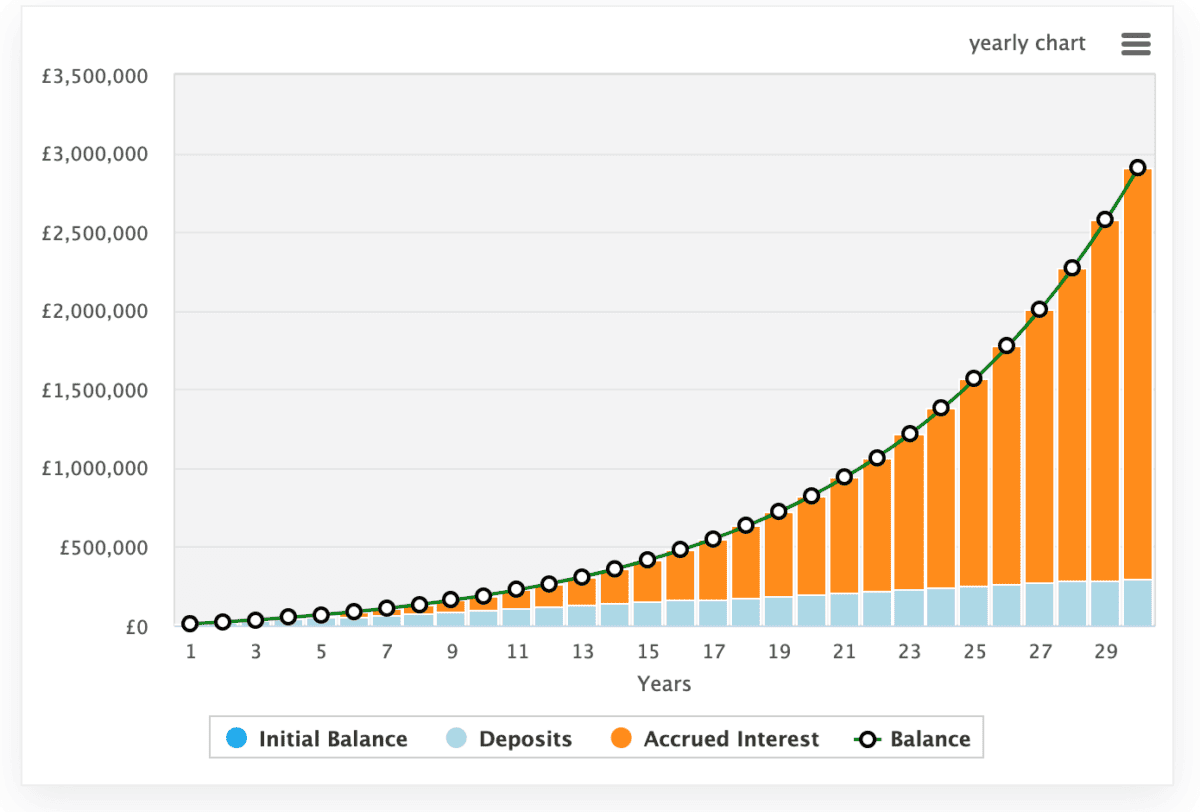

For example, if I were to maximise my ISA contributions, and add £833 a month into my portfolio, and actualise a return of 12%, it’d take me just 22 years to reach millionaire status.

Of course, most of us can’t afford £833 a month. So the less we contribute, the longer it’ll take to get there. But as time goes by, the pace of growth will increase as we earn interest on our interest.

An important variable

In the above example, I’ve suggested actualising an annualised return of 12%. That’s quite ambitious for novice investors, but it’s certainly possible if we make the right investment decisions. To add some context, my daughter’s ISA has grown 28% since I opened it four and a half months ago. Six of her seven investments are in the green.

Equally, if we make poor investment decisions, we could lose money. And losses can also compound. This is why it’s important we do plenty of research and make informed, data-driven decisions.

One such stock I like the look of in the relatively buoyant market is Li Auto (NASDAQ:LI). The Chinese automaker has very strong valuation metrics despite surging 77% over the past 12 months — most of that growth has come since the turn of the year.

Li is one of a few new energy vehicle manufacturers to have turned a profit, and it’s on an impressive trajectory. Its range of PHEV (plug-in hybrid electric vehicle) clearly hit the spot in China, with many buyers still wary about the ranges offered by pure EVs.

With profitability and strong brand reputation achieved, Li recently launched its first all-electric vehicle. Deliveries of the flagship MEGA Max, touted by Li as the fastest-charging mass-produced car, will begin on 11 March.

Some investors may understandably be concerned about Li’s prospects outside of China as carmakers could get caught up the crossfire of trade wars. But it’s worth remembering that China is a huge market itself.

WIth a price-to-earnings-to-growth ratio around 0.5, I think Li remains a bargain. It could help me achieve a 12% or higher average annual return.