If the National Lottery rang you up and offered you the choice of a million pounds now or 1p doubled every day for a month, which would you choose?

I asked a few friends and family members this question not long back. Nearly all said they’d take the £1m, and I can’t fault them. That sort of money could pay your energy bills for literally months!

Seriously, though, a million pounds remains a life-enhancing sum for many people, even if it doesn’t go as far as it once did. It would still pay off most mortgages and fund any luxury holiday.

But which would be the most enriching option to take? The £1m or 1p doubled? Let’s find out.

The power of compound interest

Here are the calculations for the first 15 days.

| Day | Amount |

| 1 | £0.01 |

| 2 | £0.02 |

| 3 | £0.04 |

| 4 | £0.08 |

| 5 | £0.16 |

| 6 | £0.32 |

| 7 | £0.64 |

| 8 | £1.28 |

| 9 | £2.56 |

| 10 | £5.12 |

| 11 | £10.24 |

| 12 | £20.48 |

| 13 | £40.96 |

| 14 | £81.92 |

| 15 | £163.84 |

So far, so good. The million-pound option is looking like the smart bet.

Here are the next 10 days.

| Day | Amount |

| 16 | £327.68 |

| 17 | £655.36 |

| 18 | £1,310.72 |

| 19 | £2,621.44 |

| 20 | £5,242.88 |

| 21 | £10,485.76 |

| 22 | £20,971.52 |

| 23 | £41,943.04 |

| 24 | £83,886.08 |

| 25 | £167,772.16 |

Things are starting to look a lot closer now, though…

| Day | Amount |

| 26 | £335,544.32 |

| 27 | £671,088.64 |

| 28 | £1,342,177.28 |

| 29 | £2,684,354.56 |

| 30 | £5,368,709.12 |

| 31 | £10,737,418.24 |

The final figure is £10.7m!

Clearly, I’d have missed out on a truly life-changing sum if I’d taken the easy money.

Warren Buffett

Now, no investor is going to regularly double their money in one year let alone one day. But compound interest still works wonders at smaller rates of return.

Take investing legend Warren Buffett, for example. Between 1965 and 2022, he earned an average 19.8% annual return for his company Berkshire Hathaway. That’s double the market average.

Berkshire shares were valued at about $19 in 1965. Today, the Class A shares trade for $625,510. That’s a mind-boggling return of 3,292,057%.

To put this in context, $100 invested in 1965 would now be worth over $3.2m.

I’d buy this stock

Buffett says you should only buy a stock you’d happily hold for at least 10 years.

For me, FTSE 100 spirits giant Diageo (LSE: DGE) is one such investment. Its portfolio contains some brands that are likely to remain popular for decades, if not permanently. Johnnie Walker, Baileys, Smirnoff, Gordon’s, Tanqueray, Don Julio, and more.

More importantly, these drinks sell for a healthy profit. In its last financial year, the firm made an operating profit of nearly £6bn from revenue of £20.8bn.

Given that was in a slow year, I’m optimistic about what better economic conditions can bring.

Of course, inflation remains high and many consumers are cash-strapped. So sales could be sluggish for a while yet, which is reflected in the stagnating share price.

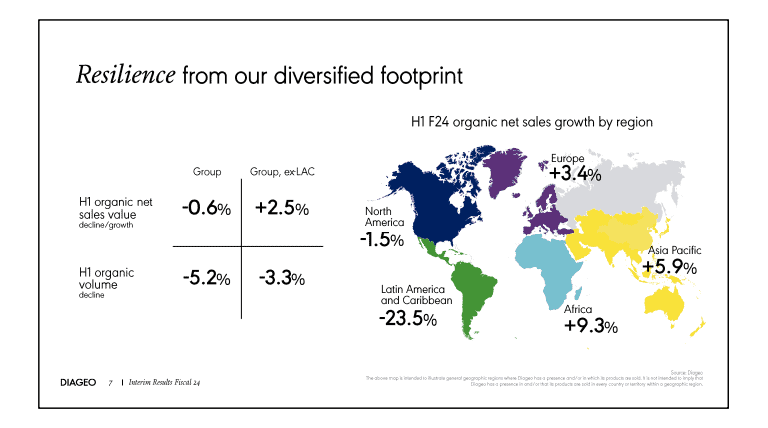

Still, discounting inventory issues in Latin America, its global brands are showing resilience.

As a long-term investor, I’m very bullish on the firm’s growth potential in India and China.

Meanwhile, after raising its annual dividend for over 25 years, Diageo is a Dividend Aristocrat.

As such, I think the shares can help compound returns in my portfolio for decades. I’d buy more with any spare cash.