The managers of Polar Capital Technology Trust (LSE: PCT), a surging FTSE 250 investment trust, always believed that artificial intelligence (AI) would go mainstream. They just weren’t sure when.

Well, I think we can safely say that time has arrived. After all, ‘AI’ was crowned 2023’s word of the year by Collins Dictionary. And Cambridge Dictionary’s word for last year was ‘hallucinate’, which refers to an incorrect or misleading response generated by a ‘hallucinating’ AI chatbot.

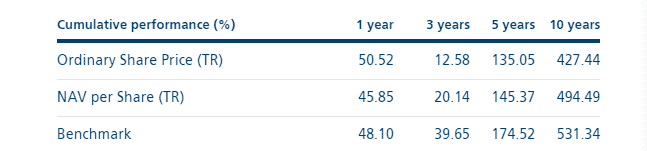

With the share price up 133% over the past five years, the tech trust’s shareholders have certainly been benefitting.

Investing in the AI boom

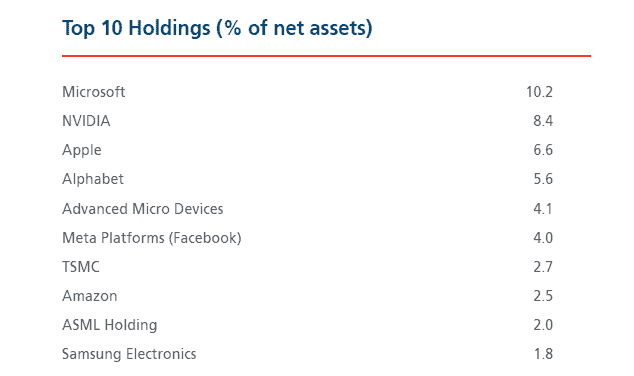

The portfolio’s top 10 holdings read like a who’s who of AI royalty:

Microsoft part-owns ChatGPT maker OpenAI while TSMC manufactures many of the cutting-edge chips needed to train and run generative AI models.

As far as chipmaker Nvidia is concerned, one analyst memorably summed up the firm’s position last year: “There’s a war going on out there in AI, and Nvidia today is the only arms dealer.”

Beyond AI, the portfolio is invested across several core technology themes. These include digital advertising and commerce, software-as-a-service and 5G.

Expect volatility

Now, this trust obviously concentrates on a single sector within the stock market. This can lead to above-average volatility in its shares.

With the portfolio weighted towards technology, it also becomes more susceptible to market downturns.

For instance, in 2022, amid a bearish sentiment towards tech stocks, the shares slumped 36.8% versus the S&P 500‘s 19.4% fall.

Cutting through the hype

In theory, I like the company’s disciplined stock-picking. It says: “Our approach aims to cut through the hype which often can be found within the technology sector, and lead to unjustified valuations and elevated levels of risk.”

This approach means it avoids pre-revenue companies listed on the stock market. And it therefore differs from Scottish Mortgage Investment Trust, its larger peer, which has backed a handful of early-stage companies.

Underperformance issues

Unfortunately, and perhaps somewhat surprisingly, the trust has actually underperformed its benchmark (the Dow Jones Global Technology Index) over three, five and 10-year periods.

The reason for this seems to be that the trust has long been underweight on giant tech stocks.

For instance, at the end of its last fiscal year in April, its three largest holdings were Apple, Microsoft and Alphabet. These made up 27% of net assets in contrast to a 41.9% weighting in the benchmark index.

Therefore, the better the mega-cap stocks have done, the more difficult it has been to outperform.

Given this structural weighting issue, I’m not looking to invest myself.

New billionaires are being made

Returning to the billionaire-making AI revolution the trust is tapping into, I found these stats mind-blowing:

- Nvidia added $277bn to its stock market value on 22 February.

- This was the largest gain ever on a single day on Wall Street.

- Jensen Huang, CEO of Nvidia, saw his wealth soar by $9.6bn in one day, placing him 21st on the Bloomberg Billionaires Index.

Meanwhile Lisa Su, CEO of Advanced Micro Devices, recently became a paper billionaire after her company’s stock doubled in one year. Incredible!