I think this company looks like an exceptional opportunity to invest in at the moment for passive income. Not only is the dividend yield good, but the valuation looks incredibly attractive to me.

Here are the main reasons I’m buying it for my portfolio.

Impax

Impax Asset Management (LSE:IPX) is a UK-based investment firm that focuses on environmental markets, particularly in resource efficiency.

It manages funds and accounts that invest in companies that work in renewable energy, water management, waste technology, and sustainable agriculture.

The firm chooses its investments by analysing long-term changes in global trends, and it caters to a range of regions across the world.

Convincing financials

First of all, I think Impax has a lot of stability at the moment, considering its balance sheet has 71% of its assets balanced by equity. This matters to me because the future is often uncertain, and having minimal debts means the firm is well-protected from unexpected challenges.

Also, its revenues have been growing fast. Over the past 10 years, it’s been growing its top-line income by 29% on average every year.

It looks cheap to me, at 68% below its high and selling at a price-to-earnings ratio of 14. Particularly, its valuation, based on my discounted cash flow analysis, shows that it could be 60% undervalued.

I estimated this by projecting earnings per share growth of 20% per year over the next 10 years. That’s conservative, considering it grew its earnings at 37.4% each year on average over the last decade.

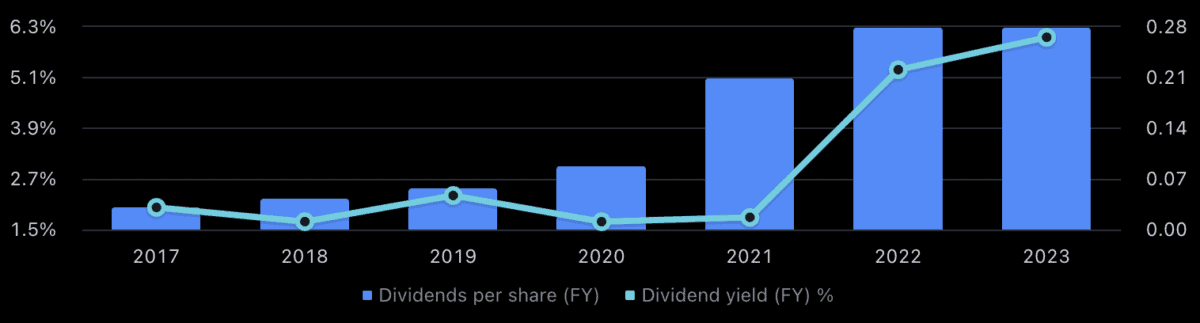

Of course, as I was looking for dividends when I found this company, its higher-than-usual yield means I could pocket some nice cash over the next few years if I buy the shares now:

Risks I’ve noticed

However, Impax pays out 78% of its earnings as dividends at the moment. While that’s nice and contributes to its high 5% dividend yield, it means it isn’t reinvesting much of its net income into its funds at this time.

Even if the company decides to maintain this, it’s arguably not sustainable. That’s why I think the yield will go back down to 1%-2% soon, which is the level it was at prior to 2022.

Also, while I noted its excellent revenue growth above, this has slowed down in the past 12 months. That further emphasises that there’s no guarantee the great financial results will continue.

Why I’m buying it

Although there’s a lot I love about this company, I reckon the high dividends are temporary. That means I need other reasons to make an investment in the firm, as the residual income might not last.

Because I want exposure to environmental, social, and governance (ESG) investing, I’ll buy it next time I have some spare cash to invest. It especially seems good to me because the price is so low right now.

The thing is, if I take the dividends out of the equation, it’s still something I’d buy. Why? Because over the past 10 years its grown in price 773%. While past returns are no guarantee of future success, that does give me confidence in a winning track record.

Next time I make more investments, Impax is one company I’m buying a stake in.