Real estate investment trusts (REITs) can be an excellent way for investors to make a passive income.

The regular rents these companies receive gives them the financial firepower to pay a steady dividend. They are also subject to unique rules that require them to pay most of their profits out to shareholders.

REITs also aren’t required to pay corporation tax on their property rental businesses. In exchange, they must pay a minimum of 90% of their annual rental profits out in the form of dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Two choices

Investors have two ways to play the REIT sector. They can purchase an exchange-traded fund (ETF) which comprises of a basket of different REITs. This strategy reduces risk and provides exposure to a variety of potential growth opportunities.

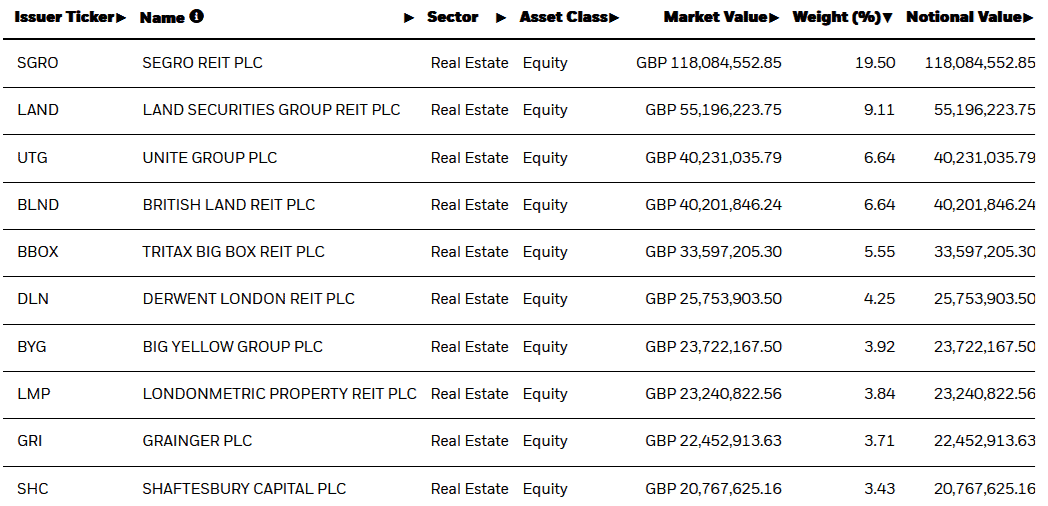

One example is the iShares UK Property UCITS ETF. This investment vehicle holds shares in 43 different REITs, the main holdings of which are:

More confident and experienced investors often choose to park their cash in particular REITs too. This is a path I’ve chosen — I currently own stock in warehouse operator Tritax Big Box REIT, care home owner Target Healthcare REIT, and GP surgery operator Primary Health Properties.

I’m considering buying the following two REITs too, to give my passive income an extra boost.

Unite Group

FTSE 100-listed Unite Group (LSE:UTG) is a huge player in the student accommodation market. It currently owns 157 blocks spanning 23 university towns, and has terrific growth potential as the UK’s student population expands.

Fresh UCAS data this week showed the number of overseas student applications rose again this year, to 115,730. This is a great omen for Unite as incoming students are more likely to live in purpose-build accommodation.

The business doesn’t offer the largest dividend out there. For 2024, this sits at 1.3%. But the prospect of reliable payout growth over the long term still makes this REIT highly attractive to me. I’d buy it despite the threat that changes to immigration laws could pose.

Supermarket Income REIT

FTSE 250-quoted Supermarket Income REIT (LSE:SUPR) could be a great selection for investors seeking a large dividend income. For the financial years to June 2024 and 2025 its yields sit at an impressive 7.9% and 8% respectively.

As its name implies, this company makes money by letting out properties to food retailers. And we’re not talking about fledgling grocers either. Tesco, Sainsbury’s, Asda, Aldi and Morrisons are among the big players on its tenant list.

This makes Supermarket Income a rock-solid business in my book. Its focus on the defensive food retail sector provides stability at all points of the economic cycle. And the blue-chip companies that let its properties aren’t likely to miss paying their rents any time soon.

Like Unite, profits at the company may take a hit if interest rates remain high. But over the long term I expect both companies to prove top investments.