Rolls-Royce (LSE: RR) shares didn’t just crush the wider FTSE 100 last year. The 221% surge meant they also outperformed all of Europe’s blue-chips too.

However, we haven’t seen the same sustained momentum this year. After reaching 322p earlier this month, the share price has pulled back and now sits at 303p.

Is there a buying opportunity at this price? Or has Rolls stock found its cruising altitude around £3?

Here’s what the charts say.

Valuation

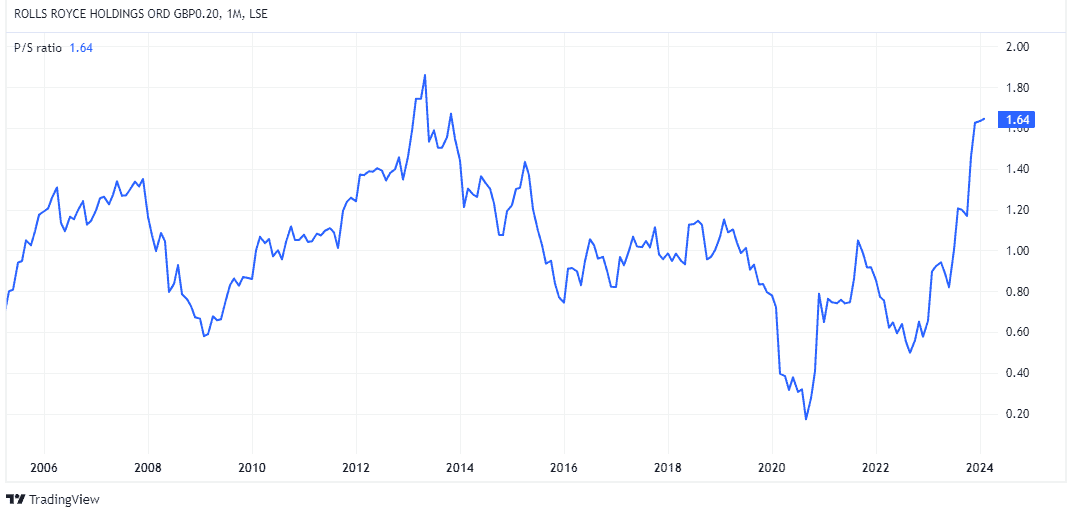

First, if we consider the price-to-sales (P/S) ratio as a valuation gauge, the shares look quite pricey on a historical basis.

With a P/S multiple of 1.6, the stock is currently trading at the top end of where it’s been over the last 20 years or so.

Even adjusting for 2024’s projected sales figures, the stock would still be towards the top end.

Of course, we can also asses the stock on a price-to-earnings (P/E) basis now that Rolls-Royce has swung back into profitability. Below are the earnings per share (EPS) forecasts through to 2025 with the corresponding P/E multiples.

| 2023 | 2024 | 2025 | |

| EPS | 9.5p | 12.6p | 15.1p |

| P/E | 32 | 24 | 20 |

Looking at this, the stock doesn’t look particularly cheap, assuming these EPS figures prove accurate.

Now, none of this need worry investors if Rolls-Royce truly is set to become a more resilient and profitable company in future (as management is attempting to do).

It just means the market is willing to value it more highly than in the past. But it also means there is little margin for error.

Balance sheet

Rolls-Royce had to take on enormous levels of debt to survive when the pandemic effectively shut the global civil aviation sector. This was the main reason the share price dipped as low as 38p in late 2020.

Looking back, that price proved to be a once-in-a-generation chance to invest. Of course, only with the benefit of hindsight do we now know this. Most investors I know weren’t touching the stock with a bargepole back then (myself included).

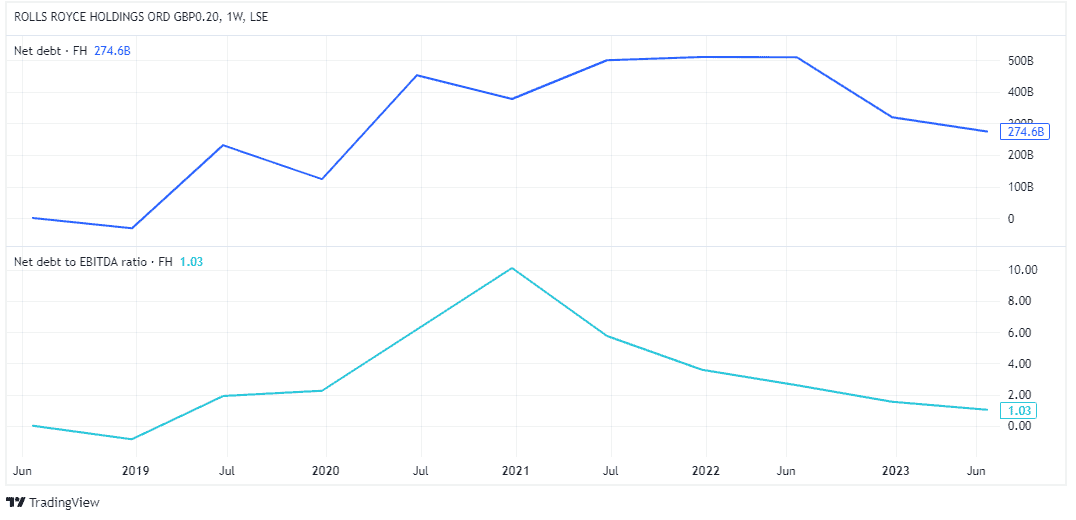

However, this net debt situation has been improving recently, as we can see in the chart below.

Net debt was down to £2.8bn as of June. Consequently, the net debt-to-EBITDA ratio is also lower. This is obviously good as it means the company has less debt compared to its earnings, which provides more flexibility to invest in growth opportunities.

Price targets

A final thing we can consider is what analysts think. After all, it is their targets/opinions that can move the near-term share price. Currently, the consensus price target is 354p (about 16% higher).

My verdict

Putting all this together, I think the stock looks priced for perfection as things stand. In other words, the market is probably already factoring in all potential positive outcomes, leaving little room for disappointment.

Any failure to meet these expectations could see the share price pull back sharply. This is a risk here. Therefore, I’m not adding to my holding today. Yet, neither am I selling, as I think the turnaround looks set to continue.

On 22 February, the company is due to report full-year earnings for 2023. I’ll wait till then to see what management says before making my next move.