Growth stocks associated with artificial intelligence (AI) have recently helped drive the S&P 500 index above 5,000 points for the very first time.

Meanwhile, shares of UK-based chip firm Arm Holdings rose a staggering 50% in New York on 8 February after an AI-powered earnings beat.

AI is not in any way, shape or form a hype cycle. We believe that AI is the most profound opportunity in our lifetimes, and we’re only at the beginning.

Arm CEO Rene Haas speaking to Bloomberg

Here, I’ll consider three ways investors can get in on the action.

Individual shares

The most straightforward method is through buying the shares of companies already benefitting from AI.

That could be the so-called ‘Magnificent Seven’ group of tech stocks:

- Microsoft

- Apple

- Alphabet (Google)

- Amazon

- Nvidia

- Meta Platforms (formerly Facebook)

- Tesla

However, after a massive year-long surge in their respective share prices, this collective is highly valued right now.

We’re looking at an average price-to-earnings (P/E) ratio of around 50. That’s a hefty premium to be paying.

ETFs

An alternative way to invest in AI might be through exchange-traded funds (ETFs). That could either be dedicated technology ones or ETFs that track, say, the Nasdaq 100 or S&P 500.

Again, though, valuation is an issue here. After a jaw-dropping 53.8% rise last year, the P/E ratio of the Nasdaq-100 technology index is 31, which is very high by historical standards.

There’s also the issue of top-heaviness, with the five largest stocks — Microsoft, Apple, Alphabet, Amazon and Nvidia — making up around 25% of the S&P 500. So there’s overconcentration risk.

Funds and trusts

A third way to invest could be through investment trusts and funds that have a good level of exposure to the theme.

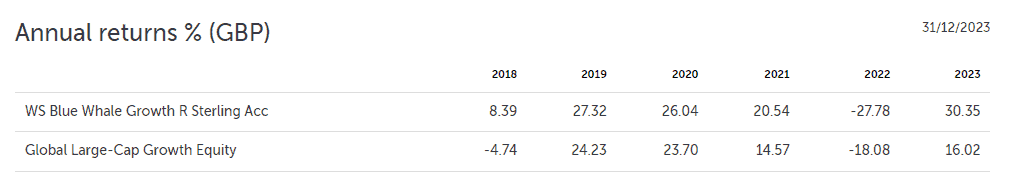

For a fund, I reckon Blue Whale Growth ticks the boxes. It holds a handful of world-class AI stocks like Meta, Nvidia and chip equipment supplier Lam Research.

However, it’s also invested in other sectors, which could offer downside protection in case the AI revolution underwhelms or encounters growing pains.

Blue Whale is a truly active fund with a very concentrated portfolio of just 29 stocks. That adds risk because a couple of duds could drag on performance to a greater degree than a more diversified fund.

However, it’s up 122% since its 2017 launch, easily outperforming the global market.

One to consider

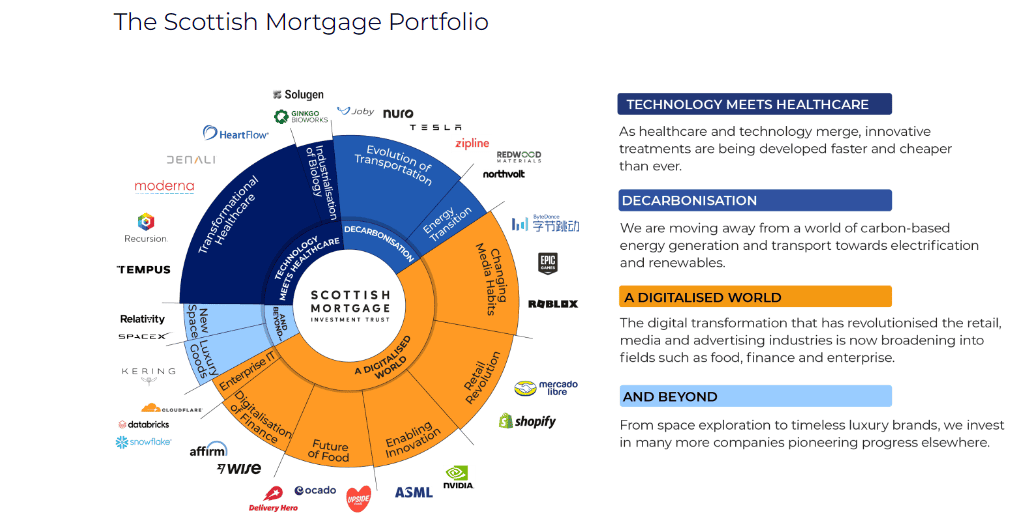

My best idea here though is Scottish Mortgage Investment Trust (LSE: SMT).

It holds the likes of Amazon and Tesla, but is also invested in top-notch firms like Shopify. The e-commerce platform has released Shopify Magic, a suite of AI-enabled features integrated across its products.

Unlike stocks and funds, trusts can trade at a discount to their underlying assets. This means the market price can be lower than the net asset value per share.

Scottish Mortgage is currently trading at a 12.4% discount, which I think offers a safer way of investing in AI at the moment.

One risk here is interest rates staying higher for longer than expected. High rates are generally a negative for the type of rapid-growth stocks the trust holds.

Yet I’m confident that Scottish Mortgage’s world-class growth portfolio will drive market-beating returns over the only period that matters. The long term.