Looking for strong passive income from companies that also offer dividend reliability is a challenge. However, I think it’s certainly possible to get close to having both.

Rathbones Group (LSE:RAT) has a 7.4% dividend yield, which I find amazing. Additionally, it hasn’t reduced its dividend payment in over 25 years.

Its share price has risen over 1,700% since becoming publicly traded, so let’s take a closer look at why I’m considering the shares for my portfolio right now.

A look at the company

Rathbones is a British investment and wealth management firm providing services for private clients, charities, and trustees. As of 31 January 2024, it had £56.3bn in assets under management.

Its operations can be broken down into three segments: investment management, financial planning, and trust and estate services.

In January of this year, the company announced it had completed its acquisition of Investec Wealth & Investment UK. As a result, Rathbones is now the UK’s top discretionary wealth manager.

Understanding its dividend

The shares offer a significant 7.4% dividend yield at the moment, meaning that this percentage of the share price is paid out to investors annually.

Additionally, its dividend payout ratio is 0.66, which means 66% of its earnings are paid out to shareholders.

Interestingly, the share’s yield on cost over a five-year time frame is 10.2%. That means that based on the price that investors paid for the shares five years ago, the dividends are actually yielding 10.2%. That’s not bad if you ask me, considering that’s approximately the average annual return for the S&P 500 over the last 30 years.

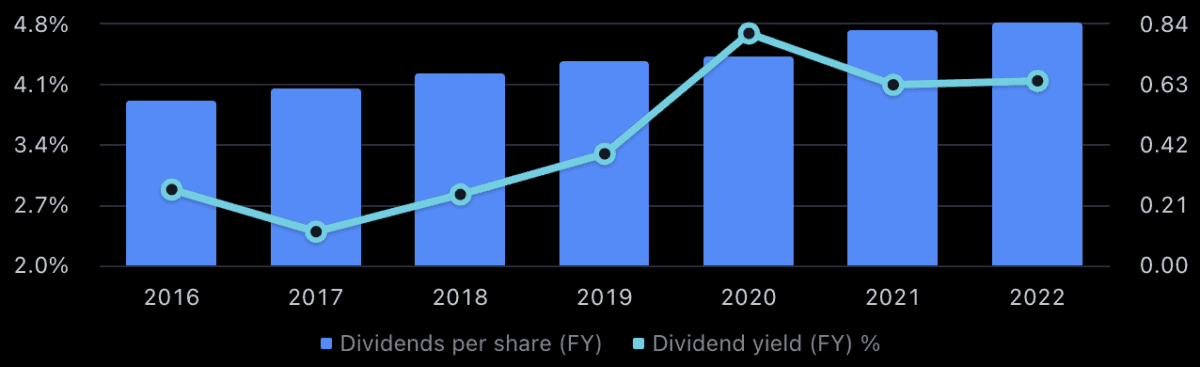

However, while its share payments have risen consistently over time due to higher earnings, the percentage of the present cost of the shares paid out in dividends has not been a smooth ride.

Therefore there’s a risk of instability in my dividend income due to this, and that’s something I’d have to account for when planning my finances.

Risks if I invest

I think Rathbones’ dividend is very compelling, but there are also risks I need to address.

First of all, it has only 18% of its assets balanced by equity. This is very poor, considering the median in the asset management industry is 82%.

Also, its net margin is weaker than usual at the moment. Over the last 10 years, it tended to be around 15.5%, yet right now, it’s 9.5%. Therefore, the dividend payout could grow at a slower rate than I’d like, and it may affect the dividend yield.

Why I’m considering it

With the risks noted, it’s also prudent I admit the strengths.

For example, it has a full 10 years of profitability over the last 10 years. Also, its price-to-earnings ratio of around 10 based on future earnings estimates looks quite cheap to me.

Therefore, I could be buying shares in a company at a good valuation with a stable track record of earnings.

It’s not a perfect investment, but I’d definitely hold the shares long-term if I wanted residual income. After all, its not often you find a company so appealing in terms of its dividend.

As I’m more focused on growth, it’s going on my watchlist for now.