I love the look of Record (LSE:REC), and it’s my top penny stock pick at the moment.

Notably, it’s selling at around 30% below its high.

I’ll break down the strong profitability, the stable balance sheet, and its leading growth.

Of course, there are always risks if I invest, so I’ll take a close look at those too.

What does it do?

Record is a financial services firm that specialises in currency management.

It offers currency risk solutions for institutions such as pension funds, charities, foundations and corporations.

The organisation tailors its services to the specific needs and risk tolerance of its clients. Most of its revenue comes from Switzerland, but it also has a presence in the UK, US, and other countries.

Leading financials

Some of the key figures I like include a 20.8% revenue growth rate over the last three years as an annual average.

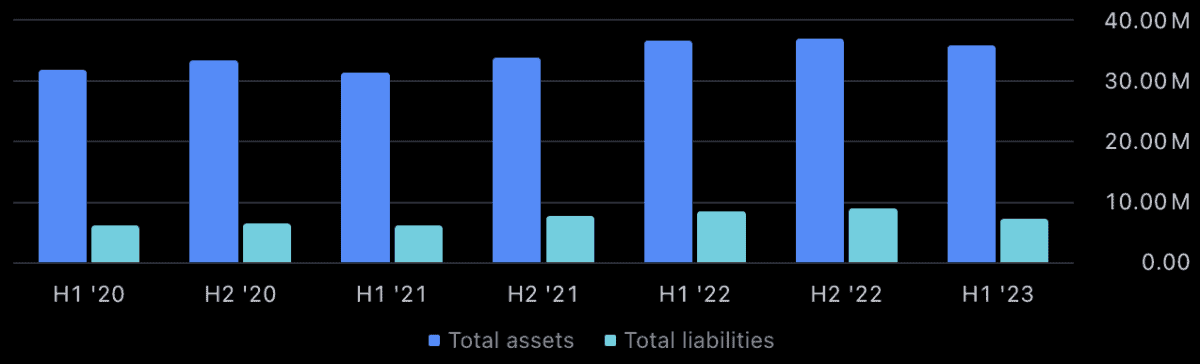

Also, it has a high gross margin of almost 100%, which is massively higher than the industry median gross margin of 52%. Additionally, it only has 3% of its equity balanced by debt.

The reason I like this investment is that it looks relatively low-risk to me. Of course, I also want to make sure the shares are trading at a fair valuation.

Good value

Some analysts might look at Record’s price-to-earnings ratio of around 14 and think it’s not that cheap. After all, the industry median is a little lower than that.

But, by projecting the firm’s earnings forward, assuming 11% growth as an average over the next 10 years, I estimate each share is really worth around 90p.

To do this, I used a method called discounted cash flow analysis.

My result shows a potential 25% discount on the shares as they’re trading at around 70p at the moment.

Risks

Now, there’s no guarantee the firm will grow at 11% per year, and some investors might say I’ve been a bit optimistic here.

After all, the 10-year average growth for its earnings per share is 7.8%. But it’s been increasing recently, which is why my estimate is higher.

Nonetheless, if something bad happens to the business or macroeconomic factors worsen, the earnings could be much lower than I expect.

The result would be some volatility in the price. However, the discount I estimated is often called a margin of safety because it acts like a safety net for such bad events.

Also, the firm has really low momentum indications. That means that its not exactly a hot pick right now.

Therefore, if I buy the shares, I need to have the patience to sit around and wait. Catching the active trader bug and selling before the investment has time to mature could be fatal to my opportunity here (and not The Motley Fool way).

The hefty yield

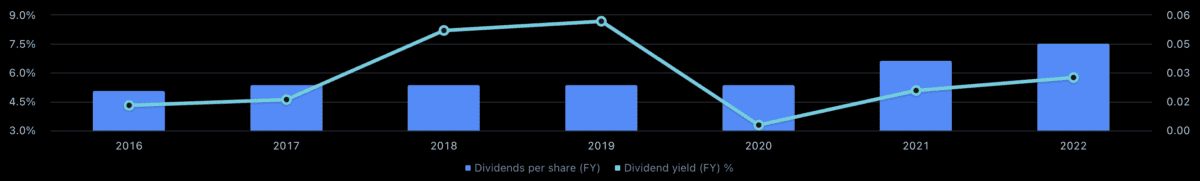

The shares also come with a nice 7% dividend yield, so I think this company is a stellar choice for me.

It has also been much higher than this in the past, and it was only really down in 2020 due to the pandemic.

It’s one of my best picks at the moment. I’m making a couple of investments in February, and Record is right at the top of my list right now.