Nvidia (NASDAQ: NVDA) stock was at $490 the last time I wrote about it. Now it’s at nearly $700. The crazy thing is that the massive share price gain happened in one month!

In fact, Nvidia’s market-cap increased by around £232bn in January, an unprecedented surge. In other words, the equivalent of BP and Shell combined were added to its market value in 23 days of trading. It’s now a $1.7trn company!

So how much would I have today if I’d invested £10k in the stock just over one month ago?

The gold standard

The share price ended 2023 at $495. As I write, it’s at $693, which represents a gain of 40%. This means that my £10,000 investment would be worth £14,000, on paper.

That’s obviously an incredible return in such a short period. And it builds on last year’s meteoric 239% rise, which was driven by the firm’s position as the world’s top artificial intelligence (AI) chipmaker.

Its H100 chip, which contains 80bn transistors, has become the gold standard for building and training AI models. And some analysts estimate it has a 90% market share in this space.

In FY 2024 (which ended in January), the company is expected to have generated around $30.7bn in net profit from $59bn in revenue. That would be year-on-year growth of 267% and 118% respectively! I’ve seen worse.

No January blues

Generative AI is the single most significant platform transition in computing history and will transform every industry.

Jensen Huang, co-founder and CEO of Nvidia, January 2024

There have been a couple of things that have kept investors buying the shares this year. Firstly, and perhaps most importantly for short-term momentum, brokers remain incredibly bullish. More so than I can ever remember on a soaring stock, in fact.

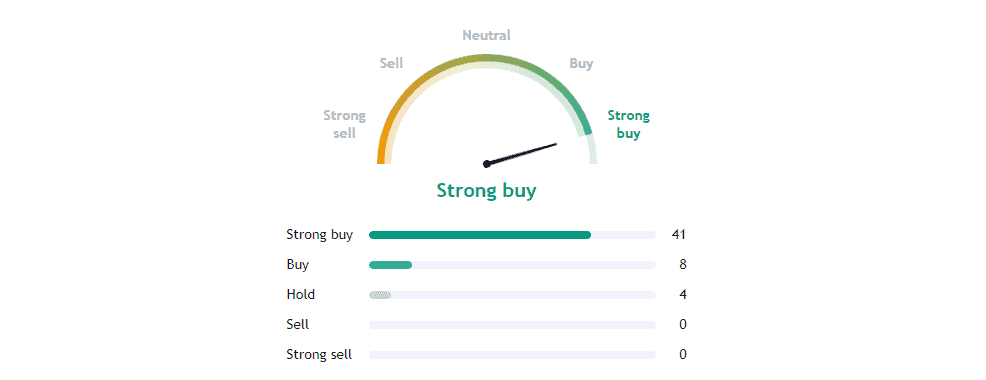

The graphic below shows 53 analyst ratings on the shares over the past three months.

Incredibly, 41 from 53 analysts rate the stock as a ‘strong buy’. Not a single one has a ‘sell’ rating. This overwhelmingly positive consensus from brokers will have resulted in their clients piling into the shares.

Continuing this trend, Goldman Sachs yesterday (5 February) raised its price target on the stock to $800.

Meanwhile, Meta Platforms said it plans to spend about $10bn on Nvidia’s graphics processing units (GPUs) by the end of 2024. Tesla‘s been stockpiling them too, as has any tech firm worth its salt. And the latest H200 AI chip will start shipping in the second quarter.

Would I invest now?

The stock is trading at a premium 33 times forecast earnings for the next 12 months. Therefore, an unexpected slowdown in the company’s booming data centre business is a major risk. That would increase the valuation and cast doubt on AI’s overall growth rate.

Plus, the shares could pull back if concerns about competition from Advanced Micro Devices (AMD) start swirling. AMD also has rival GPUs out.

Looking ahead though, I’m very optimistic. Driven by visionary CEO Jensen Huang, Nvidia has a culture of relentless innovation. I don’t see that changing.

Personally, I think it’s just a matter of time before the share price rallies beyond $1,000. So if I didn’t already own the stock, I’d invest in it today for the long term.