Ferrari (NYSE: RACE) shares rose 11% last week after the iconic Italian automaker posted record annual profits. This means the growth stock is up 45% in 12 months and more than 200% over five years.

But after such a huge run, is it still worth investing in?

The power of true luxury

The company’s business model is built on scarcity. Or as founder Enzo Ferrari famously said: “Ferrari will always deliver one car less than the market demand.”

This is a delicate balancing act between securing short-term profits while preserving long-term brand exclusivity and pricing power. Management has fine-tuned this to a precision associated with one of the firm’s high-calibre engines.

In 2023, it sold 13,663 vehicles, just 3.3% more than 2022. Yet revenue rose 17% to €5.97bn while net profit surged 34% to €1.25bn.

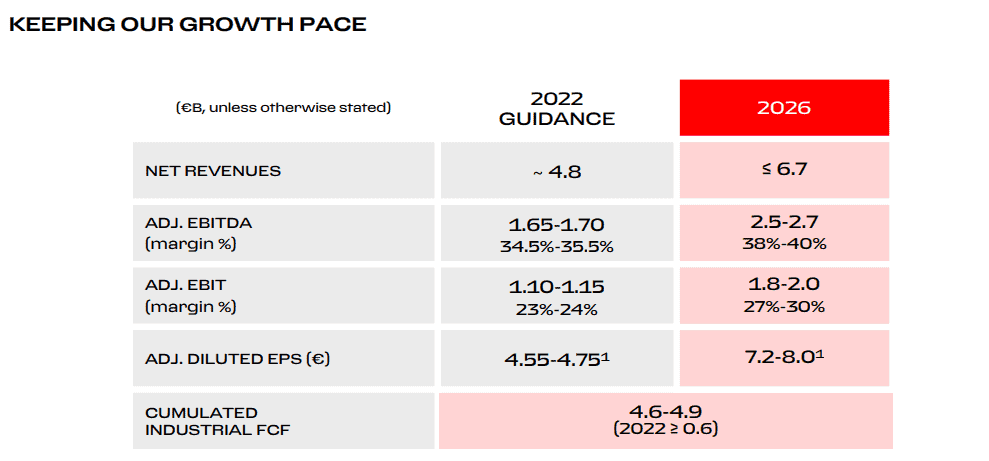

Consequently, management affirmed “confidence into the high end of our 2026 target” set out in 2022.

It has such confidence because every car Ferrari is building between now and 2026 already belongs to someone. And these rich buyers are spending “exceptional” additional amounts on personalised configurations like bespoke interior stitching patterns and special paint finishes.

Ferrari plans to raise the price on these high-margin personalisations by mid-single-digit percentages. I suspect its wealthiest customers might not be fazed.

Nurturing brand equity

Meanwhile, at a time when firms are desperate to expand in China — home to the world’s highest number of billionaires — Ferrari is limiting sales there to 10% of overall volume.

Management says China is still a “very young” market that isn’t “margin-accretive” (there are tariffs on luxury imports). Therefore, the annual number of cars shipped will stay at around 1,200 as it moderates its growth cadence there.

I suppose you can do that if you’re Ferrari!

Valuation

Currently, the stock is priced like one of its supercars — very luxuriously. Adjusted earnings per share is expected to advance from €6.90 to €7.50 in 2024. So we’re looking at 46.5 times forecast earnings.

This is a similar earnings multiple to luxury peer Hermès International (48), though more than double that of LVMH (23.8). And it’s towards the upper end of its historic multiple range, which suggests investing today could be risky.

That said, a premium valuation is clearly warranted. As mentioned, the order book on current models covers all of 2025 (and further in some cases), meaning there’s very little chance of a major earnings disappointment before then.

Invest more money?

In 2024, revenue is forecast to rise 7% to €6.4bn. However, it’s important to remember this slower growth is by design. The company’s value lies in not being a mass-market producer.

Long term, I’m very bullish. Sir Lewis Hamilton is joining its Scuderia Ferrari F1 racing team in 2025. As one of the world’s most marketable sportspeople, Hamilton should help grow its Sponsorship, Commercial and Brand business segment.

This division currently accounts for around 10% of group sales, but is already on track to double between 2022-2026.

Additionally, the first fully electric Ferrari is set for launch in the final quarter of 2025.

All things considered, I’m not going to buy more shares due to the strong run and higher valuation. But I certainly would if there was any big share price pullback.