Many retailer investors can earn a living from the stock market, and I’m not talking about traders? Let’s take the 4,000 ISA millionaires in the UK. A portfolio worth £1m could easily generate £60,000 a year with current dividend yields. And of course, because it’s within an ISA, it’s entirely tax free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The strategy

The reality is the vast majority of us don’t have £1m in a Stocks and Shares ISA. So we need to build a portfolio. This requires to make sensible investment decisions, reinvest our earnings to harness the power of compound returns, and make regular contributions.

Of course, the premise here is that my portfolio needs to be rising faster than inflation. And the quicker my portfolio grows, the greater my ability to generate an income.

An annual growth rate — excluding monthly contributions — of 6-8% is normally considered good for novice investors. However, more experienced investors can aim for returns in excess of 10%. For example, I’m aiming for 20% annually on my daughter’s junior ISA — she also benefits from the absence of fees and currency charges.

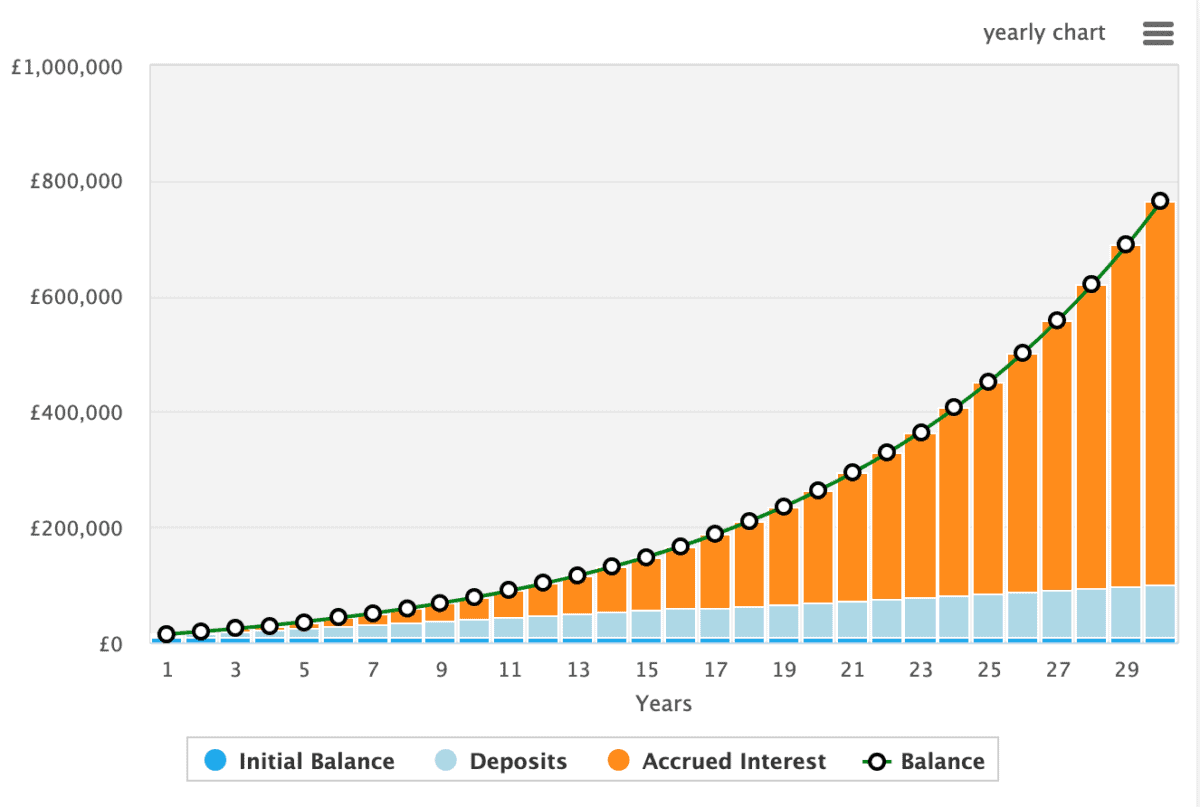

And finally, the graph below highlights that the longer I stick with my strategy, the faster my portfolio will grow. That’s how compound returns works. It’s because I’m earning interest on my interest — it compounds.

The chart is based on £10,000 starting capital, £250 of monthly contributions, and a 10% growth rate. At the end of the period I’d have almost £800k, enough to generate nearly £50,000 a year. Would that be enough to live on in 30 years? Maybe, just, assuming average inflation of 2%.

Sensible picks

The issue is, if I invest in the wrong stocks, I could lose money. And that’s why it’s so important to make wise choices, and make the most of the resources available to me.

So where would I put my money? Well, my pick this month would be GigaCloud Technology (NASDAQ:GCT). GigaCloud providers a platform that connects furniture factories in Asia with resellers in Western Europe and North America.

The beauty is that GigaCloud is cutting out the middleman and reducing storage costs by giving factories access to real-time demand in high-wealth economies. It also benefits from agreements with manufacturers.

When you think about it, storage is a big issue in the furniture game. Items are bulky and most retailers in the UK don’t have the space to store and displays huge volumes of furniture.

Of course, there are risks. The first is short interest in the stock which contributes to volatility. The second is the impact of the Houthi attacks in the Bab al-Mandab Strait. With ships taking the Cape of Good Hope route, shipping times from Singapore to Rotterdam have increased by around 30%.

Nonetheless, with earnings per share set to grow at 34.8% this year, it still looks like a very attractive stock to buy. Moreover, it’s trading a just 11.2 times earnings — that’s pretty inexpensive for a company that’s registering 30%+ growth. And that’s why I’ve added this stock to my portfolio.