There are so many cheap shares in the UK right now that it can be hard to know where to start. Luckily, I’m a big believer in Peter Lynch‘s view that “the best stock to buy is the one you already own.”

The idea here is that if I already own shares in a company with sound fundamentals and growth potential, it may be worth buying more rather than constantly seeking new investment opportunities.

One holding in my own Stocks and Shares ISA that’s declined over the past few months is Ramsdens Holdings (LSE: RFX). It’s down 15% since the end of August despite the pawnbroker recently posting record profits and upping its dividend.

Here’s why I’ve chosen to buy more shares.

A very solid FY 2023

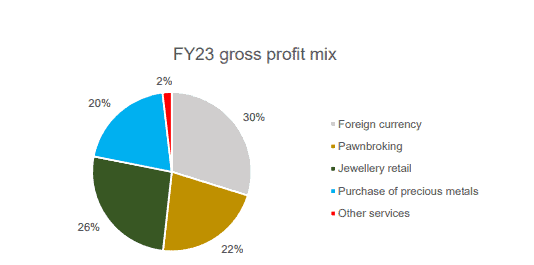

The company’s four business segments are foreign currency exchange, pawnbroking loans, buying and selling precious metals, and the retail of second-hand and new jewellery.

While the number of UK pawnbrokers is in decline, Ramsdens continues to expand and now has 165 shops. It also has a growing online presence.

On 15 January, the company released strong results for the 12 months to the end of September. Revenue rose 27% year on year to £83.8m while pre-tax profit reached a record £10.1m, up 22% on last year’s £8.3m.

Basic earnings per share increased 17% to 24.5p, up from 20.9p.

This strong performance was driven by growth across all of the group’s segments. And its active pawnbroking loan book ended the year 19% higher, reaching a record £10.3m.

The full-year dividend was lifted by 16% to 10.4p per share. This equates to a payout ratio – the proportion of earnings a company pays out in dividends – of 42%. The firm plans to raise this to 50%.

For FY 2024, the forecast dividend yield is 5.4%, with the payout nicely covered 2.1 times by expected earnings.

Another attractive feature here is the strong and asset-rich balance sheet, with £13m in cash at the end of September.

Fintech threat

One potential threat I do see for its travel money business is the secular shift from cash to digital. Apps like Revolut make currency transfer effortless nowadays, potentially jeopardising further growth in this part of the business.

The firm did launch a new Mastercard multi-currency card in September, with the hope of capturing a greater share of its customers’ holiday spend. But I’ll be monitoring this fintech threat.

That said, my concern is lessened by the fact that the business mix remains well-balanced. Foreign currency exchange represents only 30% of gross profit, despite the FX in the stock’s ticker symbol.

I’m buying

Looking ahead, I think the company remains well-positioned in a fragile economy bedevilled by higher interest rates. Demand for its services, especially small loans, should stay strong.

Meanwhile, the price of gold is expected to remain high due to geopolitical uncertainty. This benefits both its pawnbroking and precious metals buying operations. Indeed, revenue in the latter surged by almost 50% last year.

Finally, the stock looks like a bargain, trading on a price-to-earnings ratio of just 8.5. I think the share price weakness offers a nice buying opportunity, and it’s one I intend to take.