We all dream of making a healthy second income with minimal effort. My chosen strategy of generating a passive income is by creating a diversified portfolio of UK shares in a Stocks and Shares ISA.

Like billionaire investor Warren Buffett, I like to target undervalued stocks that have the potential to deliver stunning share price gains as the market wises up to their investment potential.

I also like to find stocks that pay high dividends. By reinvesting the payouts they provide, I can acquire more shares, which give me more dividends, which gives me more money to buy more shares… and so on.

Compound benefits

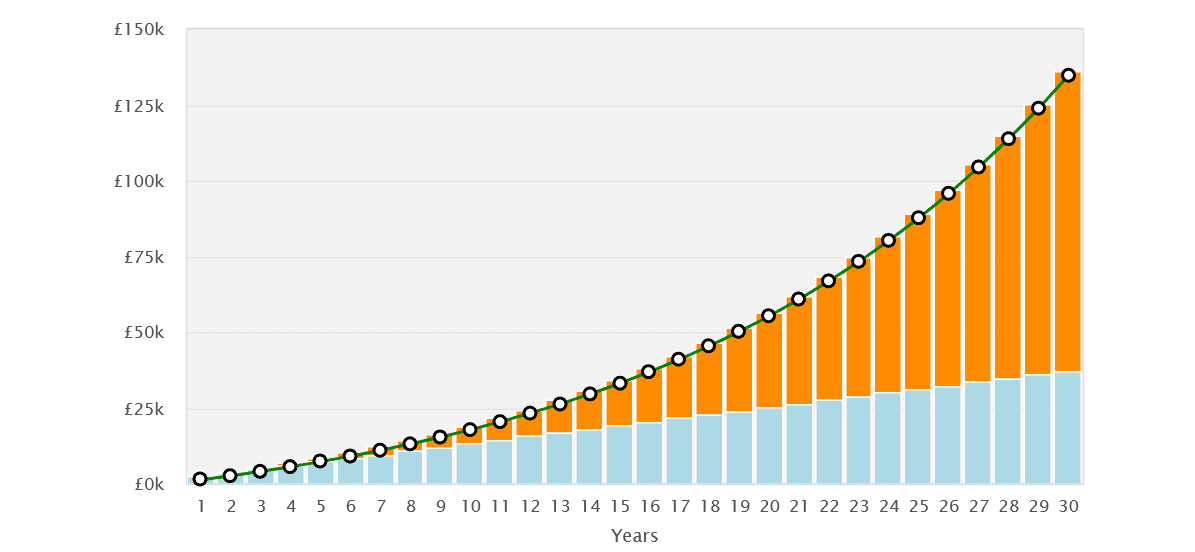

This process is called compounding. And it has the potential to turbocharge my wealth over time. Over 30 years, even a modest £100 monthly investment in FTSE 100 shares could create a retirement fund of £134,744.54.

That’s based on the Footsie’s average annual return of 7.5% between 1984 and 2022. The beneficial impact of compounding to my wealth can be seen in the chart below.

That said, I think I could make better returns by selecting individual shares rather than investing in a FTSE 100 tracker fund.

A top FTSE 100 stock

One of my favourite stocks I’ve recently acquired for my own ISA is Aviva (LSE:AV.). It fills two key criteria for me, namely its shares look undervalued, and it has a terrific track record of paying market-beating dividends.

For 2024, the life insurance giant trades on a price-to-earnings (P/E) ratio of 9.6 times. Meanwhile, its dividend yield for this year sits at a gigantic 8%.

Financial services companies like this could struggle if consumer spending remains weak. But I believe this threat is more than baked into Aviva’s rock-bottom share price.

I think the business has exceptional long-term investment potential as citizens in its UK, Ireland and Canadian markets rapidly age. In this climate, demand for its protection and retirement products could soar.

I also like Aviva shares because of the company’s strong cash generation and deep capital reserves. This could give it extra strength to keep paying large dividends. Its Solvency II capital ratio also stood at an impressive 200% as of September.

A £531 monthly income

£10,000 invested in Aviva stock today would give me a second income of £800 this year, providing broker forecasts prove correct. If the dividend yield stayed the same at 8% for 10 years — and I took my dividends out to spend — I would make £8,000.

However, if I decided to reinvest my dividends I would have made a far higher £21,589. If the dividend yield stayed the same for 30 years, I would have generated a gigantic £100,627, comprising that £10,000 initial investment and £90,627 worth of dividends.

Now let’s say I can afford to double up and invest £800 extra a year in Aviva shares. I would have made a solid £191,253, a sum that could really supercharge my passive income. It would — over three decades — give me a monthly second income of £531.

The potential for share price and dividend growth means I could make an even larger nest egg over time too, and therefore a more impressive passive income. But even excluding these two phenomena, I could still potentially make a brilliant extra income for my retirement.