NIO (NYSE:NIO) stock has been moving the wrong direction for some time. Having peaked during the pandemic, the new energy vehicle (NEV) company has struggled to live up to expectations.

Part of this underperformance can be attributed to Chinese lockdowns which added to supply chain constraints. However, things haven’t improved significantly over the past 12 months.

In fact, it’s now trading below what was previously seen as a support level — around $7. A support level is created by buyers entering the market whenever the asset dips to a lower price.

So with the share price falling even further, is this an opportunity to buy the innovative EV company, or to swerve it? Let’s take a look at some of the pros and cons.

Pros

NIO isn’t growing as quickly as its peers, but there’s a lot of positives. The company possess innovative battery-swapping technology that allows users to change empty batteries for full ones in a matter of minutes. This technology also offers another revenue generating operation.

In addition to its strong brand offer, it’s also the case that NIO is cheap compared to its peers. It trades at just 1.4 times forward sales. And that certainly makes it cheaper than Tesla at 7 times forward sales.

Cons

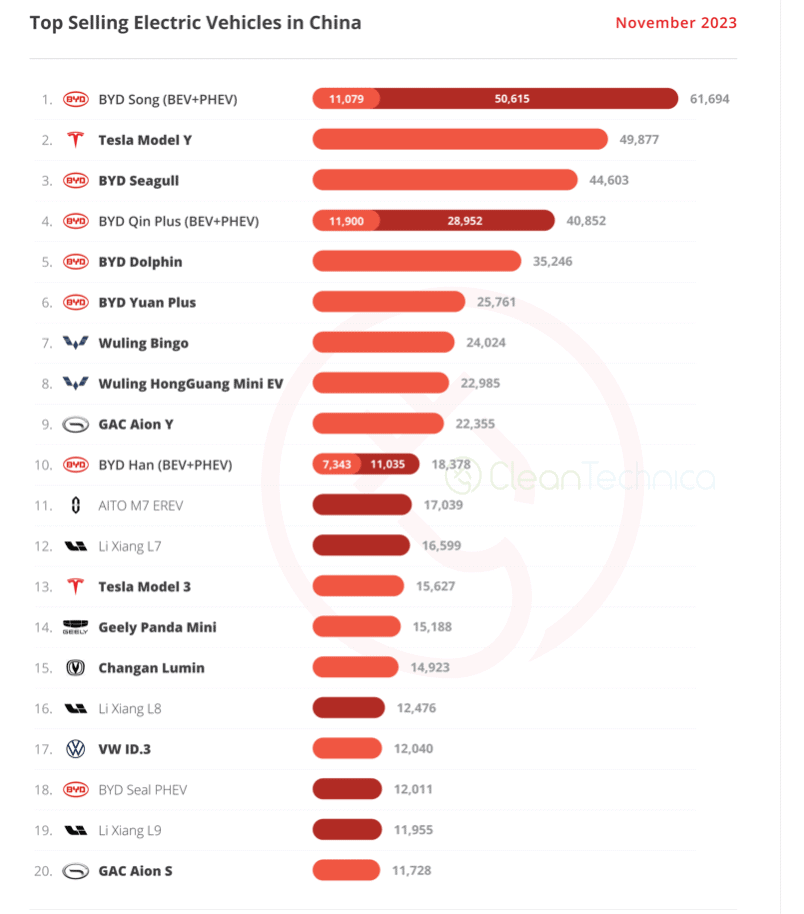

NIO has seriously lost ground versus its peers. EVs made up 27% of all cars sold in China in November, but NIO vehicles do not feature among the top 20 models sold.

It’s worth noting that NIO’s vehicles are towards the more expensive end of the market, so it would be unlikely to rival BYD, with its more competitively price vehicles. However, it’s certainly true that NIO, once considered a forerunner in China’s EV market, has fallen behind.

It’s also the case that slower than expected growth has pushed profitability back a year. Initially, 2024/2025 was touted as the break-even point, but that’s likely not going to be achieved.

NIO is now burning cash an alarming rate, with the company’s cash balance decreasing by almost $2bn in the first half of the fiscal year.

In fact, analysts are not forecasting NIO to turn a profit until 2027. It will probably encounter liquidity problems unless conditions and the burn rate improves significantly over the next four years.

In the near term, the company will probably burn $500m a quarter. And this raises questions about further capital raises and share dilution.

Moreover, with NIO failing to achieve significantly stronger sales volumes, margins are very important. However, amid pricing pressure from the likes of Tesla, margins have fallen.

These steadily declined from Q1 of 2021, at 21.3%, to 5.1% in early 2023. There was some pick up to 11% in Q3 of 2023, but margins are still some way below optimal levels.

There’s also questions about the viability of battery swapping moving forward. That’s because CATL’s new battery can provide 500km of range on a 12 minute charge.

The bottom line

There are certainly more cons than pros at the moment. However, that doesn’t mean NIO can’t turn things around in 2024. Eighteen months ago, analysts were writing off Rolls-Royce, and look what’s happened there. However, I’m unsure whether NIO is worth the risk.