I have a plan to build a healthy passive income for retirement. It involves building a winning portfolio of growth and dividend stocks with my Stocks and Shares ISA.

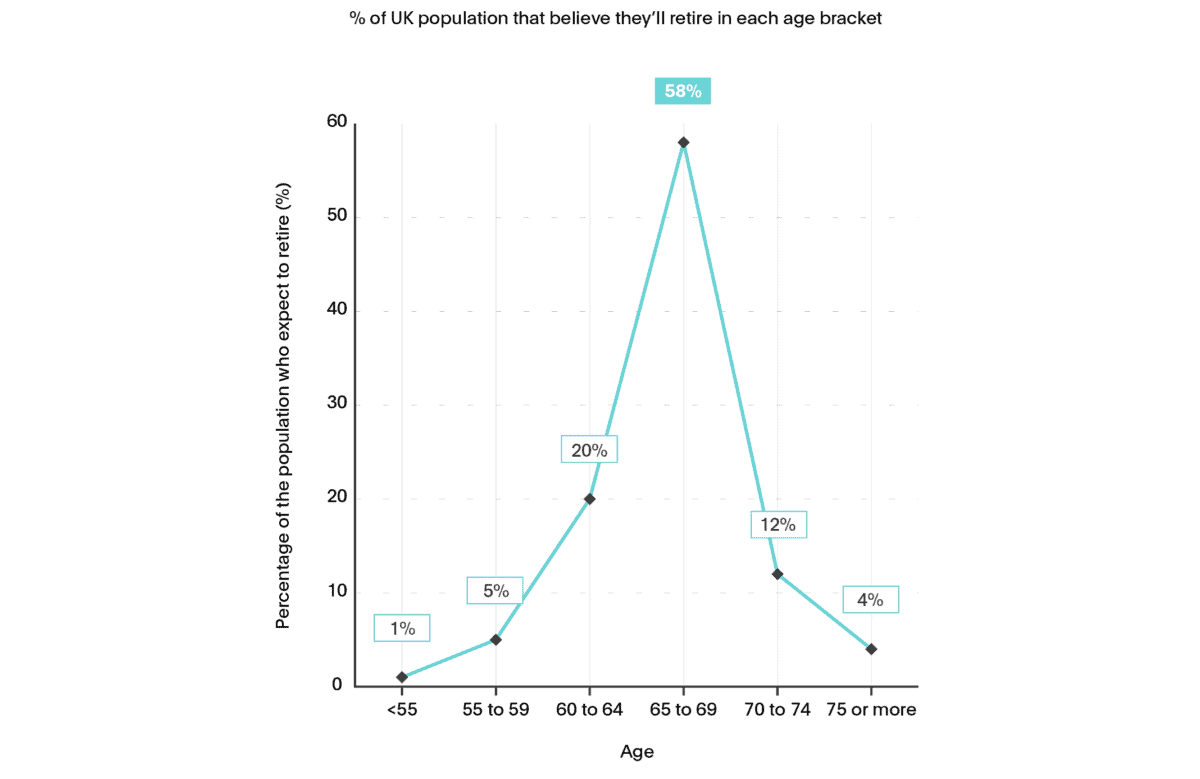

Like many people, I plan to retire while I’m still able to do the things I love. Some 60% of Britons have retired between the ages of 65 and 69. Research from financial services provider Flagstone shows that the majority of UK adults aspire to retire within this age range, as the chart below shows.

Unfortunately millions of people are sleepwalking into a future of perpetual work, even in their later years. It’s something I’m taking active steps to avoid, as I’ll explain shortly.

How much will someone need?

According to Flagstone, a whopping 68% of people don’t know how many years of retirement they need to fund. They’re leaving themselves wide open to having to return to — or perhaps even stay in — the workplace.

The passive income each of us will need in retirement can differ wildly. Flagstone notes that “the money you’ll need will vary depending on your lifestyle and retirement plans, including the length of your retirement.”

Having said that, the Pensions and Lifetime Savings Association has helpfully come up with a ballpark figure to help people plan.

They estimate that the average UK retiree will need a minimum yearly income of £12,800. Someone who wishes to retire comfortably will need almost three times that amount (£37,300).

A plan to retire

It won’t be a walk in the park. But by making a commitment to regularly invest, each of us has a chance to build long-term wealth and thus financial security in old age. The abundance of information available from investment experts like The Motley Fool thankfully makes the task easier too.

The earlier we take steps to plan for retirement, the better. This is thanks to the miracle of compounding, where — by reinvesting interest or, in the case of share investing, dividends — I can generate massive returns.

As I said at the start, I’ve decided to invest in UK shares to target a solid second income in retirement. Past performance is no guarantee of the future, but the proven successes of share investors shows what’s possible with regular investment.

A £37,557 second income

Over the past half-century, British stocks have produced an average annual return of between 6% and 8%. If this trend continues I could — with an investment of £630 a month in UK shares over the next 30 years — build an impressive nestegg of £745,180.

If I then applied the 4% drawdown rule, I could generate a yearly passive income of £37,557. Applying this percentage would allow me to enjoy this annual sum before the well runs dry.

That would give me a great chance of retiring comfortably, at least according to what the Pensions and Lifetime Savings Association has said.

Stock investing can be a bumpy ride at times. But over a long time horizon it’s a reliable wealth-builder. And I think it’s a better way for me to hit my retirement goals than by putting my cash in a low-yielding savings account.