Trying to identify the next growth stock that goes up 10, 50, or 100 times in value isn’t easy. It usually means investing in an industry of the future, which again isn’t straightforward (3D printing stocks, anyone?).

But it’s important to remember that the market’s big winners weren’t always viewed as no-brainers. In the mid-1990s, it wasn’t certain many people would ever trust Amazon/the internet with their bank card details.

Meanwhile, the idea of an electric vehicle (EV) start-up like Tesla disrupting the mighty auto industry was widely seen as absurd in 2010. It sill is by some.

As daft as it sounds, though, I think electric flying taxis may soon take off, in more ways than one. And Joby Aviation (NYSE: JOBY), whose shares are at $5, is currently the leader in this space.

Here’s why I’ve invested.

The Uber of the Sky

The Toyota-backed company is building four-passenger electric vertical take-off and landing (eVTOL) aircraft. In layman’s terms, flying taxis that carry four passengers.

They lift off like a helicopter, fly like a traditional aircraft, but are near-silent like EVs.

The benefits here include less pollution and noise, traffic reduction, and much shorter journeys. With a top speed of 200 mph, they’re perfect for regional air mobility (airport runs, city-to-city trips, etc).

Joby acquired Uber Elevate in 2020, with the two companies agreeing to integrate their respective services into each other’s apps. It expects to begin commercial operations in 2025.

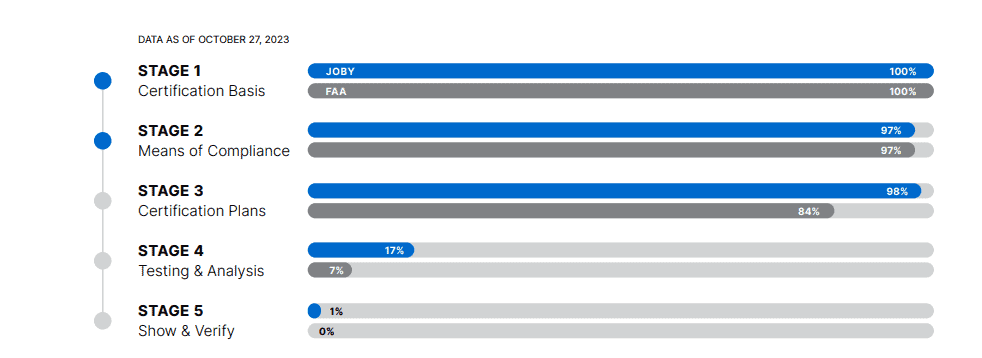

However, there are still regulatory hurdles to overcome with the Federal Aviation Administration. The company has made great progress here, but there’s still more work to secure full airworthiness certification.

As part of this process, the company successfully performed an exhibition flight in New York City in November. While this marked the first ever such flight over the city, a delay to commercial operations remains a risk.

The Tesla playbook

Put simply, Joby is trying to do in the air what Tesla has achieved on the ground with EVs. And it is following Elon Musk’s firm in a couple of specific ways:

- Production: it is vertically-integrated

- Infrastructure: similar to Tesla’s Supercharger network, Joby has just announced the first electric air taxi charger in Southern California

Similar to Elon Musk investing in Tesla after leaving PayPal, Joby’s executive chairman Paul Sciarra invested in the eVTOL start-up then left Pinterest, the internet company he co-founded.

It has rivals

The firm currently has a market cap of $4bn. This reflects a lot of optimism as the industry leader, but there is competition, notably from Archer Aviation.

However, one thing I like here, especially in this higher interest rate environment, is that the company remains well-capitalised (for now). At the end of September, it had $1.1bn in cash.

Keeping things right-sized

It’s too early to tell whether investing in Joby at $5 will be like investing in Tesla in 2010. It’s very high-risk.

But I’m convinced there will be a big winner in this market, which Morgan Stanley predicts could reach $1trn by 2040.

For now, I’m keeping my holding small. If it flops, it won’t harm my overall portfolio. But if Joby does turn out to be the next Tesla, I’d only need a small investment to make fantastic returns.