My Stocks and Shares ISA contains a variety of investments. However, most of my largest holdings are in companies that dominate their industries. They sometimes get called ‘800-pound gorillas’.

Two such stocks stand out to me. And unless something dramatic changes, I can’t imagine selling them.

1. A natural monopoly

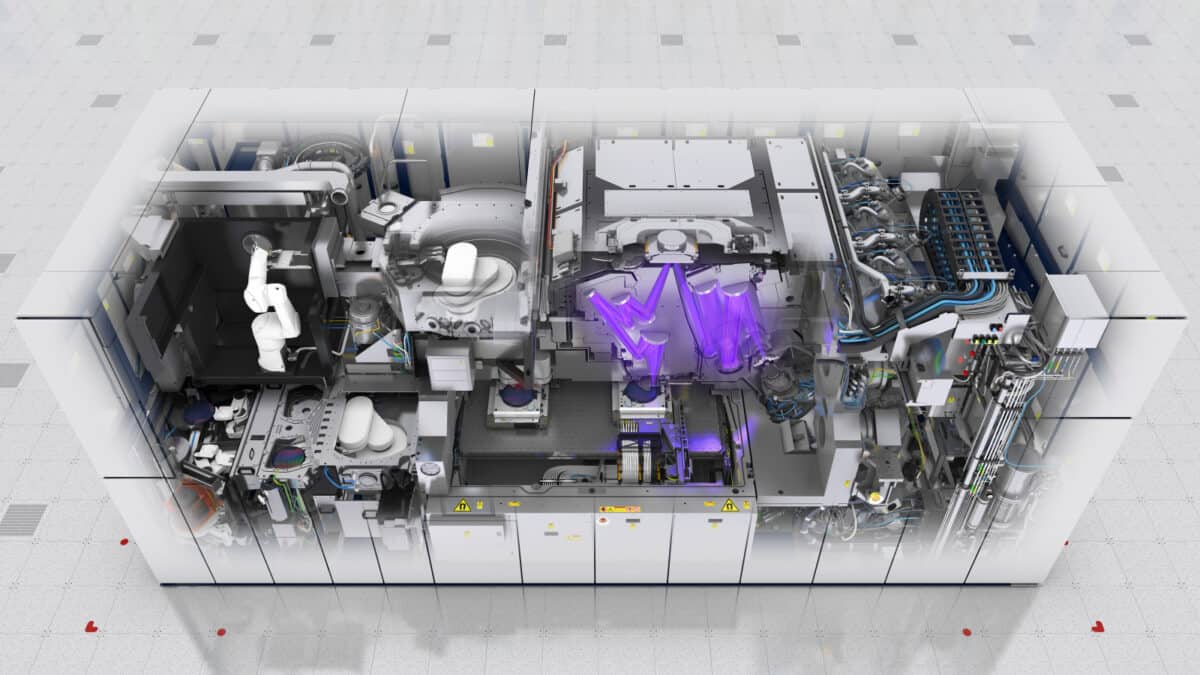

First up we have ASML (NASDAQ: ASML). It controls around 90% of the global semiconductor lithography equipment market. Lithography involves light being used to print tiny patterns on silicon wafers.

ASML is the only firm that sells extreme ultraviolet (EUV) machines capable of making the smallest transistors. As such, it’s critical to the continuation of Moore’s Law – the doubling of transistors on a microchip roughly every two years – and the ongoing technology revolution.

Mind you, this isn’t equipment that would fit in your garden shed. Its new High NA EUV system, the first of which is currently being delivered to Intel, is larger than a truck and costs $300m-$400m.

The standard EUV machines cost about $153m each, and some large foundries require as many as 18 of them.

Clearly, this immense cost does limit who can buy them (certainly not start-ups). Its three main customers are Intel, Samsung Foundry and TSMC, with the latter accounting for nearly 40% of revenues.

So there’s significant customer concentration, which could create risks if one of these firms suddenly pushes the pause button on long-term capital expenditure.

On the other hand, the barriers to entry in this market are sky-high (arguably insurmountable). And despite the capital-intensive nature of its business, ASML is extremely profitable.

In 2023, it’s expected to have made around €7.7bn in net profit from revenue of €27.2bn. That would be year-on-year growth of 36% and 28%, respectively. That translates into a very attractive 28% net profit margin.

A bright future

Looking ahead, the firm should benefit as the West diversifies global chip manufacturing beyond Taiwan.

New plants are being built or planned in the US, Germany, South Korea and Japan. ASML will equip them all.

The stock is currently trading at 33 times earnings. Based on its 10-year historical average, that looks like fair value to me. With spare cash, I’d invest long term at that price.

2. Robotic surgery

Next we have Intuitive Surgical (NASDAQ: ISRG), which is the 800-pound gorilla in the global robotic surgery market.

This type of assisted surgery has the advantage of being minimally invasive. Smaller incisions lead to less pain, reduced scarring, and shorter recovery time for patients, which places less burden on hospitals.

It’s a win-win proposition that has seen the stock rise nearly 600% over the last decade.

There are now 8,285 of its da Vinci surgical systems installed worldwide. Hospitals invest millions buying these and training surgeons, meaning switching costs are incredibly high.

Procedures grew by approximately 19% during Q3. This growth is important because the firm generates recurring revenue from repeat instrument purchases (known as the razor-and-blades business model).

One risk here is valuation, with the stock trading at a pricey 49 times this year’s forecast earnings.

Therefore, I’d only invest more if there was a pullback in the share price. Fortunately, the market does occasionally lose the plot and forgets about the long-term secular growth of robotic surgery.